EUR/USD wobbled on the market mood, suffering from the changing sentiment regarding the British EU Referendum. Apart from the event itself, we have key German surveys and PMIs. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

A UK exit of the EU is also seen as a danger for the euro-zone. When opinion polls showed a stronger lead for the Leave campaign, the euro suffered. When the pound recovered, the euro followed. Elsewhere, inflation figures were confirmed at low levels for May but industrial output surprised to the upside. In the US, the Fed was certainly dovish, but the dollar weakness that followed did not last on its own, nor did the positive retail sales. The upcoming week will see the culmination in the UK, the euro-zone and for many other currencies as well.

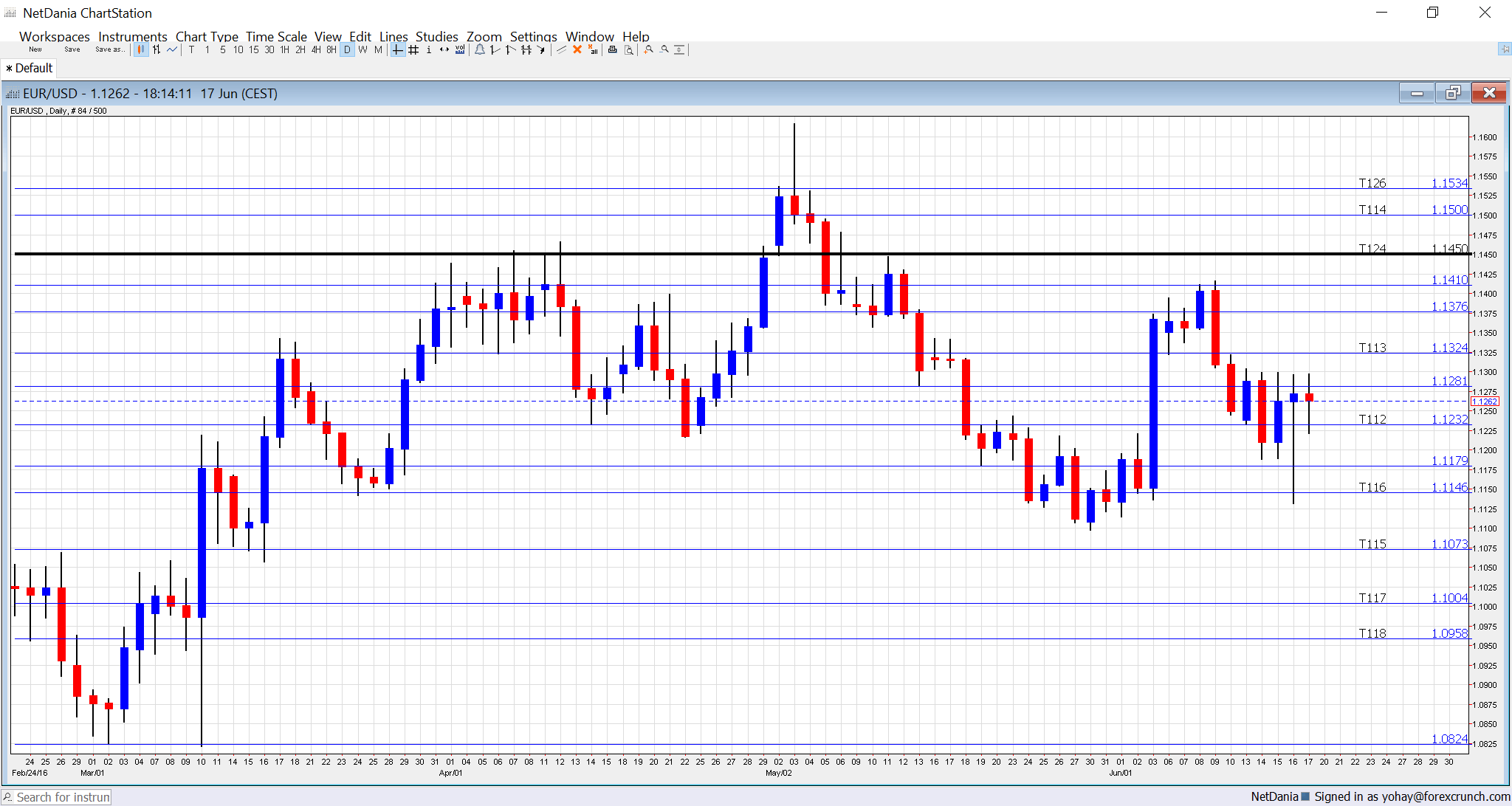

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German PPI: Monday, 6:00. Early in the week, we’ll get an indicator about producer prices. These feed into consumer prices. The euro-area’s biggest economy saw a small rise of 0.1% in April. We now get the data for May. Expectations stand at 0.4%.

- German Bundesbank report: Monday, 10:00. The German central bank publishes its monthly report with an assessment of the economy. They have warned that Q2 growth will probably be weaker than Q1. It will be interesting to hear if they talk about the danger of Brexit.

