- EUR/USD continues to fall from its seven-week high and has recently reached an intraday low.

- Participants in the market seek clarity as stock futures and yields rise.

- Omicron’s problems are worsening, but politicians remain confident that the battle between the ECB and the Fed will determine 2022.

In the early hours of Monday, EUR/USD price was down 0.25% for the day at 1.1345, a bleak start to 2022. A weaker dollar boosted the pair’s seven-week high the previous day. However, a recent market consolidation triggered a corrective retreat amid mixed concerns during a sluggish session earlier in the year.

–Are you interested to learn more about Nigerian forex brokers? Check our detailed guide-

Concerns about the South African version of Covid, Omicron, are affecting EUR/USD prices. According to the most recent record updates, there is an outbreak of communicable diseases throughout the entire block and globally, which questions previous hopes for recovery on the old continent. Covid infections worldwide reached an all-time high in the last seven days, with an average of over a million cases each day between December 24th and 30th, Reuters reported. The news also stated, “More than 4,000 flights were canceled worldwide on Sunday, more than half of them from the US, resulting in holiday travel disruptions.”

The suspension of Chinese real estate company Evergande also challenges market sentiment and a recovery in the US dollar. The Chinese government also ordered the company to liquidate 39 illegal residential buildings. “China Evergrande Group will be suspended from trading on Monday pending publication of ‘inside information,” Reuters reported.

The news that Germany will introduce tax breaks for local residents in 2023 relates to a study that shows Omicron is less serious than previous COVID-19 flavors in challenging EUR / USD bears.

A major point to watch in 2022 is the monetary policy divergence between the US Federal Reserve System (FRS) and the European Central Bank (ECB), as the Fed is likely to move faster than the ECB towards tightening monetary policy. In turn, this can impact future exchange rates for EUR/USD.

Due to this, the minutes of Wednesday’s Federal Reserve Open Market Committee meeting (FOMC) and Friday’s Nonfarm Payments (NFP) report will be crucial for pair traders. In addition, Markit’s final US manufacturing PMI for December could provide the markets with an immediate direction later in the day.

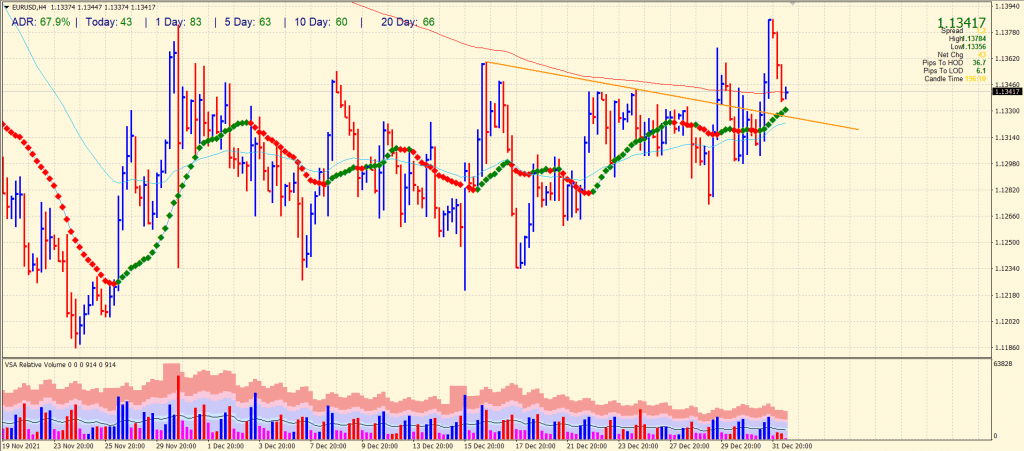

EUR/USD price technical analysis: Bulls look strong

The EUR/USD price found a recent top around 1.1385 and fell towards the broken descending trendline. The 20-period SMA on the 4-hour chart also coincides with the same level. We expect the pullback to stay limited around this confluence area near 1.1330. The volume data gives clues about the potential uptrend.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

On the other hand, the pair may slip towards 1.1300 and below it. This may result in a deeper retracement towards 1.1260 ahead of 1.1200.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.