- GBP/USD pares off gains partially as the US Treasury bonds yields went higher.

- The risk sentiment improves as China recorded zero cases in the country.

- The New Home Sales and Richmond Manufacturing Index are the next data today.

The GBP/USD forecast is slightly bearish on the day. The GBP/USD returned to an intraday fall below 1.3700 and was last traded with modest intraday gains in the 1.3710-20 area.

Earlier on Monday’s trading session, the pair retraced to 1.3600 (the monthly low) after a strong rally from 1.3600 the previous day. The momentum was driven solely by the continued decline in the US dollar pullback but did not continue and stopped near the mid-1.3700.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

As the COVID-19 situation in the US has worsened, investors appear to have lowered their expectations about when the Fed will phase out its pandemic-era incentives. According to the United States, the number of new cases reached a record high on Monday. This, combined with impulsive risk-taking, undermined the dollar’s safe-haven status.

The risk sentiment has improved since China reported halting the spread of COVID-19. China’s growth momentum could be restored by the year’s end as a result. However, investor appetite for riskier assets has further increased with the full approval of Pfizer / BioNTech’s COVID-19 vaccine.

Although US Treasury bond yields increased modestly, severe dollar losses were contained. Also, investors didn’t appear to make aggressive bets before the Jackson Hole Symposium speech by Fed Chairman Jerome Powell. This, in turn, was the only thing holding back the GBP/USD pair from further rise.

In addition to the New Home Sales report, the Richmond Manufacturing Index will provide a secondary look at US economic performance. The overall appetite for risk may affect the price action of the US dollar and create some trading opportunities for the GBP/USD pair. Still, this data is unlikely to provide any significant boost.

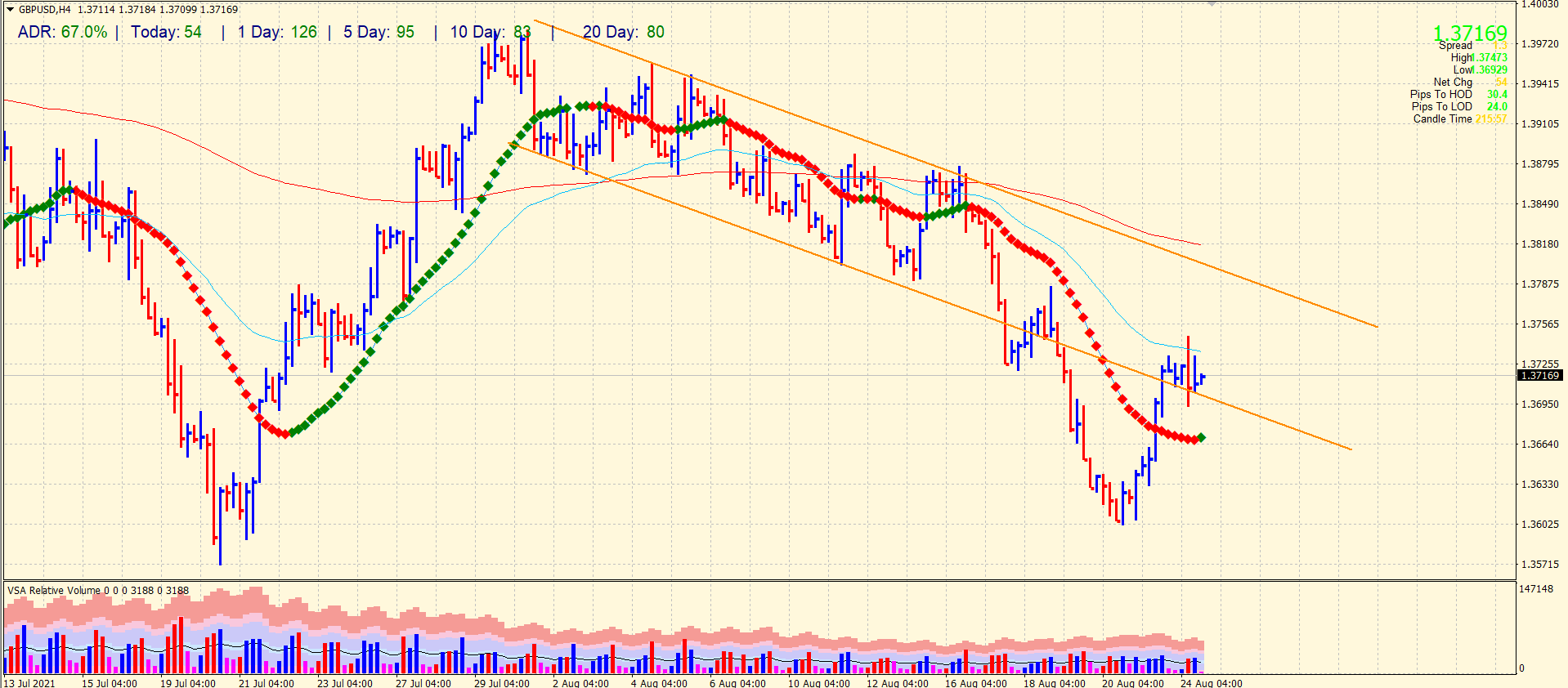

GBP/USD price technical forecast: 50-period SMA triggered selling

The GBP/USD price settled above the 20-period SMA on the 4-hour chart. The price also managed to break the resistance of descending trend channel. However, the 50-period SMA got the sellers that sent the price back towards the 1.3700 area.

–Are you interested to learn more about forex signals? Check our detailed guide-

The price has posted two consecutive upthrust bars with above-average volume. The descending trend channel will now act as support, followed by the 20-period SMA at 1.3660. On the upside, 50-period SMA will be the first hurdle ahead of 1.3790 (horizontal level).

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.