EUR/USD drifted to the upside, driven by the dollar’s weakness. Is there more to come? The big event of the upcoming week is the French elections, followed by the ECB decision. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The latest polls towards the first round of the French presidential elections showed a very close race between no less than four candidates. Only two will make it to the second round. Final euro-zone inflation figures confirmed the drop in both headline and core inflation, vindicating Draghi’s dovishness. In the US, housing figures were mixed and the greenback mostly slipped on a growing disillusion with Trump’s policies.

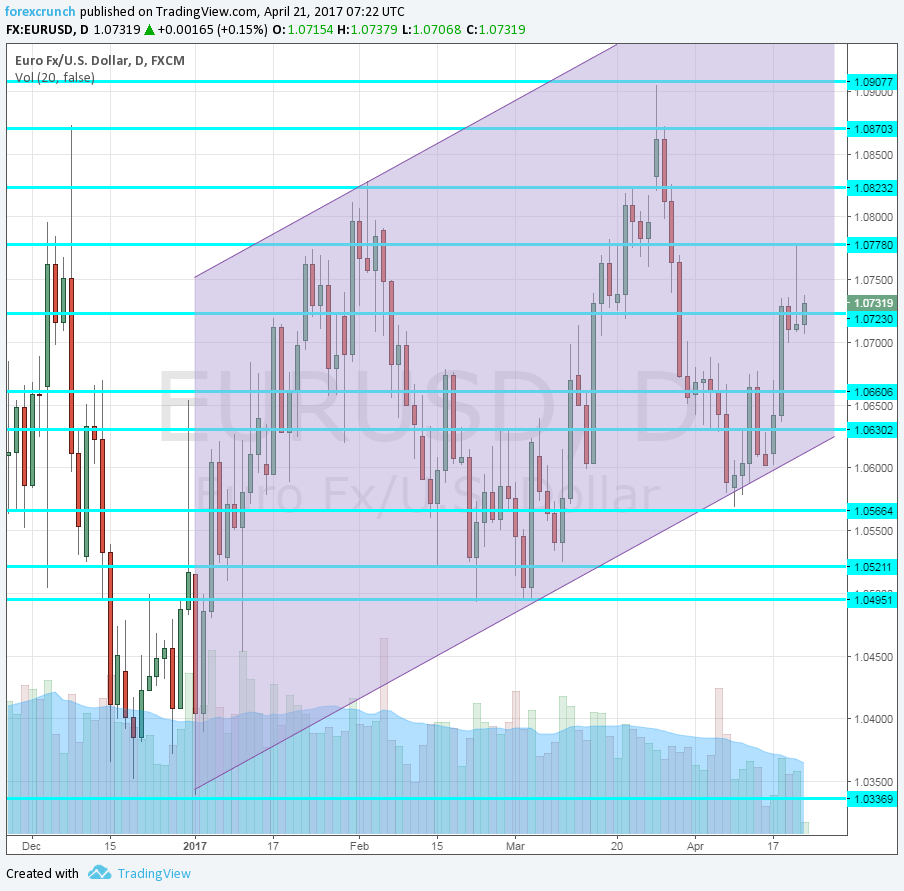

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- French Presidential Elections: Sunday, exit poll expected before markets open, but full results could wait for Monday morning if the race is very close. The No. 1 political event of 2017 sees 11 candidates vying for two places in the second round. There are four contesters that could not be more different. Markets hope for centrist Emmanuel Macron or center-right Fran̤ios Fillon to become the next President of the French Republic, but the candidate with the highest chances of making it to the second round is Marine Le Pen. Le Pen, of the extreme right, wants to leave the euro and the EU, in what could be the final blow to the project. She is unlikely to win the second round, but her specter frightens markets. A new source of fear is radical-left Jean-Luc Melenchon, who is making a late surge in the polls. A Le Pen-Melenchon runoff is the worst nightmare for markets and the euro. Here is the full preview: trading the French elections with EUR/USD Р4 scenarios and targets. Also, follow all the updates on this page.

- German Ifo Business Climate: Monday, 8:00. Germany’s No. 1 Think-tank reported a rise in business confidence, to a score of 112.3, above expectations. The sustained recovery fuels future expectations. Will it continue this time? A score of 112.4 is on the cards now.

- Belgian NBB Business Climate: Tuesday, 13:00. Despite coming from a small country, Belgium’s wide survey is a good belwhether of confidence in the continent. A score of -1.6 was seen last time. -1.4 is predicted this time, very similar.

