- EUR/USD bears continue to weigh on the pair near fresh yearly lows.

- The rising US dollar maintains a selling pressure on the pair.

- ECB’s cautious stance and Fed tapering talks continue to whip the Euro.

The EUR/USD price remains well below Friday’s level of 1.1700 as the selling pressure remains in place. Despite the oversold conditions with the pair, there are no signs that buyers will return to the single currency anytime soon.

The EUR/USD is trading at 1.1680 on Friday’s earlier NY session, up 0.05% at the time of writing.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

Due to the rising dollar, the market has also been under pressure, all in the context of the prevailing sense of safety, which is influenced by increasing volatility.

Friday’s only eurozone publication comes from Germany, where producer prices rose 1.9% m/m in July and 10.4% over the previous year.

Since there is no planned pool of data releases to influence global asset prices, risk appetite tends to be a driving factor instead.

What’s next for the Euro?

As of Thursday’s close, the EUR/USD is trading well defensively, nearing new 2021 lows at 1.1660, which was last occupied in early November of last year. After another failed attempt to break through 1.1880/1.1900 resistance, the pair dropped 0.5% this month. Moreover, the dollar’s outlook remains fairly solid, largely due to taper/interest rate speculation.

Regarding the Euro, the ECB’s cautious stance (as of its last meeting) is expected to remain under fire, despite a strong fundamental backdrop and consistently high morale within the region.

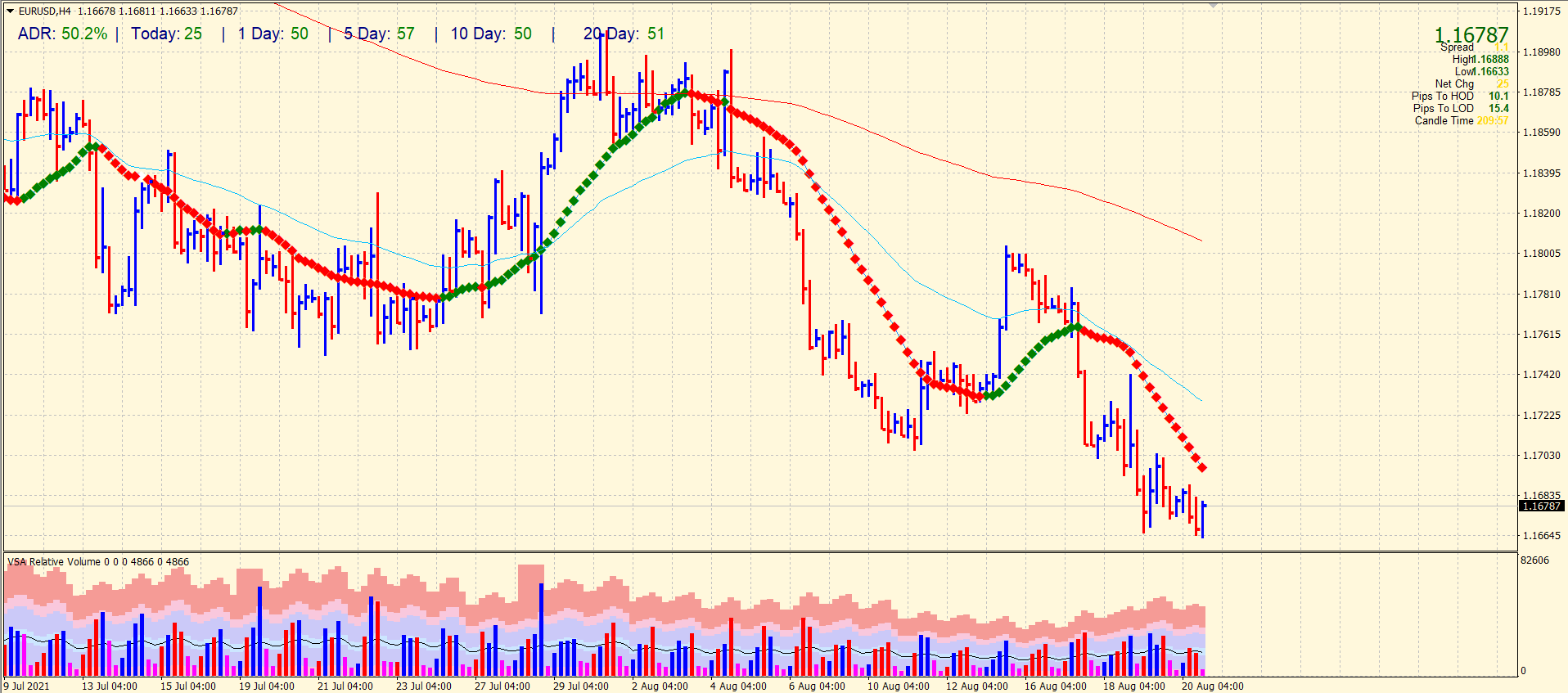

EUR/USD price technical analysis: Double bottom to provide interim support

The EUR/USD has formed a double bottom at the new yearly lows around 1.1660. Although the pattern looks weak to hold, there is a probability of upside correction after a huge fall. The bearish volume reduced slightly, but the recent 4-hour bar will make the difference at its close.

The price is not too far from the 20-period SMA, around the 1.1695 area where yesterday’s upside attempt had failed. The 1.1700 marks will again act as a strong resistance for the pair. However, only breaking the level is not sufficient to trigger a bullish reversal. Rather, a sustained move towards the 1.1750 area will be needed to gain buying traction.

–Are you interested to learn more about forex signals? Check our detailed guide-

On the downside, the probability to test the Nov lows of 1.1603 is still on the cards. Dollar’s strength can further weigh on the pair and help the bears.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.