EUR/USD was still struggling with the strength of the US dollar that continued dominating the scene. The main event of the week is undoubtedly the ECB meeting. Will Draghi drag down the euro or let it rise? Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Euro-zone inflation came out worse than expected with 0.2% on the headline and 0.8% on the core figure. This keeps the pressure on Draghi. In the US, te impact from the Jackson Hole Symposium continued boosting the dollar and sent EUR/USD back to the post-Brexit levels. The initial reaction from the weak NFP was a rebound in EUR/USD, but that did not last and the pair ended the week lower.

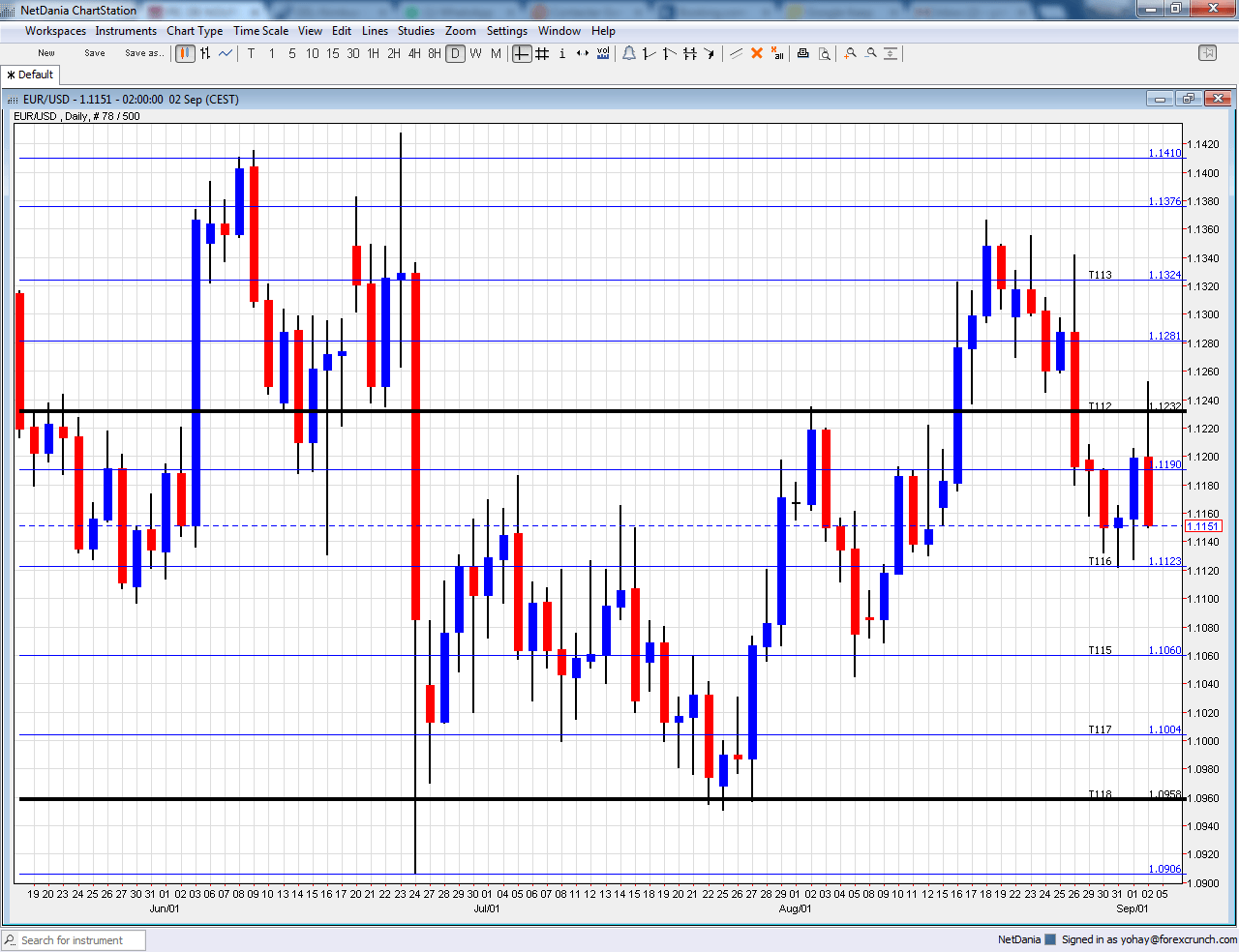

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Services PMIs: Monday morning: 7:15 for Spain, 7:45 for Italy, final French number at 7:50, final German number at 7:55 and final euro-zone number at 8:00. A figure above 50 represents an expansion, and a number below it reflects contraction. Spain saw solid growth with 54.1 points in July and 55.1 is now expected. Italy had slower growth at 52 points. 52 is now on the cards. According to the preliminary figure for France for August, the second-largest economy of the euro-zone had 52 points. Germany, the largest economy, had 53.1 points, and the whole euro-zone saw 53.1 in August. The last three numbers are expected to be confirmed.

