The swings continue for GBP/USD, as the pair posted gains of close to 1.0% last week. This week features the PMI reports. Here is an outlook for the highlights of the upcoming week and an updated technical analysis for GBP/USD.

CBI Realized Sales improved to -3 in November, compared to -10 a month earlier. Consumer confidence remains mired in negative territory, but there was some good news as consumer credit rose to GBP 5.6 billion, above the estimate of GBP 4.5 billion.

There was some positive economic news last week, as second-estimate GDP increased at an annual rate of 2.1%, which was higher than the 1.9% estimate. Analysts had expected that the GDP reading would confirm the initial release of 1.9%, and the upward revision was a pleasant surprise for investors. The Core PCE Price Index, which is the Federal Reserve’s preferred inflation gauge, posted a weak gain of 0.1%, shy of the estimate of 0.2%. This points to weak inflation, which means that the Fed could greet the markets with another rate cut early in 2019, without having to worry about causing high inflation.

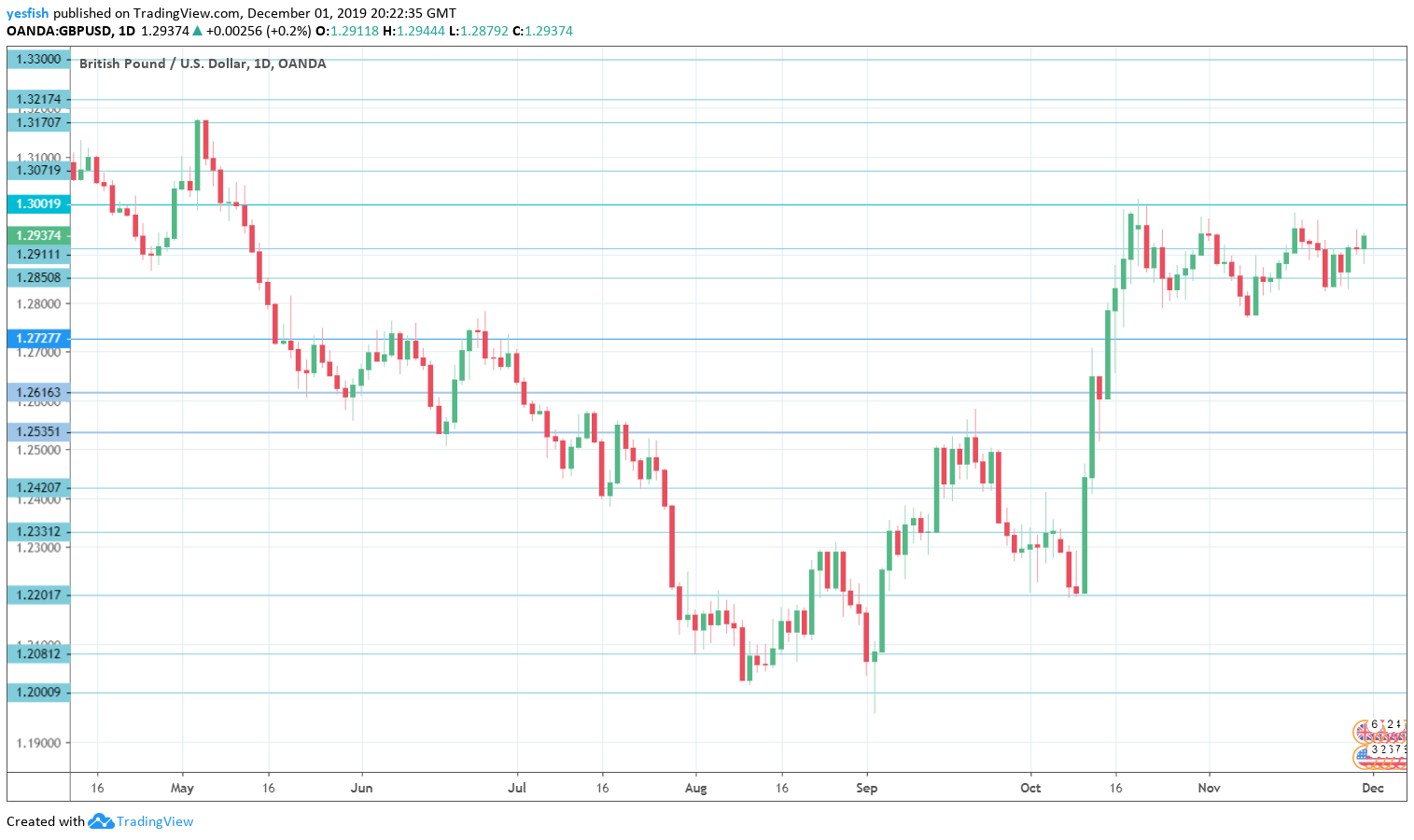

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Final Manufacturing PMI: Monday, 9:30. The British manufacturing sector continues to sputter, with PMI readings below the 50-level, which points to contraction. The index rose to 49.6 in October, but is expected to dip to 48.3 in November.

- BRC Retail Sales Monitor: Tuesday, 0:01. This consumer spending gauge posted a small gain of 0.1% in October, after back-to-back declines. Another decline is expected in November, with an estimate of -0.4%.

- Construction PMI: Tuesday, 9:30. The construction industry is mired below the 50-level, which separates contraction from expansion. The index came in at 44.2 in October and the forecast for November stands at 44.5 pts.

- Final Services PMI: Wednesday, 9:30. The PMI has been hovering close to the 50-level in recent months, which points to stagnation in the services sector.

- Halifax HPI: Friday, 8:30. This housing inflation index has declined four times in the past five months, which indicates weakness in the housing sector. The index is expected to improve to 0.2% in November.

GBP/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.3217. Close by, there is resistance at 1.3170.

1.3070 was a high point in November 2018.

The round number of 1.3000 has held since mid-October.

1.2910 remains relevant.

1.2850 is the first line of support.

1.2728 has held in support since mid-October.

1.2616 (mentioned last week) is next.

1.2535 is the final support level for now.

I am bearish on GBP/USD

The British economy is not doing all that well, and the uncertainty over the general election and Brexit has left businesses and consumers apprehensive. This week’s PMIs could have a strong impact on the movement of GBP/USD.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!