- EUR/USD is wobbling under 1.1900, taking respite from 20-period SMA.

- ECB is looking to tighten the monetary policy.

- Fed may pause the tapering plan after the dismal jobs report.

The EUR/USD price gains to 1.1878, up 0.09% on Tuesday ahead of the European session. Due to this, the pair contributes to the US dollar’s weakness as it continues to round to last Friday’s multi-day high.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

At the time of publication, the US Dollar Index (DXY) has fallen 0.07% on the day to 92.14. In addition to escalating talk of restricting the activities of the European Central Bank (ECB), the optimism stems from a calming of coronavirus fears and hope for vaccination. With the return of American traders from the holiday break, the week starts with familiar tunes about the gloomy American jobs, and the mood improves.

The COVID-19 outbreak in Australia, New Zealand, and Japan is waning, and all three countries plan to overcome it. The talk of Covid boosters and faster vaccinations is also encouraging.

European Union (EU) Economic Commissioner Paolo Gentiloni said on Monday that “the first P in PEPP is a pandemic, not permanent, and for a good reason.” Markets are also predicting the ECB’s tightening stance this week. However, Bloomberg states, “I think this is a mistake since the main consensus is that inflation is temporary.”

The ECB, which is not an event-oriented central bank, is expected to boost market movements on Thursday. Still, policymakers are divided over a plan to purchase the bloc’s central bank bonds during this period of economic improvement.

Following recent disappointment with US labor market data, talk of a Fed cap seems to have diminished.

S&P 500 futures are up 0.13% today to 4540 at the latest as the 10-year US Treasury yields are trading at a more stable level of no more than 1.34%.

–Are you interested to learn more about forex signals? Check our detailed guide-

Additionally, for the second reading, the ZEW sentiment for Q2 of the Eurozone and Germany may indicate the immediate direction of EUR/USD. The reaction of Canadian and US traders to market catalysts is, however, of great interest.

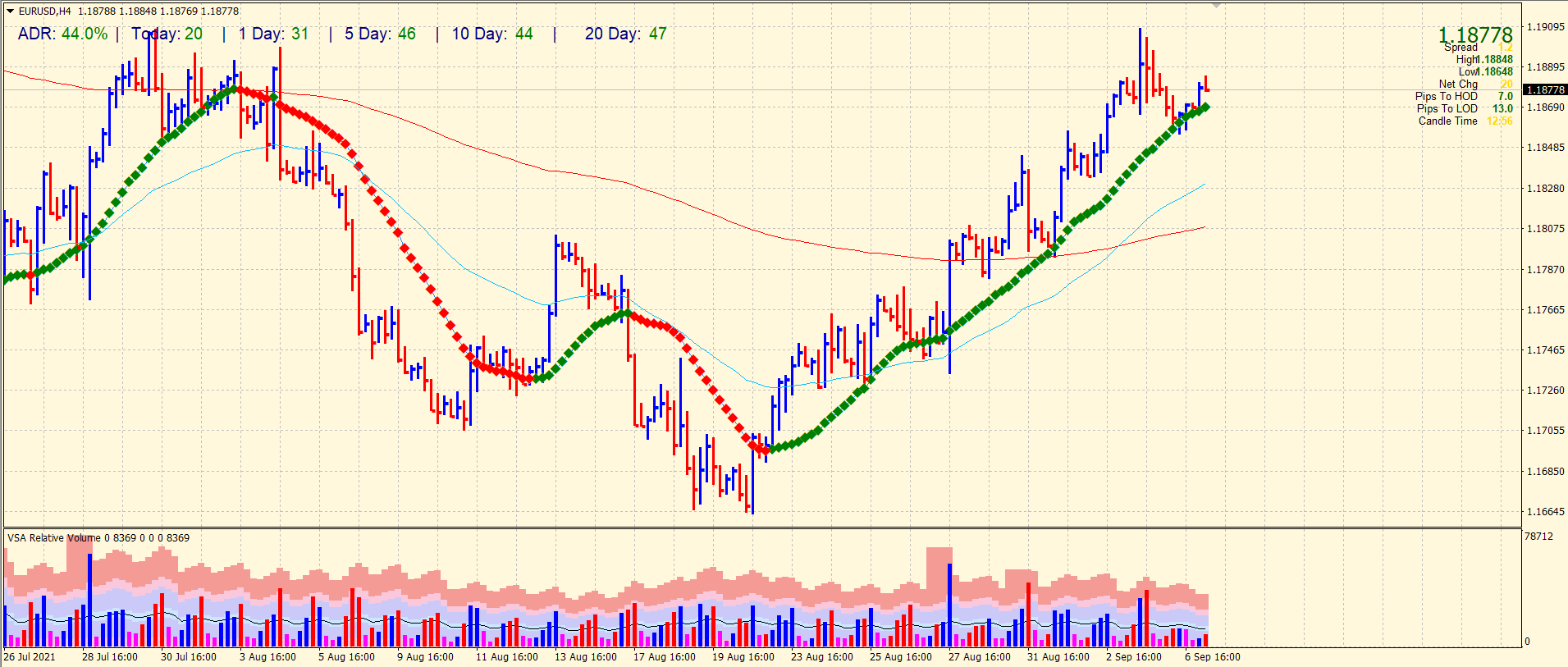

EUR/USD price technical analysis: 20-SMA supports

Yesterday’s retracement finds respite around the 20-period SMA on the 4-hour chart. The pair is now attempting to rise towards 1.1900 area. However, this does not look like a strong move. Interestingly, the average daily range during the Asian session is 44%, indicating dense activity ahead. On the downside, the price may test 1.1850 ahead of 1.1800.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.