- The EUR/USD pair drops as the DXY rallied.

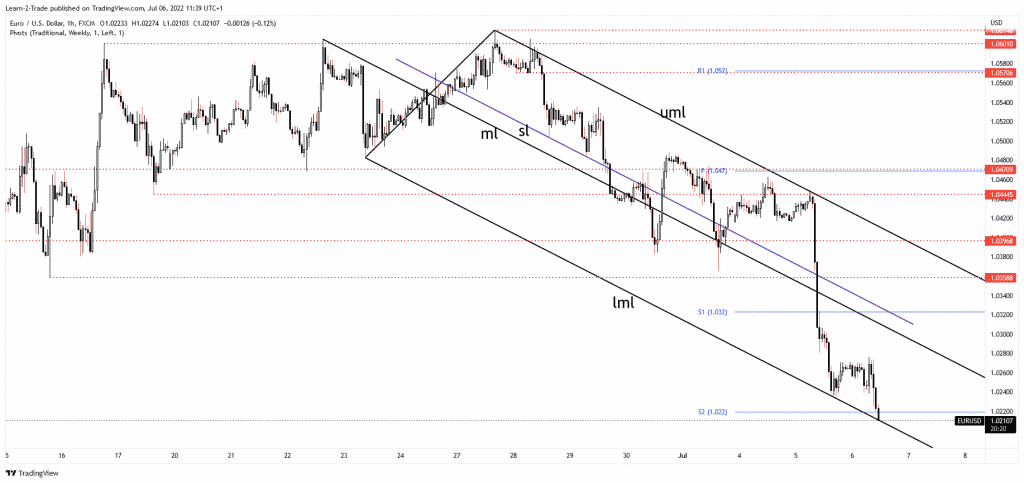

- A valid breakdown below the lower median line (LML) could activate more declines.

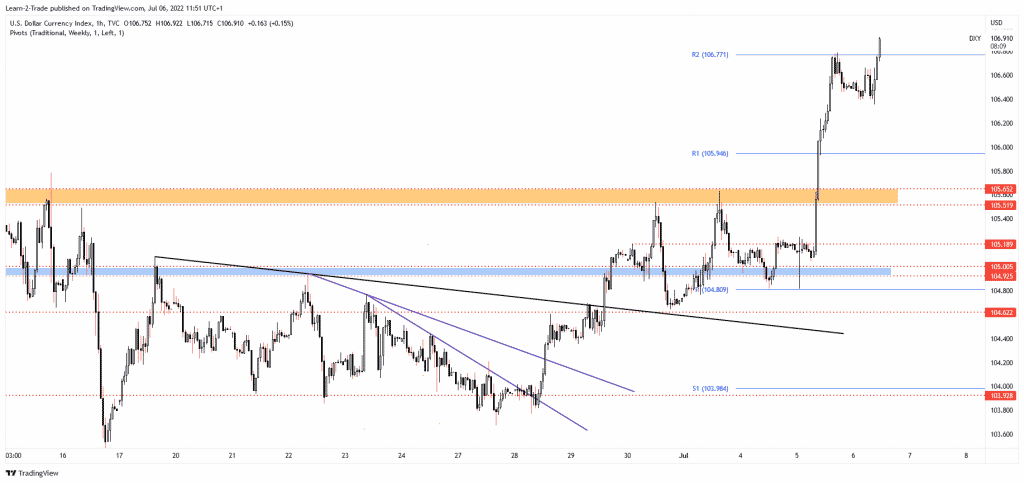

- The Dollar Index jumped above the weekly R2, signaling an upside continuation.

The EUR/USD price was trading in the red at 1.0208 at the time of writing. It has tried to rebound in the short term, but the pressure remains high as the Dollar Index ended its minor retreat.

-Are you interested to find high leverage brokers? Check our detailed guide-

DXY’s further rise should force the USD to appreciate versus its rivals to dominate the currency market. The bias remains bearish, so the EUR/USD pair may approach new lows. Yesterday, the Eurozone data came in mixed.

On the other hand, the USD was boosted by the US Factory Orders, which reported a 1.6% growth versus 0.5% expected and compared to 0.7% growth in the previous reporting period.

Today, the Euro took another hit from the Eurozone Retail Sales indicator, which reported a 0.2% growth versus the 0.4% growth expected.

The German Factory Orders surged by 0.1% versus a 0.5% drop estimated but the EUR/USD pair is strongly bearish as the FED is expected to increase the Federal Funds Rate by 75bps again in the next monetary policy meeting.

Later, the JOLTS Job Openings indicator is expected at 11.05M, while the ISM Services PMI could drop from 55.9 to 53.9 points. The most important event is represented by the FOMC Meeting Minutes. This report could bring high volatility and sharp movements.

Dollar Index price technical analysis: Rallying

After its amazing rally, the Dollar Index found temporary resistance at the weekly R2 (106.77). It has retreated a little, but the upside pressure is strong. Now, it has managed to jump above the R2, signaling a potential upside continuation. DXY’s growth forces the USD to appreciate versus the other currencies.

-Looking for high probability free forex signals? Let’s check out-

EUR/USD price technical analysis: Massive drop

The EUR/USD pair challenged the weekly S2 (1.0220) and the descending pitchfork’s lower median line (LML), representing downside obstacles. Taking out these support levels may signal more declines. Its failure to come back to test the median line (ml) signaled strong bearish pressure. Closing and stabilizing below the lower median line (LML) indicates a downside continuation.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money