Euro dollar started the week with a gap higher, but this was quickly erased and it fell to lower ground. Silvio Berlusconi tendered his resignation, but things are too good for Italy and the euro-zone in general. A fresh Italian bond auction yielded high yields and the fear of a significant recession is stronger. The ECB isn’t hurrying to be a lender of last resort.

Here’s a quick update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

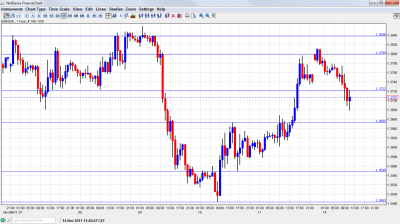

- Asian session: An active session saw the pair gap higher to around 1.3810, where the fall began.

- Current range: 1.3650 to 1.3725.

- Further levels in both directions: Below 1.3650, 1.3550, 1.3480, 1.3360, 1.3250.

- Above: 1.3725, 1.38, 1.3838, 1.39, 1.3950, 1.4050, 1.4130, 1.42, 1.4250, 1.4282.

- 1.3650 made a complete switch from support to resistance after yesterday’s collapse. Further important resistance is at 1.3838.

- 1.3480 was the trough of the current move down, on the road to 1.3145.

Euro/Dollar lower – click on the graph to enlarge.

EUR/USD Fundamentals

- 10:00 Euro-zone industrial output. Exp. -2.1% Actual -2.0%.

- 10:20 Italian bond auction results: Yield for 5 year notes came out at 6.29%, 97 bp more than last time. Worrying indeed.

* All times are GMT.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Italy still in focus: The Italian bond auction was the main event of a busy day. The high price that Italy paid for 5 year notes shows that the new Italian Prime Minister, Mario Monti, will have a difficult task in reassuring the markets. Over the weekend, Silvio Berlusconi finally resigned after the new austerity measures were passed in both chambers of parliament.

- ECB Not Accelerating Yet: German opposition for utilizing the ECB’s unlimited purchase power in order to lower yields is still strong. Both Jens Weidmann and Juergen Stark remain opposed to using the central bank as a “Lender of Last Resort” (LOLR). But they may eventually have to change course. and this could turn into a full scale QE program that will weigh on the euro and has moral hazard implications.

- French fear: An “error” on the website of rating agency S&P caused fear that France’s downgrade is imminent and weakened the euro. While this technical glitch was fixed, a downgrade for the euro-zone’s second largest economy seems imminent. According to the bond market, France is going south.

- Spanish squeeze: Spain managed to distance itself from Italy, but was also required to make adjustments to its budget. This demand comes from the European commission. The euro-zone’s fourth largest economy is going to the polls this weekend. A landslide victory is expected for the PP opposition party.

- Recession coming to Europe: A collapse in French and German industrial production raise the worried voices about a recession. Draghi, the new president of the ECB spoke about a mild recession. Tomorrow we have the highly anticipated GDP numbers (first release).

- Encouraging US figures: Recent data that came out of the US was encouraging: another small drop in jobless claims, a smaller trade deficit and a drop in import prices all help the US economy. Later this week we’ll get the Philly Fed Manufacturing Index, which will provide fresh data for November.

- Political deadlock in the US: The debt ceiling is slowly creeping back. The November 23rd deadline for reaching a deal on long term debt reduction is getting closer, but the politicians are getting further away from each other.