- German ZEW Economic Sentiment: Tuesday, 9:00. This 275 strong survey is released early in the month and precedes the more important IFO one. In May, German business sentiment dropped to 6.4 points, whilst it was expected to rise and after mostly positive surprises beforehand. Will the current negative mood feed into the figure? Expectations stand on a positive 5.1 point read. A negative number would reflect pessimism. Also note the all-European figure which stood at 16.8 points in May and 15.3 is on the cards for June.

- TLTRO II: Begins Wednesday. As part of the ECB’s big announcement in March, it performs new Targeted Long Term Refinancing Operations or in simpler words: it lends money to banks quite cheaply on the condition that the money is lent to the real economy. In the current interest rate environment, the ECB basically pays banks so that they lend out the money. The total take will be watched: if the banks take on more loans, it is good for the wider economy and for the euro but is also means more easy money that could flow out of the zone. Less loans would be more worrying for the euro-zone.

- Consumer Confidence: Wednesday, 14:00. According to the latest Eurostat survey, consumers are somewhat more confident with -7 points in April. This is still in negative territory but the best since December. A repeat of -7 is expected.

- British EU Referendum: Thursday, with polls closing at 21:00 GMT and clear results due early on Friday. Brits will decide on whether to remain in the European Union or to leave it. Markets have a clear preference for the status quo which implies more certainty and less trade barriers. While a vote to leave will not have immediate actual implications, it will certainly rattle financial markets and trigger high uncertainty. The political and economical situation in the euro-zone is at a low point: debt crises haven’t been fully solved, the refugee crisis is tearing the continent apart and confidence in Brussels is also low. A decision of the UK to leave, even if it isn’t a euro-zone member, could deal a death blow to the already fragile union, with potential damage to trade and perhaps more countries thinking of leaving. We have seen how opinion polls have moved the euro in addition to the pound in recent weeks.

Currently, polls show a momentum towards the Leave campaign with an advantage of 48% against 43%, totally different from what we’ve seen several weeks ago. However, the still close polls, the tragic murder of MP Jo Cox and the potential of undecided voters to “stick with the devil they know” are more likely to lead to a small victory for Remain. In case of a vote to leave, the euro will fall alongside the plunging pound. But also with a narrow win for staying, it will take a long time for the wounds to heal. More:

All the Brexit updates in one place

Is your broker Brexit ready? Some brokers are changing margins also for the euro - Flash PMIs: Friday: 7:00 for France, 7:30 for Germany and 8:00 for the euro-zone. These are forward looking indicators published by Markit which releases the preliminary figures for June. The French manufacturing sector was in contraction according to Markit, with a score of 48.4 points in May, under the 50 point threshold separating growth and contraction. A rise to 48.8 is predicted now. The services sector was doing better with 51.6 points with 51.5 expected now. Germany, the largest economy, had manufacturing at 52.1 points in May. The same score is expected now. Services was at 55.2 points and a small slide to 55 is estimated. The euro-zone had 51.5 and 53.5 for manufacturing and services respectively.. Both are expected to tick down by 0.1.

- Belgian NBB Business Climate: Thursday, 13:00. This wide survey coming from the heart of Europe showed a slight deterioration in sentiment in May, with -2.8 points. The negative number means worsening conditions. A score of -2.9 is predicted.

- German Ifo Business Climate: Friday, 8:00. Germany’s No. 1 Think Tank showed improving sentiment in May with 107.7 points, better than expected and the best since December. It will not be totally surprising to see a slide now. No big changes are expected: 107.6.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar started the week supported by the 1.1230 level (mentioned previously). It then dipped to much lower ground at 1.1130 before bouncing back up in a high-volatility week.

Technical lines from top to bottom:

1.1712 was the high point in August 2015 and remains high in the sky. The May 2016 high of 1.616 is certainly worth watching.

1.1535 is a stepping stone as seen in May 2016 and also beforehand. It is followed by the very round level of 1.15.

1.1460 was a key resistance line in 2015 and 1000 above the multi-year lows. 1.1410 capped the pair in early June. 1.1375 worked as resistance in February and as support in May 2016.

1.1335 worked as the lower bound of a higher range and then capped recovery attempts in May. 1.1230 capped the pair after the fall in May and works as resistance.

1.1175 was the low point in the mid-May fall. 1.1140 cushioned the pair in October. 1.1070 served as a clear separator of ranges during February and also beforehand.

1.10 is a round number and significant resistance. 1.0960, which worked in the past as resistance, provided a cushion for the pair in February. 1.0825 worked as support in early March 2015 and should also be watched. This is now a triple bottom.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015.

I remain bearish on EUR/USD

Brexit seems more and more real and this weighs heavily on the euro as well. It could be the beginning of the end of the EU and the euro-zone. A narrow victory for Bremain, which still has good chances, will also leave open wounds in the UK and in the continent. A short-lived relief rally in the euro could be temporary in this case. Only a huge victory for remain would send the euro higher. European data will probably not help, as the green shoots seen Q1 may be behind us.

Our latest podcast is titled Oil, Brexit and the Big Fed Preview