- The EUR/USD pair is strongly bearish as the DXY edges higher.

- The price action invalidated a larger rebound signaling strong downside pressure.

- Better than expected, US data could boost the USD.

The EUR/USD price plunged as the Dollar Index looked to trade higher. The bias is bearish, so the currency pair could approach and reach new lows. The DXY ended its corrective phase, and now it seems determined to approach new highs after retesting the near-term broken resistance levels.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

Fundamentally, the USD has taken full control as the FED is expected to increase the Federal Funds Rate by 75bps in the next monetary policy meeting. The EUR/USD pair signaled that its rebound ended after failing to make a new higher high. The price recovered a little in the short term after yesterday’s sell-off. It has tested the immediate resistance levels, and now it looks heavy.

Today, the Eurozone data came in mixed. German Retail Sales rose by 0.6% versus 1.1% expected, and German Import Prices surged by 0.9% less versus 1.6% forecasts. In contrast, the German Unemployment Change came in at 133K versus -5K forecasts. In addition, the Eurozone Unemployment Rate dropped unexpectedly from 6.7% to 6.6%, even if the specialists expected a potential growth of 6.8%.

Later, the US data could bring high action on the EUR/USD pair. The Unemployment Claims could drop from 229K to 228K in the last week, while the Core PCE may report a 0.4% growth versus 0.3% growth in the previous reporting period. Personal Spending, Personal Income, and Chicago PMI could also bring some volatility.

EUR/USD price technical analysis: Sell-off

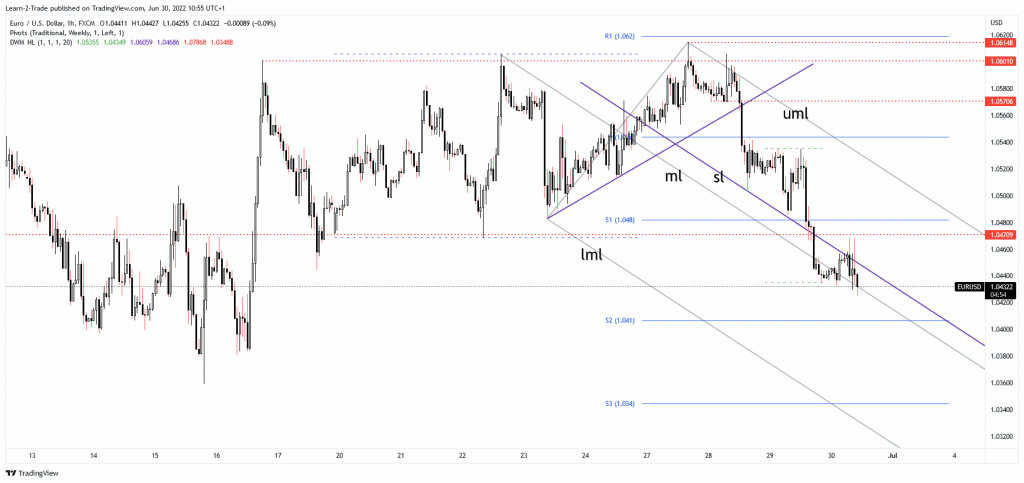

From the technical point of view, the rate was expected to drop after registering only false breakouts through the 1.0601 and after dropping below the immediate uptrend line. Breaking below 1.0470 and under 1.0444 signaled a deeper drop.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

Today, it has tried to rebound but failed to stabilize above 1.0444 or to reach and retest the 1.0470 resistance (support turned into resistance). It has also failed to stabilize above the median line (ml) of the descending pitchfork, confirming strong sellers. A valid breakdown below the weekly S2 of 1.0410 and below the daily S1 (1.0400) could activate a border drop.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money