Draghi disappointed markets and has already begun some kind of damage control.

What’s next? The team at Barclays weighs in:

Here is their view, courtesy of eFXnews:

After last week’s sharp movements in financial markets triggered by the ECB’s policy under-delivery,Barclays Capital expects rather muted market movements generally ahead of the all-important FOMC meeting on 16 December.

“The ECB’s announcement last Thursday triggered sharp sell-offs across European rates, equities and FX markets. EURUSD moved 4% on the day, the second-largest day-to-day move since EUR inception (after the 18 March 2009 move) and a 4.7 standard deviation,” Barclays notes.

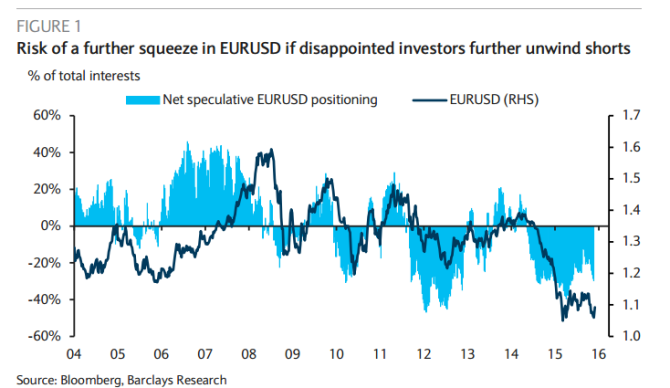

Considering the build-up of EUR shorts leading up to the ECB meeting, we see a risk of further reductions in short positions that could potentially drive more short squeezes in EURUSD.

In line with this view, Barclays closed its EUR/USD short poistion from 1.1278 and now sees challenges to its 2015-end forecast of 1.03, although maintains its 2016-end forecast at 0.95.

“We see the ECB still needing to ease monetary policy, even if it seems reluctant to front-load in the short term.

However, we prefer to sit on the sidelines in EURUSD positions for now, but will continue to look for catalysts or better entry levels to re-engage in strategic short EURUSD positions. A positioning clean-up and a level above 1.12 would likely make us reconsider our neutral position,” Barclays advsies.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.