- As the US dollar remains sluggish, EUR/USD gains modestly amid caution amid upcoming important data/events.

- Along with Powell’s comments about the bond coupon cut, Omicron’s concerns have diminished.

- The ECB emphasizes today’s inflation numbers without taking into account concerns about rate hikes.

As European trading begins on Tuesday, the EUR/USD price pulls back from an intraday high of 1.1305. However, the major currency pair is posting 0.15% daily gains at press time, offsetting yesterday’s losses, as cautious optimism in the markets dampens demand for the US dollar as a safe haven.

–Are you interested to learn more about South African forex brokers? Check our detailed guide-

The US president did not know that a lockdown was needed, while the chairman of the Federal Reserve Board remained unchanged about inflation and maintained his strong support for risk-taking. After Treasury Secretary Janet Yellen mentions the strength of the US economy and urges Congress to break the frozen debt ceiling, sentiment improves.

Vaccines were expected to be available against the strain within a few months, and politicians were confident that swift action would be taken to stop the outbreak. The current global economy is also going strong due to the encouraging conditions for market participants, as opposed to the early days of the pandemic.

While this game is taking place, US Treasury bond yields remain under pressure as the 10-year total coupon fell three basis points (bps) to 1.50% while the S&P 500 futures have gained modestly recently.

Despite this, it should be noted that Governing Councilor Pablo Hernandez de Cos and Vice President Luis de Guindos keep EUR/USD buyers away. The ECB’s spokesman de Cos said European leaders were concerned about tightening monetary policy prematurely. However, he reminded them that high inflation is likely temporary, although it is stronger than expected a few months ago. According to de Guindos, “New variants of the Coronavirus and the spread of COVID-19 cases will increase uncertainty.” Additionally, the ECB director, Isabelle Schnabel, said on Monday: “We believe that inflation peaked in November.”

Hence, it is important to watch today’s tentative Consumer Price Index (CPI) value, which was predicted at 3.7%, down from 4.1%. On the other hand, inflation rates in Germany spiked to a record level of 6.0% the day before.

For spotting new momentum, the Federal Reserve’s consumer confidence data for November, as well as the Covid data, as well as Jerome Powell’s statements, will be crucial.

–Are you interested to learn more about spread betting brokers? Check our detailed guide-

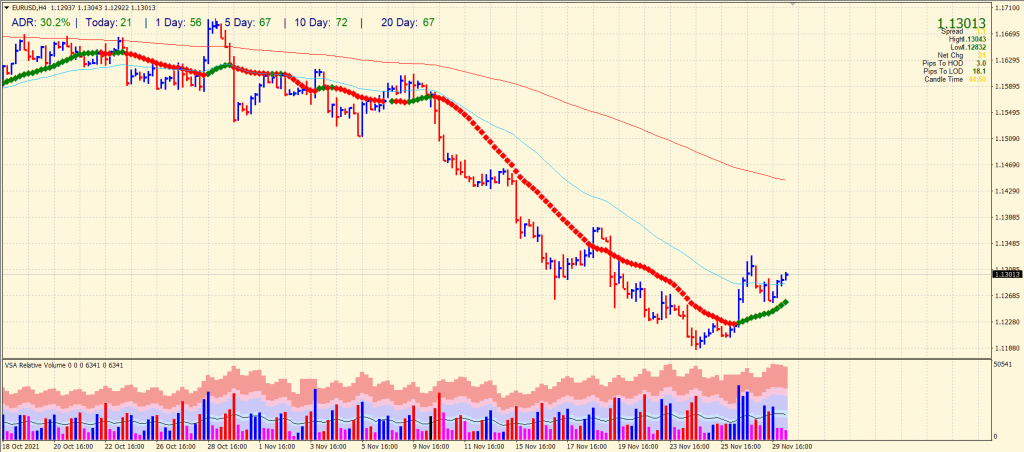

EUR/USD price technical analysis: Bulls being tested around 1.1300

The EUR/USD price has successfully surpassed the 50-period SMA on the 4-hour chart. Although the volume data does not indicate any significant bullish price action, the Euro stays supported around the 1.1300 level. However, the pair may find some resistance around yesterday’s highs near the 1.1330 area ahead of Nov 18 swing highs around 1.1370. On the flip side, immediate support lies around 1.1260 ahead of 1.1200.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.