Euro dollar remains on high ground despite the rejection of the PSI deal by the Eurogroup. In addition, the EU demanded Greece to get back on track before more aid is granted. A statement about giving Greece’s membership in the euro-zone a “full backing” sounds like the last stage before letting it go. A lot of indicators are released today in the old continent, and they are slightly better than expected so far.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

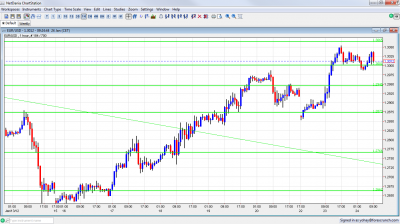

EUR/USD Technicals

- Asian session: Very active session, that saw a big Sunday gap lower, and then a strong recovery..

- Current range: 1.30 to 1.3060.

- Further levels in both directions: Below 1.30, 1.2945, 1.2873, 1.2760, 1.2660, 1.2623, 1.2580, 1.2520 and 1.24.

- Above: 1.3060, 1.3145, 1.3212, 1.3280, 1.3333 and 1.3450.

- 1.3060 proves to be very tough resistance, as in the beginning of the year.

- 1.2873 switches into strong support.

Euro/Dollar in high ground- click on the graph to enlarge.

EUR/USD Fundamentals

- 8:00 French Flash Services PMI. Exp. 50.5. Actual 51.7 points.

- 8:00 French Flash Manufacturing PMI. Exp. 49.2. Actual 48.5 points.

- 8:30 German Flash Services PMI. Exp. 52.6 points. Actual 54.5 points.

- 8:30 German Flash Manufacturing PMI. Exp. 49.1 points. Actual 50.9 points.

- 9:00 Euro-zone Flash Services PMI. Exp. 49.1 points.

- 9:00 Euro-zone Flash Manufacturing PMI. Exp. 47.4 points.

- 10:00 Euro-zone Industrial New Orders. Exp. -2.1%.

- 14:00 Belgian NBB Business Climate. Exp. -10.1 points.

- 15:00 US Richmond Manufacturing Index. Exp. 6 points.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Greek haircut deal stuck: The EU finance ministers reject the offer for a deal made by the IIF and demand a lower interest of 3.5%, not more. It is surprising that the demand came from the EU and the IMF, after Greece already agreed to a higher coupon. It all seemed very close on Friday. It’s also important to remember that some hedge funds have an interest to see an involuntary default by Greece, which will trigger CDS that they are holding.

- Greek “not doing enough”: EU finance ministers say that Greece is off track and must make reforms and secure PSI as soon as possible. This joins reports say that the EU and the IMF request a new report on debt sustainability, while a report on Germany’s Bild Zeitung says that these international creditors are “shaken” by the state of administration in the Hellenic Republic.

- Spain faces another auction: The euro-zone’s fourth largest economy is facing another bond auction after enjoying many successful ones that yielded more money than expected, and at lower yields. A report by the Bank of Spain says that the economy contracted by 0.3% in Q4. This was expected.

- US unemployment drops: The number of jobless claims dropped to 352K, the lowest in almost 4 years. In addition, the employment component of the Philly Fed Index shined. Is America on the right track?

- Portugal deteriorates: The biggest victim of the multiple S&P downgrades is Portugal, which saw its yields leap. The chances of a default there are rising. The bond auction today will be closely watched. The downgrade of the bailout fund (EFSF) hasn’t hurt its bond auction. Also France, which got the historic downgrade, survived it quite well.

- ECB sees stabilization: The ECB bulletin and Mario Draghi expressed “tentative signs of stabilization” in the euro-zone.