EUR/USD hit the same levels for a third time since Friday, ahead of the highly anticipated rate decision and press conference by the ECB.

Many details have leaked about the contents of Draghi’s bond buying scheme, but markets remain cautious. Where will it go?

Update: Follow the live blog of Draghi’s press conference.

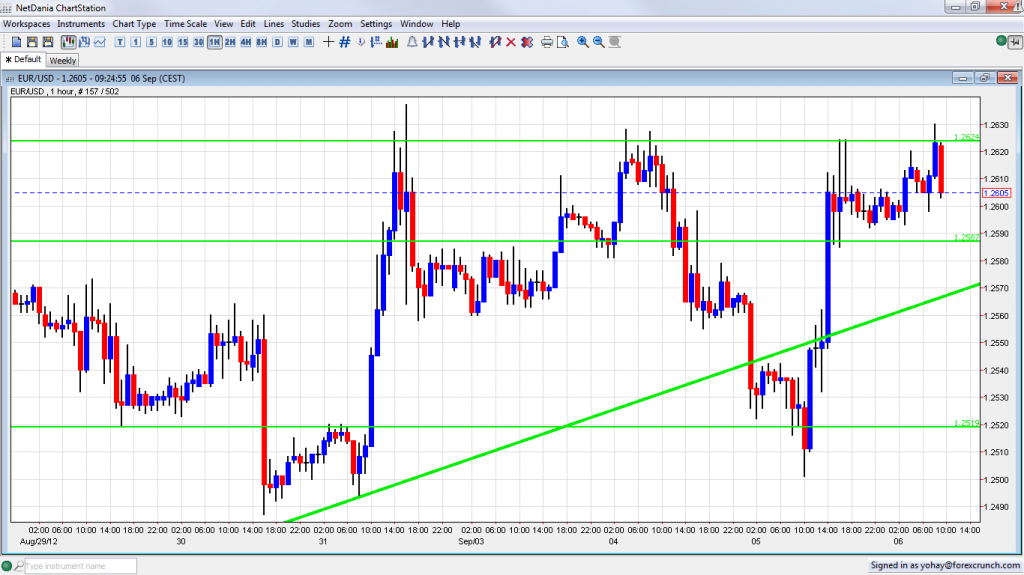

EUR/USD is struggling once again with the January 2012 low of 1.2624. Despite peeking above this level three times, a convincing break is still to be seen:

Will the actual event be a “buy the rumor, sell the fact“, that will see a sell-off from this top?

The absence of real news in the event could disappoint many traders. One reason for Draghi and the markets to be cautious is the looming decision of Germany’s constitutional court on September 12th. Most analysts expect an approval of the bailout mechanism, but nothing is 100% certain.

Draghi could even provide less details than were leaked. A disappointment could send the pair to lower support at 1.2520, and even to 1.2460.

Are markets just waiting for a clear confirmation, that will result in a rally?

With so many disappointments from Europe (more from politicians than from the central bank), markets may be refusing to buy the rumor, and are still waiting for the hard facts. They might still wait for another leg up after judges in Karlsruhe have their word, but an upwards move could be seen today as well.

In this case, 1.2670 and 1.2714 are the next lines.

For more, see the EUR USD forex forecast.