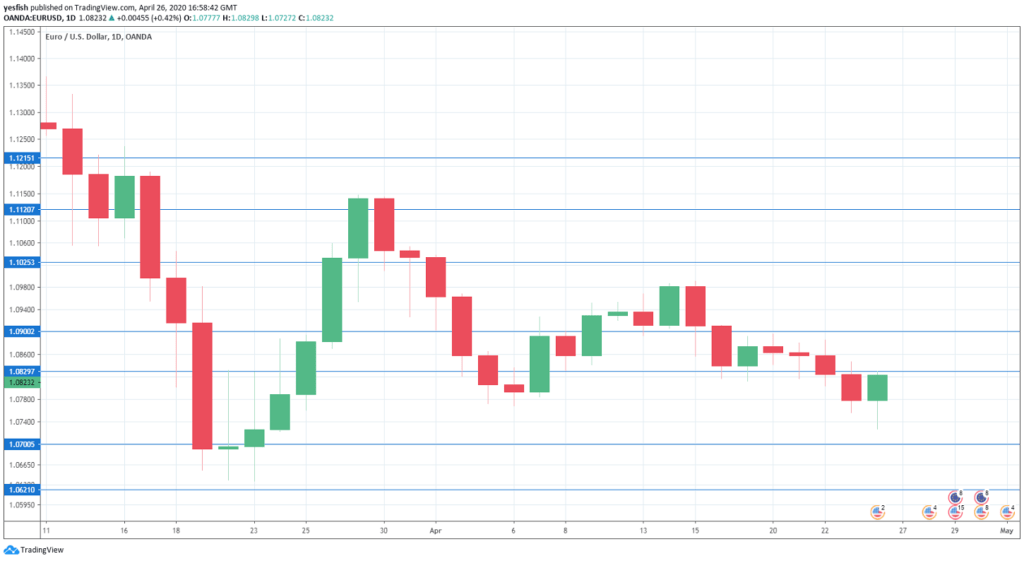

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Preliminary CPI: Wednesday, All Day. Inflation remains very low in the eurozone’s number one economy. CPI came in at just 0.1% in the final reading for March, confirming the initial release. CPI is expected to dip to 0.0% in the upcoming release.

- Monetary Data: Wednesday, 8:00. M3 Money Supply accelerated to an annual growth rate of 7.5% in February, up from 5.5% a month earlier. Private Loans slowed to 3.4% y/y, down from 3.8%. We will now receive data for March. Money Supply is projected to climb to 7.8%, while Private Loans is expected to post a gain of 3.5 percent.

- French Flash GDP: Thursday, 5:30. The euro zone’s second-largest economy contracted by 0.1% in the fourth quarter. Economic conditions have deteriorated significantly due to the Covid-19 outbreak and analysts are bracing for a sharp decline of 4.0% in Q1 GDP.

- German Retail Sales: Thursday, 6:00. Retail sales is closely watched, as it is the primary gauge of consumer spending, a key driver of the economy. In February, retail sales climbed 1.2%, good enough for a 3-month high. This crushed the estimate of 0.1%. However, the March reading is expected to be dismal, with an estimate of -8.4 percent.

- Eurozone Flash GDP: Thursday, 9:00. The initial read of GDP tends to have the most significant impact, even though it does not include data from Germany. Back in Q4, the third read confirmed a growth rate of 0.1%. For Q1, the forecast stands at -3.7 percent. A decline in this range could send the euro sharply lower.

- Eurozone Inflation: Thursday, 9:00. CPI came in at 0.7% in the final March reading, as inflation remains well below the ECB target of around 2 percent. The forecast for the initial April reading stands at just 0.1%. The core reading showed a gain of 1.0% in March and the April forecast stands at 0.7 percent.

- ECB Rate Decision: Thursday, 11:45. The ECB is scrambling to deal with the turmoil in the financial markets due to the corona crisis. The bank has changed some rules in order to maintain banks’ access to its ultra-cheap liquidity. The ECB will also publish fresh forecasts for growth and inflation and may downgrade some of the data points.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.1215, which has held since mid-January. 1.1119 is next.

1.1025 (mentioned last week) has some breathing room in resistance. The round number of 1.0900 is next.

1.0829 is an immediate resistance line.

The round number of 1.07 is next.

1.0620 is protecting the 1.06 level.

1.0500, which has held since January 2017, is the final support level for now.

.

I remain bearish on EUR/USD

Economic numbers for March are expected to be dismal, reflecting deteriorating conditions due to the Covid-19 outbreak, which hit Europe in March. This does not bode well for the euro.

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!