As traders get back from the long New Year’s holidays, the main trend of 2016 resumes a stronger US dollar. This also applies to EUR/USD, but the pair is certainly giving a fight. It is always important to remember that the eurozone’s trade balance, originating from German exports, keeps the euro bid.

On the other hand, things are not that great in the old continent. While Spanish inflation has fully emerged from deflation and even closed 2016 above 1%, France seems to lag behind. The preliminary estimate for Frances’s CPI shows a rise of 0.3% month over month, lower than 0.5% predicted. Year over year, the harmonized figure stands at 0.8%, also below 0.9% predicted.

Later today, we will get the inflation data from Germany. It is also important to note that despite a considerable rise that is expected in headline inflation, core CPI will likely refrain from budging: it is stuck at 0.8%.

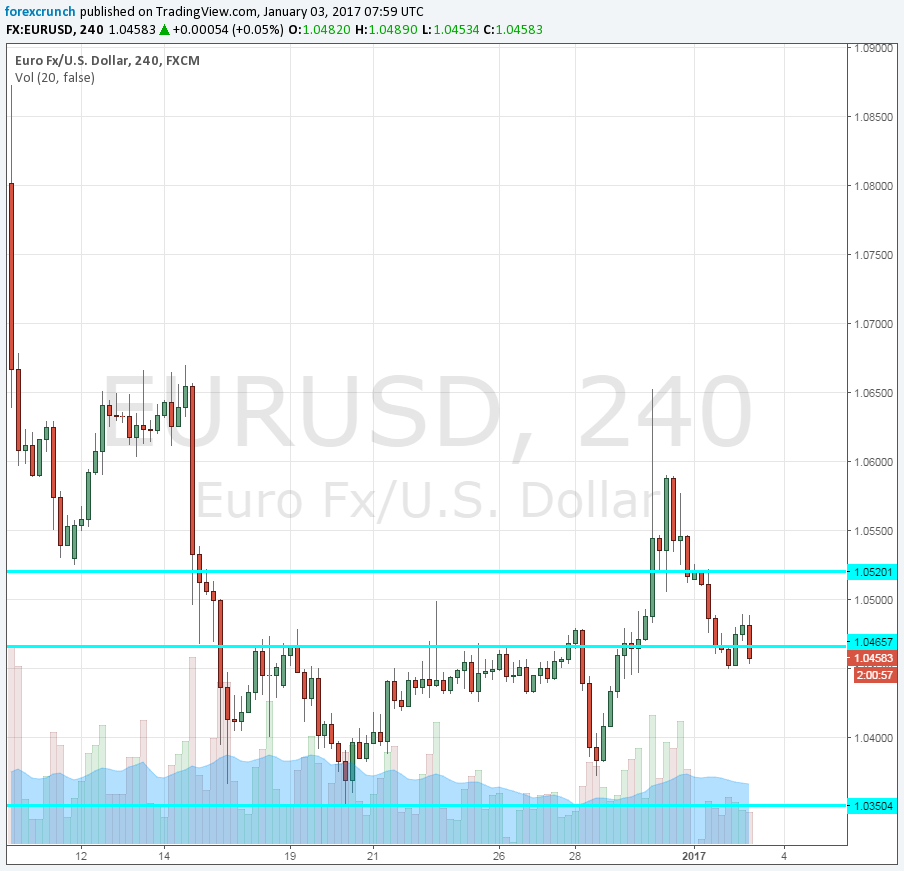

EUR/USD kicked 2017 with a dip below 1.05 but never got too far. As traders in London get back to their desks, the pair is battling the 1.0460 level once again. This was the March 2015 low that held its ground up until late 2016. After the consequential breakdown, EUR/USD was temporarily capped by this number.

The next cushion on the downside is at 1.0350: this was the low point of 2016 and also worked as resistance back in 2003, a long time ago, but the line remains relevant. On the road to parity, we find yet another hurdle, at 1.0150, a level that was a peak back in 2002.

EUR/USD flash surge: Lessons for forex traders