The British pound was stuck between a rock and a hard Brexit. GBP/USD had already slipped to the lowest levels in 31 years and an accident was bound to happen. Sooner rather than later, the accident did happen. It took another push, thin volume and low liquidity to send cable temporarily under 1.20.

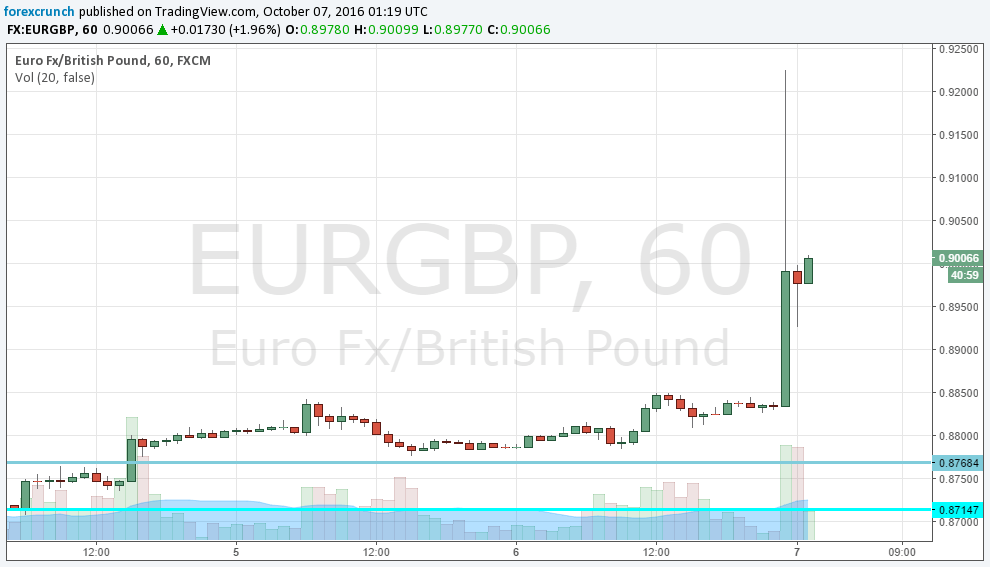

For EUR/GBP, we are also at levels not seen for quite a few years. The flash crash of the pound sent it to as high as 0.9225 before the big bounce-back. From here, we dropped back under 0.90, but the pound pressure continues and we’re seeing the cross settle above 0.90.

Will it hold or even push higher? It seems quite unlikely. Why? The pound could continue falling, but the euro could be on its tail. It is always important to remember that it is not only the UK that is leaving the EU but the EU also being left out. A harsh comment by French President Hollande is cited as being the straw that broke the camel’s back. Well, in that speech, he mentioned the EU’s existential crisis. And he’s probably right.