The US dollar remains under pressure. The greenback was partially hit by the FOMC minutes and then got a big blow from the Donald. While foreign exchange trading is never a one-way street, the trend that emerges is a sell-off in the USD.

Without fresh talk about fiscal stimulus nor tax cuts from the incoming administration, the US dollar runs out of hot air.

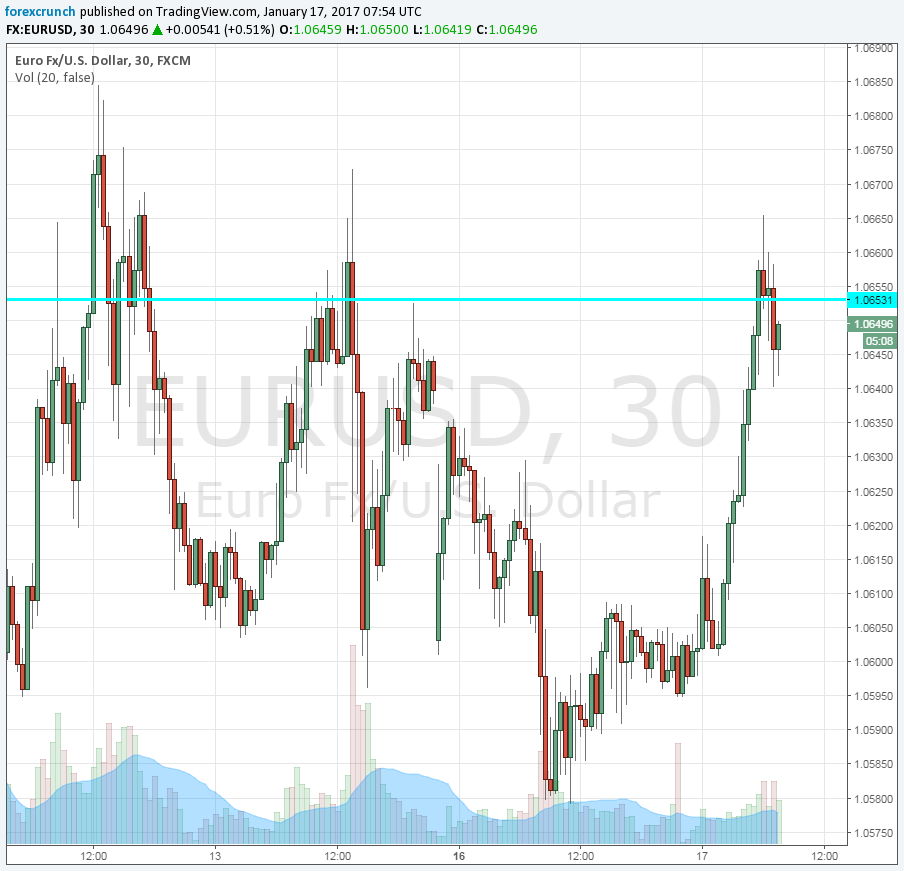

The euro, which enjoys a current account surplus, is taking advantage of this retreat and bounces back higher, trading at the 1.06 handle. Will euro/dollar break above 1.07?

Not so fast. The euro also has troubles of its own. The worsening relations with the US following German bashing by Trump could weigh. Moreover, the main dish of the day comes from the UK. UK PM Theresa May is set to outline her Brexit strategy and will likely be hard. The British exit from the EU hurts the pound, but it takes two to tango and two to divorce: the breakup has implications in the UK as well.

And of course, Mario Draghi meets the press on Thursday, and he has a tendency to weigh on the single currency.

More: EUR/USD: Trump Vs Draghi; Where To Target? – BofA Merrill