- Sentix Investor Confidence: Monday, 8:30. This 2800 strong survey suffered a drop on the Brexit aftermath but recovered to 4.2 points in August, still reflecting optimism. A rise to 5.1 is on the cards.

- Retail Sales: Monday, 9:00. Despite its release after the French and German numbers, the read for the whole euro-zone is of importance. A flat read was seen in July after two months of growth. Have consumers ramped up purchases in July? Estimations stand at 0.5%.

- German Factory Orders: Tuesday, 6:00. The continent’s powerhouse saw a drop of 0.4% in orders back in June. A bounce back could be seen for July with +0.5%.

- Retail PMI: Tuesday, 8:10. Markit’s purchasing managers’ index for the retail sector has been in contraction zone for a while. In July, the indicator stood at 48.9 points.

- Revised GDP: Tuesday, 9:00. According to the data, we have so far, the euro-zone economies grew by 0.3% in Q2 2016. This average growth is better than contraction, but still somewhat worrying. Confirmation is expected now.

- German Industrial Production: Wednesday, 6:00. Industrial output in the powerhouse of the old continent rose by 0.8% in June. Another small rise by 0.1% is predicted now.

- French Trade Balance: Wednesday, 6:45. Contrary to Germany, the second largest economy has an ongoing trade deficit. A gap of 3.4 billion euros was recorded in June. A similar figure is on the cards for July which is expected to be wider at -3.7 billion.

- Rate decision: Thursday, the decision is at 11:45 and the press conference by ECB President Mario Draghi is scheduled for 12:30. Since the ECB threw the kitchen sink back in March, it has mostly been busy implementing the new measures, such as the second TLTRO and the buying of corporate bonds. So far, the policy has contributed to better growth but inflation remains weak. With monthly buys of 80 billion euros of bonds per month, the main lending rate standing at 0% and a negative deposit rate of -0.40%, it seems the central bank is close to its limits. Draghi has been upping his rhetoric calling for governments to do more, but it fell on deaf ears so far. No new drastic measures are expected from the ECB this time. They could extend the QE program beyond the current end-date of March 2017. They could also ease some of their bond-buying restrictions. The ECB also releases new forecasts for inflation, and this will be interesting to watch as well. Draghi and his colleagues would like to keep the pressure on the euro, to assist exporters and to lift prices of imported goods. However, Draghi is not the magician he used to be.

- German Trade Balance: Friday, 6:00. Germany’s wide trade surplus keeps the euro bid. A level of 21.7 billion euros was seen in June. Another similar read is on the cards: 21.2 billion.

- French industrial output: Friday, 6:45. France’s industrial production fell by 0.8% in June, in a disappointing read. It could rebound now.with +0.2%.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar remained under pressure at the beginning of the new week, slipping under the 1.1190 level (mentioned last week).

Technical lines from top to bottom:

1.1535 is a stepping stone as seen in May 2016 and also beforehand. It is followed by the very round level of 1.15.

1.1460 was a key resistance line in 2015 and 1000 above the multi-year lows. 1.1410 capped the pair in early June. 1.1375 worked as resistance in February and as support in May 2016.

1.1335 worked as the bottom bound of a higher range and then capped recovery attempts in May. 1.1230 capped the pair after the fall in May and worked as resistance.

1.1190 is the post-Brexit high seen in July. 1.1125 cushioned the pair in early September. 1.1070 served as a clear separator of ranges during February and also beforehand.

1.10 is a round number and significant resistance. 1.0905 is the swing low seen in June and serves as a weak support. 1.0825 worked as support in early March 2015 and should also be watched. This is now a triple bottom.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015.

Further below, the 2016 low of 1.0520 and the 2015 low of 1.0460 provide further support.

I remain bearish on EUR/USD

The European Central Bank is far from achieving its goals and keeping the pressure on the euro is essential to getting closer to higher inflation. Acting now may be premature, but hinting of an upcoming move could serve to tilt to the euro down. Even if the Fed is unsure about the timing of the next move, the direction is clear: a rate hike.

Our latest podcast is titled Ready your rate radar