Welcome to 2017. The first trading day of the year is relatively light on trading, as many traders enjoy an extended weekend. Nevertheless, markets are on the move.

At the dying days of 2016, EUR/USD had a “flash surge” to 1.0660 before settling above 1.05 at the close. Yet as we discussed, early 2017 could see a resumption of the strong dollar trend, at least until Donald begins disappointing.

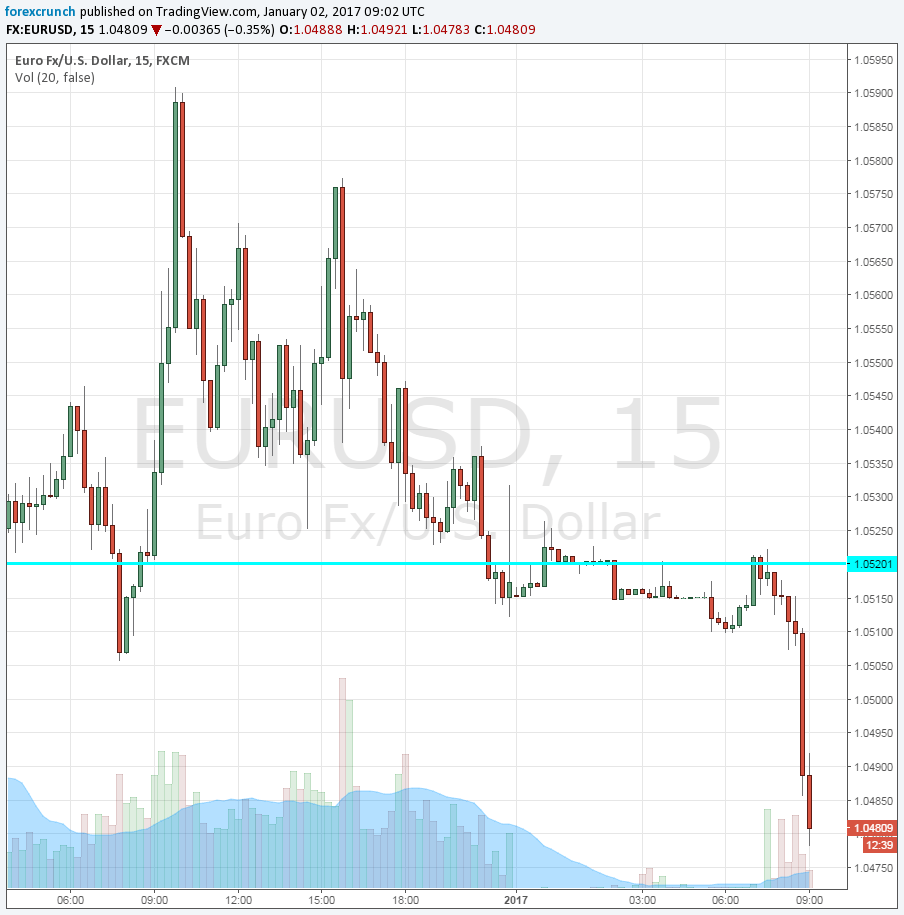

Euro/dollar is currently trading at 1.0477, a drop of 40 pips from earlier in the day. The world’s most popular currency pair was moving quite slowly in the Asian session. This time, low liquidity did not result in wild moves. However, the first European session of the year already saw a dive.

The move seems fully related to USD strength: data coming out of the euro-zone was actually quite positive: Spain’s manufacturing PMI beat expectations with a jump to 55.3 points against 54.6 expected. Also for Italy, Markit showed 53.2 instead of 52.3 that was on the cards. The data therefore suggests a stronger euro rather than a weaker one.

The next line of support is the March 2015 low of 1.0460, that capped the pair late in 2016. Further support is at the 2016 low of 1.0350. Resistance awaits at 1.0520 and 1.0660.

The window to reaching parity is open during January 2017. Will the pair take the chance?

More: EUR/USD: Set To Bottom Around 1.02 In 1-Month – Danske

Here is how it looks on the chart: