Euro dollar is leaning lower once again as details emerge from the EU Summit. Apart of having Britain left out of treaty changes, the small size of the permanent bailout mechanism and the lack of addressing the current situation weighs on the markets: This joins Draghi’s drag. Italian yields are up. We have a few important US figures to wrap up the week.

Here’s a quick update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

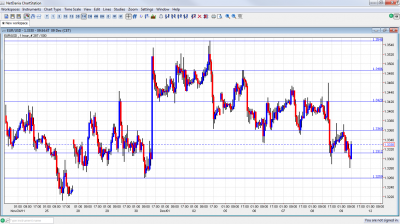

- Asian session: Active session saw the pair attempt to regain lost ground with a rise to 1.3360 but drop once again and reach a new low.

- Current range: 1.3310 – 1.3360

- Further levels in both directions: Below 1.3310, 1.3260, 1.3212, 1.3145. 1.30 and 1.2873.

- Above: 1.3360, 1.3420, 1.3480, 1.3550, 1.3650, 1.3725 and 1.38.

- 1.3360 now switched positions to resistance.

- 1.3260 provides support before the super strong 1.3145.

Euro/Dollar leaning lower after EU Summit failure- click on the graph to enlarge.

EUR/USD Fundamentals

- 7:00 German Trade Balance. Exp. 14.5 billion. Actual +12.6 billion.

- 7:00 German Final CPI. Exp. 0%.

- 7:45 French Industrial Production. Exp. -0.1%. Actual 0%.

- 13:30 US Trade Balance. Exp. -43.5 billion.

- 14:55 US Consumer Sentiment. Exp. 65.6 points. See how to trade this event with USD/JPY.

* All times are GMT.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- EU Summit Failure: The leaders of 23 out of 27 countries agreed on treaty changes enforcing stricter budget rules. This not only excludes Britain, but also has a long timetable. Regarding the permanent bailout mechanism, the ESM, its size hasn’t been enlarged. Similar to the ECB’s move (see below), the leaders failed to address current affairs. If the leaders are still playing a game, this is a dangerous one. Italian yields continue rising.

- Draghi drags markets down: In one of the busiest rate decisions seen for quite some time, the ECB lowered the interest rate to 1% as expected, eased collateral rules for banks and offered 3 years loans. But on the other hand, ECB president made it clear that the ECB would not scale up its bond buying. So, Italy and Spain continue struggling and the euro falls.

- Greeks withdraw money: The pace of withdrawals from Greek banks intensified recently, as the chances of leaving the euro-zone rose. This Greek bank run could bring down the system.

- Everyone is warned: In a move that shocked markets, credit rating agency Standard and Poor’s warned all euro-zone countries, apart from Greece, that their rating is endangered. Some countries, such as Germany, got a warning about a one-notch downgrade, while France, Italy, Spain and others received a two-notch warning. The decision on a downgrade depends on the result of the summit on Friday. The move certainly looks as a political move to put pressure on the leaders before the summit.

- Nice drop in US jobless claims: Weekly jobless claims returned to providing hope for the US, dropping to 381K. In recent weeks, most US figures have been positive. This is also reflected in the all-important job data. The US continues to gain jobs at a nice pace, with the unemployment rate falling to 8.6%. On the other hand, the services PMI dropped and also factory orders fell. This is somewhat disappointing, although US PMIs still reflect growth.