EUR/USD dipped to new lows but did not experience the magnitude of the previous weeks. Fresh inflation figures stand out as we enter the final month of 2016. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

ECB President Draghi continued sounding cautious, weighing on the euro. On the other hand, PMIs, as well as Germany’s IFO business climate measure, were mostly positive. On the other side of the Atlantic, US durables goods orders looked good, and the dollar continued enjoying a bit more of the “Trump rally.”. The pair reached a double-bottom at 1,.0520, matching the levels seen in December 2015, just before the one-year anniversary.

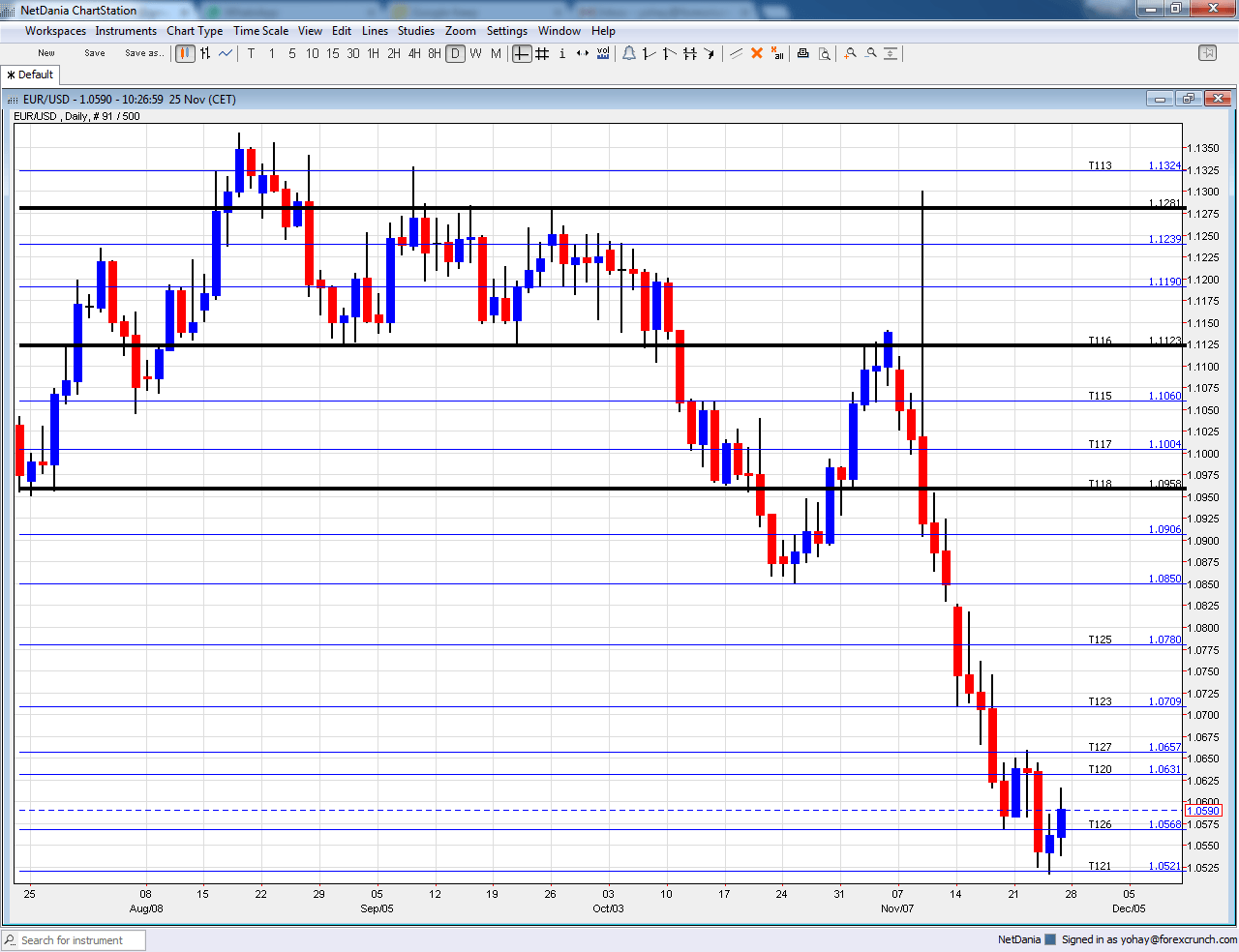

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Monetary data: Monday, 9:00. According to the ECB, M3 Money Supply, or the amount of money in circulation, rose at an annual pace of 5%, and no change is expected. Private loans advanced at a rate of 1.8% and a rise to 1.9% is predicted. Both numbers have been stable of late.