- German CPI: Thursday: throughout the European morning by the various German states and at 12:00 for all of Germany. Germany’s consumer price index rose by 0.2% in March, half the early expectations and leading the drop later seen elsewhere. A drop of 0.1% m/m is forecast.

- Spanish Unemployment Rate: Thursday, 6:00. The fourth-largest economy in the euro-zone still suffers from a very high level of unemployment, but this has been improving. In Q4 2016, the unemployment rate stood at 18.6%. The same rate is estimated now.

- German GfK Consumer Climate: Thursday, 6:00. Contrary to consumers, this 2000-strong survey showed a fall: from 10 to 9.8, below expectations. Will German consumers feel more cheerful in the Spring? A tick up to 9.9 is projected.

- Spanish CPI: Thursday, 7:00. Spain struggled with deep deflation and then saw prices surging towards the end of 2016. However, the pendulum swings once again to the downside with y/y price rises dropping to 2.3% in March. A bump up to 2.5% is expected.

- ECB rate decision: Thursday: decision at 11:45 and the press conference is at 12:30. The European Central Bank did not announce any policy changes at its March meeting, which also consisted of new forecasts. Draghi did note that the Governing Council decided to remove the “use all instruments” phrase in order to convey a message that things are not as urgent as they used to be. It then pushed the euro higher but following clarifications cooled things down. This time, we will not receive new forecasts and no changes are expected. Since the beginning of April, the ECB buys bonds at a lower rate of 60 billion euros a month instead of 80 billion. The euro will likely react to Draghi’s tone: optimism about rising inflation and growth will help the single currency while Draghi’s more usual caution and dovishness could weigh on it. Questions about the French elections are also likely, but they will probably be deflected.

- German retail sales: Friday, 6:00. Consumers went out shopping in February with a better than expected increase of 1.8% in retail sales. A modest advance of 0.1% is likely now.

- French CPI: Friday, 6:45. Consumer prices advanced by 0.6% in March, but this came out below projections. A slower rise is on the cards now. It all feeds into the all-European numbers. A rise of 0.2% is projected.

- Spanish GDP: Friday, 7:00. Spain enjoys robust growth in the past few years, with 0.7% q/q in Q4 2016. A similar expansion is predicted now: 0.7% once again.

- Monetary data: Friday, 8:00. The ECB tracks the money in circulation (M3 Money Supply) and private loans. M3 has growth at an annual rate of 4.7% in February. Private loans had accelerated their growth rate to 2.3% back then. M3 is expected to rise at the same pace while the volume of loans will likely accelerate to 2.4%.

- CPI Flash Estimate: Friday, 9:00. All those preliminary numbers from the big member states culminate in the release for the whole euro-zone. After a few months of rises that were fueled by oil prices, March saw a significant cooldown: 1.5% on the headline and 0.7% on the core, a big drop after many months of 0.9%. Core inflation is expected to bounce up and reach 1% y/y while headline inflation carries expectations for +1.8%. Note that the early releases from the member states will have some influence.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar made a move to the upside, rising within the channel (mentioned last week).

Technical lines from top to bottom:

The round number of 1.10 is the high line for now. The new 2017 high of 1.0905 is the next line.

The swing high of 1.0870 is the swing high in December and remains fierce resistance. 1.0830 was the 2017 high and follows closely.

1.0775 capped the pair in January and remains of importance. 1.0720 was also a high in January.

The pair was unable to crack 1.0660 in February and it remains the high end of the range. 1.0630 is the next level, holding back the pair in February and March.

1.0520 is a relic of the past but still serves as a cap. The more recent low of 1.0490 follows very closely.

Further below, we find the multi-year low of 1.0340. Only 1.0150 separates the pair from parity at this point.

Uptrend channel

EUR/USD has had three significant and rising lows in 2017: 1.0340 in the wake of the year, 1.0490 in March and 1.0565 in April. Also on the topside, we can see higher highs. If this is the case, there is more room to the upside than to the downside.

I am bullish on EUR/USD

Everything depends on the French elections. While they are extremely close, Macron’s lead in the polls should translate to him making it to the second round. This should be enough to push the euro higher at the wake of the week, before the pair reacts to other news. If the runoff is Le Pen vs. Melenchon, we could see a drop below parity with other data points and even a very optimistic Draghi (unlikely) being unable to help.

Our latest podcast is titled French fate and British snaps

Follow us on Sticher or iTunes

Safe trading!