EUR/USD slipped to new 14-year lows in the wake of 2017 but recovered very quickly thanks to weakness in the USD. The second week of January features trade balance and industrial output measures. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Data in the euro-zone has been relatively positive, with a significant drop in German unemployment and a rise in inflation, especially in Germany. Retail sales missed expectations, but this did not stop the euro. In the US, data had a good start with an excellent report from the manufacturing sector but then became sour with ADP. The meeting minutes from the Fed hurt most, as they showed that Yellen and co. got a bit ahead of themselves with expectations for stimulus from Trump. The last word went to the dollar, with the NFP report: wages are up 2.9%, triggering talk about inflationary pressures.

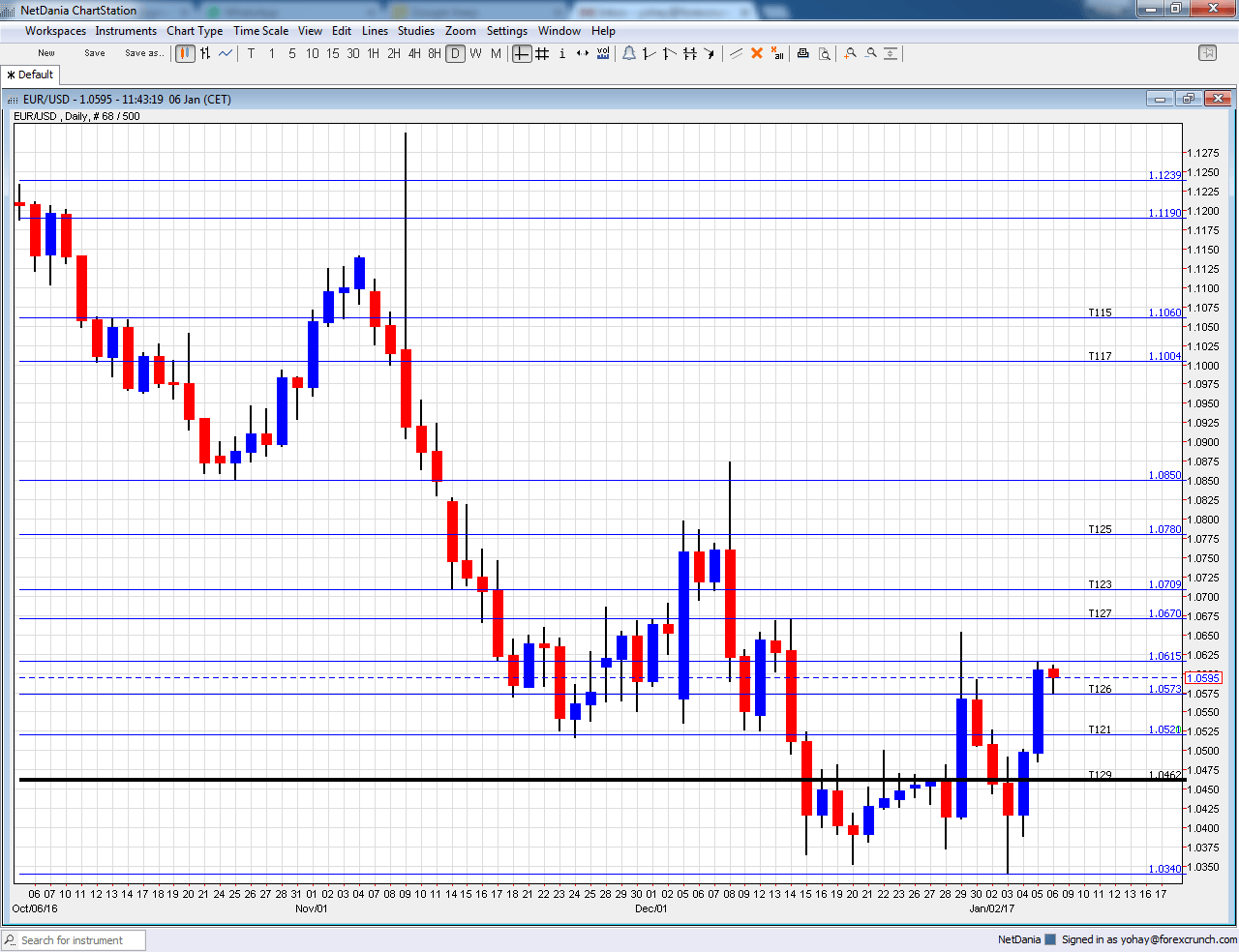

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- German Industrial Production: Monday, 7:00. Germany is considered the locomotive of the continent. In October, output rose by 0.3%, bouncing after a slide seen beforehand. A rise of 0.7% is on the cards.

- German Trade Balance: Monday, 7:00. German enjoys wide trade surpluses. Back in October, this stood at 20.5 billion euros. Germany’s exports keep the euro bid. A similar level of 20.8 billion is estimated for November.

- Sentix Investor Confidence: Monday, 9:30. This 2800-strong survey disappointed in December with a slide back to 10 points, ending four consecutive advances and surprises. A bounce to 12.6 is projected.

- Unemployment Rate: Monday, 10:00. The euro-zone unemployment rate resumed its falls back in October with a drop to 9.8%. This was quite encouraging after the rate got stuck in double-digit measures for a long time. A repeat of 9.8% is forecast.

- French Industrial Production: Tuesday, 7:45. The second-largest economy in the eurozone saw a squeeze in its output back in October, a drop of 0.2%. Changes here are less volatile than in Germany. An increase of 0.5% is predicted.

- French Final CPI: Thursday, 7:45. Contrary to Spain and Germany, France’s inflation figure for December missed expectations with 0.3%. This number will likely be confirmed in this final read.

- Industrial Production: Thursday, 10:00. Despite being released after the German and French figures, the read for the whole continent is of note. A drop of 0.1% was reported in October. A gain of 0.5% is on the cards.

- ECB Meeting Minutes: Thursday, 12:30. The European Central Bank announced an extension of its QE program through 2017, a removal of some limits on bond buying but also a reduction in the pace of these buys. The bottom line was dovish as seen in the value of EUR/USD The meeting minutes could reveal if the ECB is still very worried about inflation, the reason for extending the program, or actually satisfied with the progress that has been made, the reason for the reduction. It could also tell us something about the next potential moves.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar resumed its falls, reaching the 1.0340 level mentioned last week but quickly recovered. reaching a high of 1.0615.

Technical lines from top to bottom:

1.0710 is the upper resistance line on the chart after temporarily capping the pair in April 2015. 1.0670 is a high level reached in December, after as the pair attempted a recovery.

The early high of January, at 1.0615 is the next line. 1.0570 was a stepping stone on the way down.

Further below, the early 2016 low of 1.0520 and the 2015 low of 1.0460 are seen. 1.0460 seems to carry more weight.

Even lower, there are two significant barriers on the way to parity. The 1.0340 level was the low of 2003 before the pair advanced to higher ground. The 101.50 level was a peak seen in 2002, on the first attempt of the pair to break above parity.

And then, there is EUR/USD parity.

I am neutral on EUR/USD

Even though euro-zone data looks better, monetary and fiscal divergence leaves more room to the downside ahead of Trump’s inauguration. However, with another week left, the pair could stabilize after the recent gains.

Our latest podcast is titled Is the FED Data or Donald Dependent?

Follow us on Sticher or iTunes

Safe trading!