- Mario Draghi talks: Monday, 14:00. The President of the ECB testifies once again in Brussels. His previous comments were relatively dovish, and there is a good chance he repeats them now. Tension is growing towards the ECB’s decision in December.

- German CPI: Tuesday: the German states release the data throughout the morning with the all-German figure at 13:00. Prices rose in Germany by 0.2% in October. We now get the preliminary numbers for November. The German numbers feed into the all-European figures and they will impact the ECB. A rise of 0.1% m/m is on the cards.

- French Consumer Spending: Tuesday, 7:45. Back in September, the volume of sales in Europe’s second largest economy disappointed with a drop of 0.2% against expectations for a rise. A rise of 0.2% is predicted.

- Spanish CPI: Tuesday, 8:00. Spain suffered from one of the deepest levels of deflation but managed to return to price rises. It saw an annual advance of 0.7% back in October. We now get the preliminary data for November. A rise of 0.5% is projected.

- German Retail Sales: Wednesday, 7:00. The volume of retail sales disappointed with a big drop of 1.4% in September. For the month of October, an increase of 1% is expected.

- French CPI: Wednesday, 7:45. Hours before the all-European release, we get figures from the second largest economy. Prices stalled back in October on a monthly basis. A slide of 0.1% is projected.

- German Unemployment Change: Wednesday, 8:55. Germany enjoys a rather consistent drop in the level of unemployment. The month of September saw a drop of 13K in the number of unemployed. A drop of 6K is estimated.

- CPI: Wednesday, 10:00. This is the first estimate of euro-zone inflation for November, data that will be closely watched by the ECB in Frankfurt. In October, headline inflation rose by 0.5%, an improvement led by the diminishing effect of the fall in oil prices. However, core inflation remained stuck at 0.8%. Another tick up is predicted in headline CPI, to 0.6%, while core inflation is projected to remain unchanged.

- Mario Draghi talks: Wednesday, 12:30. The President of the ECB will make a second apperance this week, this time in Madrid, where the future of Europe is on the agenda. While monetary policy is officially off the cards, anything related to future moves could still slip.

- Manufacturing PMIs: Thursday: Spain at 8:15, Italy at 8:45, final French figure at 8:50, final German data at 8:55 and the final euro-zone data at 9:00. Back in October, Spain had a score of 53.3 points, above the 50 point threshold separating expansion from contraction. A score of 53.7 is expected now.. Italy had a lower score of 50.9 points and 51.4 is forecast now. The initial number for France stood at 51.5 points in November. Germany had 54.4 and the whole euro-zone at 53.7 points. These numbers will probably be confirmed now.

- Unemployment Rate: Thursday, 10:00. The unemployment rate in the Euro-zone had a few great months, sliding from the highs, but afterward, it stalled. In September it reached 10%. A repeat is estimated now.

- Spanish Unemployment Change: Friday, 8:00. Spain still has a very high unemployment rate and the monthly release of the change in unemployment is eyed. Back in October, Spain saw a rise of 44.7K. A drop of 25.8K is predicted.

- PPI: Friday, 10:00. The Producer Price Index ticked up by 0.1% in September. These figures eventually reach consumers. A rise of 0.4% is on the cards.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar managed to bounce back up from the lows seen last week but then reached a double-bottom at 1.0520, showing great technical behavior. However, there has been a lot of back and forth.

Technical lines from top to bottom:

1.1125 cushioned the pair in early September. 1.1070 served as a clear separator of ranges during February and also beforehand.

1.10 is a round number and significant resistance. 1.0960, which supported the pair in early 2016 worked as resistance in October. 1.0850, which worked as support during the same month, serves as support.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015.

Further below, the 2016 low of 1.0520 and the 2015 low of 1.0460 provide further support – it is the last line in the sand.

I turn from neutral to bearish EUR/USD

After a calmer week, we are back to business with a full schedule and no holidays. This could result in the resumption of the downtrend, a result of the monetary policy divergence.

Our latest podcast is titled Eyeing OPEC – Critical crude

Follow us on Sticher or iTunes

Safe trading!