- The EUR/USD pair rallied as the Dollar Index dropped.

- Larger growth is somehow expected after taking out the near-term resistance levels.

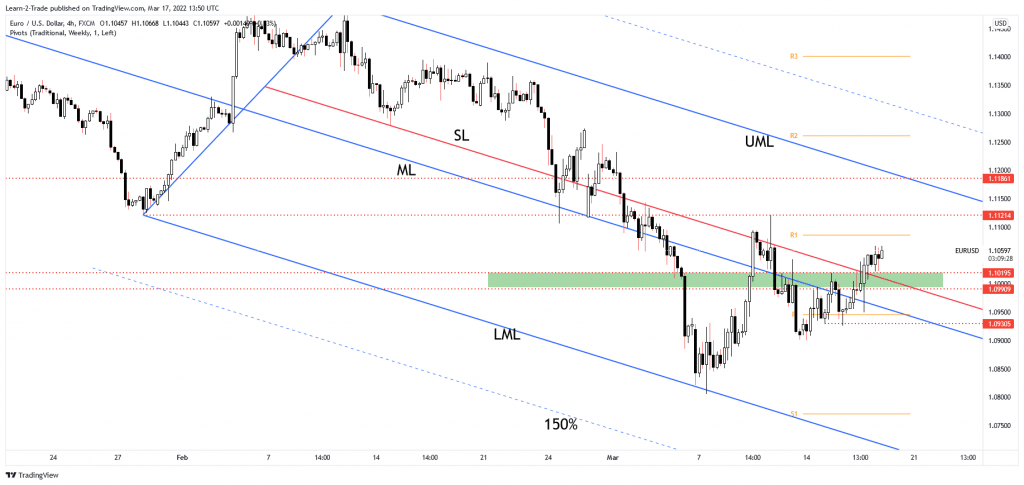

- After it fails to stay below the median line (ML), the EUR/USD pair could be attracted by the upper median line (UML).

The EUR/USD price is fighting hard to approach new highs as the Dollar Index is bearish in the short term. The DXY’s correction forced the USD to depreciate versus most of its rivals. The currency pair is traded at 1.1058 at the time of writing. Technically, the pair jumped above strong upside obstacles signaling an upside continuation. As long as the DXY drops, the EUR/USD pair is expected to climb higher. We have a strong negative correlation between these two.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Fundamentally, the Eurozone Final CPI rose by 5.9% in February versus 5.8% expected, while the Final Core CPI surged by 2.7%, matching expectations. Surprisingly or not, the greenback depreciates, although the US reported some positive economic data. The Housing Starts indicator was reported at 1.77M above 1.70M. Philly Fed Manufacturing Index surged from 16.0 to 27.4 points, exceeding the 15.1 points forecast. At the same time, the Unemployment Claims dropped unexpectedly lower in the last week, from 229K to 214K below 221K estimates. Building Permits came in better than expected, Industrial Production came in line with expectations, while the Capacity Utilization Rate reported worse than expected data.

EUR/USD price technical analysis: Swing highs on cards

After its breakout above 1.090 – 1.1019 area, the EUR/USD pair is somehow expected to resume its growth. Also, it has ignored the descending pitchfork’s inside sliding line (SL), which represented a dynamic resistance. Therefore, the weekly R1 (1.1086) represents the immediate upside target.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

The 1.1121 former high stands as a potential upside obstacle as well. Failing to stay below the median line (ML) signaled potential growth also towards the upper median line (UML). A valid breakout above 1.1121 could announce and activate an upside reversal. Still, it’s premature to talk about something like this as long as the rate stands below major and strong upside obstacles. A bearish pattern around 1.1121 could signal a new bearish movement.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money