- EUR/USD gained in the week but stayed in a tight range amid the absence of any macroeconomic event.

- Fed officials are prominently hawkish as they reiterate rate hikes and stimulus cut to stabilize the economy.

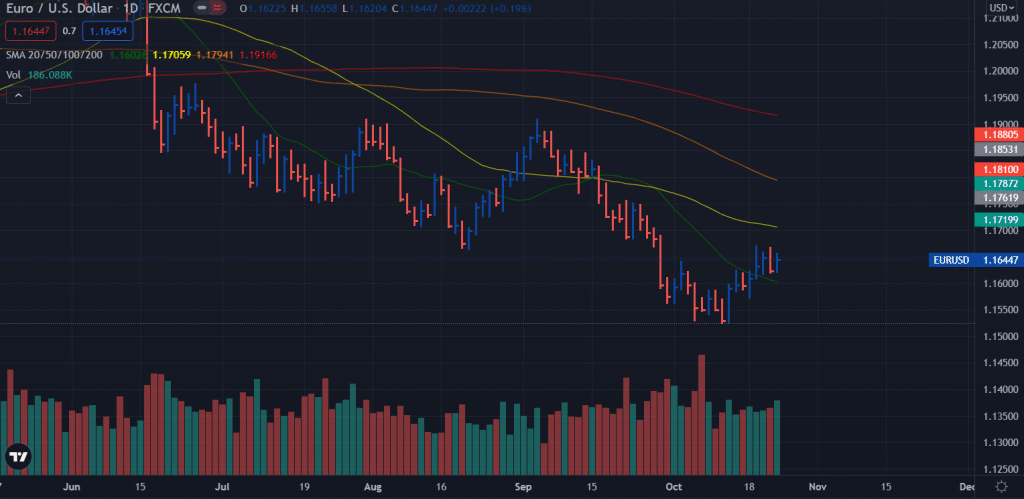

- Technically, the price is consolidating and looking to lose ground towards 1.1600 and below.

The EUR/USD weekly forecast is bearish as ECB remains on the back foot despite a rise in inflation. Moreover, the technical scenario is also not healthy for the gain.

-If you are interested in high leveraged brokers, check our detailed guide-

After rallying for the second week in a row, the EUR/USD rate ended in the 1.1630 price zone. However, as investors remained focused on the common currency, the growth was rather bland. The EUR/USD was near its 2021 low of 1.1523 and later gained about 60 pips.

Macroeconomic data was meager last week, leaving currency pairs in the hands of sentiment and US Treasury bond yields. Stocks rallied amid strong earnings reports, and Wall Street flirted with record highs. On the other hand, fears of inflation drove the yield on 10-year US government bonds to 1.70% – its highest level since late May.

Despite “temporarily” high inflation rates in the US, there is no evidence to support the opinion of Fed policymakers. According to the St. Louis Federal Reserve, the consumer price index hit a more than 10-year high of 5.4% y/y in September, while inflation expectations were 2.64 at a 10-year break-even level. It was the highest level since 2012.

According to senior Federal Reserve officials, persistently high inflation may force the central bank to raise interest rates earlier than expected. Despite this, Fed Chairman Christopher Waller said the central bank should begin cutting its bond-buying program by the end of the year. It is a “deal” at the moment that the Federal Reserve will begin cutting its asset purchases as early as November, regardless of when interest rates are raised.

The European inflation rate was confirmed at 3.4% y/y in September, while the benchmark rate was 1.9%. By Friday, market participants realized that inflation expectations in Europe had reached 2% for the first time since 2014, which, although not alarming, is putting pressure on the comfortably jaded European Central Bank. As a result, financial support from the ECB is not a priority for its policymakers.

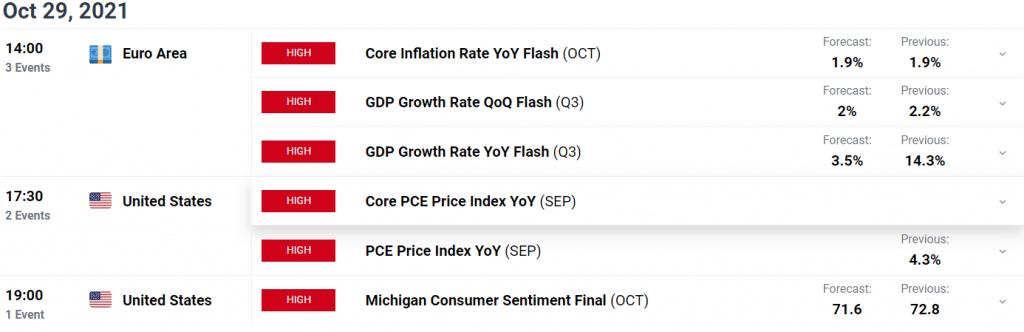

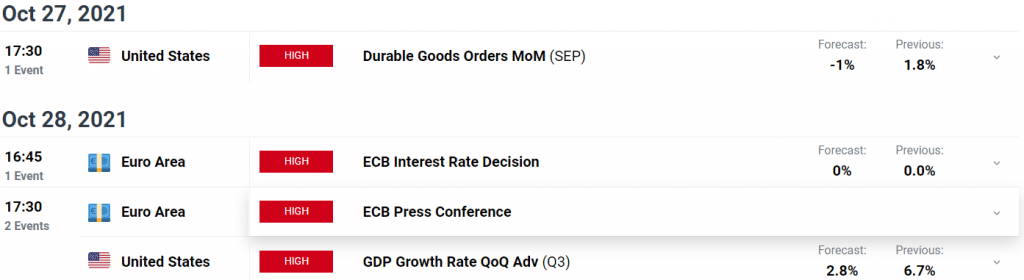

Key data/events for the EUR/USD next week

Several top-tier events are coming up next week, so it will be a busy week. In addition to the ECB’s latest monetary policy announcement, the US will release its preliminary GDP estimate for the third quarter, which is expected to total 3.2% q/q, about half of the previous 6, 7%. On Friday, the EU will release its third-quarter GDP, which is expected to rise from 2.2% to 1.9%. Additionally, the EU will release a preliminary estimate of its October CPI, which is expected to rise from 3.4% to 3.7%.

Germany will publish the October IFO and November GFK consumer confidence polls earlier this week, while the US will publish the CB consumer confidence report. In addition, the US is expecting a -0.2% m/m decline in durable goods orders, up from a 1.8% drop in August. Finally, Germany will release preliminary inflation and GDP estimates for Q3 for October.

-If you are interested in MT5 brokers, check our detailed guide-

EUR/USD weekly technical forecast: Consolidation to break

The EUR/USD price remains above the 20-day moving average, consolidating in a tight range under key support-turned-resistance of 1.1660 level. Any upside attempt may face strong resistance around 50-day SMA at 1.1700 area. On the downside, 1.1600 remains key support ahead of a double bottom at 1.1525.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.