GBP/USD struggled against the recovering USD and the rise in the UK’s unemployment rate. What’s next? The focus this week is on May’s Brexit speech and we also have some PMIs. Here are the key events and an updated technical analysis for GBP/USD.

The unemployment rate increased in the UK toi 4.4%, stealing the show from wages, that remained unchanged at 2.5%. The worrying development weighed on the pound. In the US, the FOMC Meeting Minutes included some optimism about the economy, helping the dollar in its recovery path.

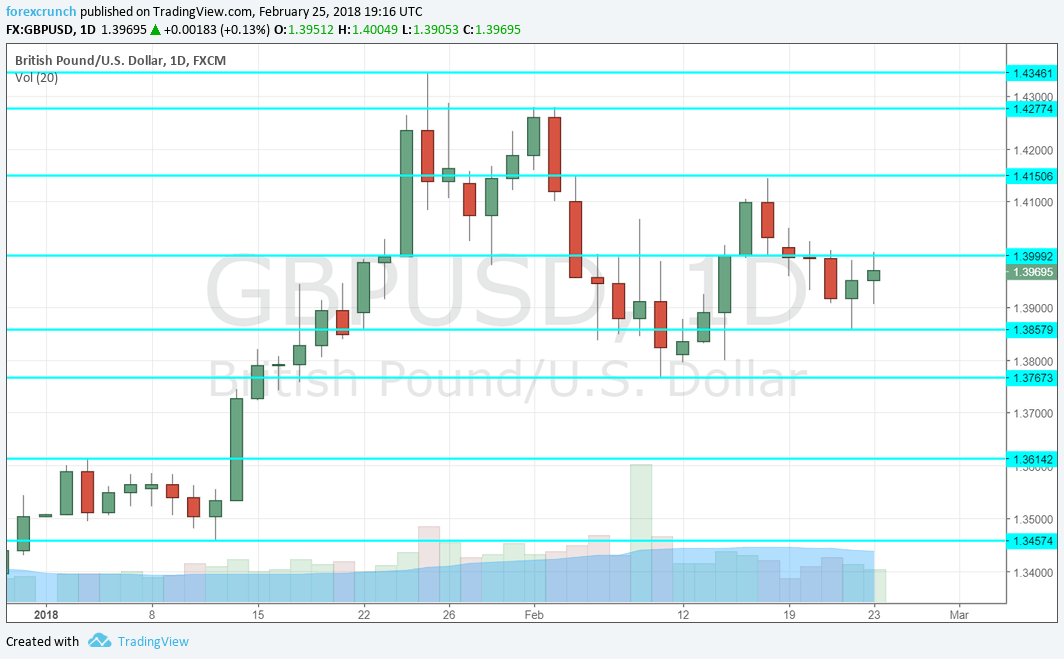

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- High Street Lending: Monday, 9:30. This is an early gauge of mortgages, as it represents around 65% of lending. After a disappointing drop to 36.1K in November, a small increase to 37.2K is on the cards now.

- Jon Cunliffe talks: Monday, 18:00. The BOE Deputy Governor will speak at the University of Warwick and may react to the latest data. The BOE is still expected to raise rates in May, but nothing is fully priced in.

- BRC Shop Price Index: Wednesday, 00:01. The British Retail Consortium showed annual drops in prices at its retail shops in recent months. A fall of 0.5% was seen in January and we could see a similar number now.

- GfK Consumer Confidence: Wednesday, 00:01. Consumer confidence surprised to the upside in January but still remains negative at -9 points. A small deterioration to -10 is on the cards now. Negative numbers reflect pessimism.

- Nationwide HPI: Thursday, 7:00. This early assessment of house prices surprised in January with an increase of 0.6%, more than had been expected. We may see a more moderate increase now.

- Manufacturing PMI: Thursday, 9:30. The first of Markit’s three purchasing managers’ indices has shown solid growth in the manufacturing sector back in January with a score of 55.3 points. A small drop to 55.1 is on the cards now.

- Net Lending to Individuals: Thursday, 9:30. A higher level of lending implies quicker economic growth. After hitting 5.2 billion in December, a small increase to 5.4 billion is on the cards for January.

- M4 Money Supply: Thursday, 9:30. The amount of money in circulation squeezed by 0.6% in December, causing some worries. A bounce back with 0.4% is projected now.

- Mortgage Approvals: Thursday, 9:30. The total number of mortgages slipped to 61K in December, significantly worse than forecast. A small increase to 62K is estimated for January.

- UK PM May talks: Friday. The Prime Minister of the UK is set to deliver a keynote speech about the future trade relations that her government wishes to have with the European Union. Markets would prefer a continued membership in the Single Market and the Customs Union, but the hard-Brexiteers would prefer a looser relationship. The speech should help clarify the direction of the government. The pound will not only move on the speech but also on the reaction by the European Union. A warm welcome would be positive while a rejection of May’s proposals would weigh on the pound.

- Construction PMI: Friday, 9:30. The construction sector has been lagging behind the other sectors and even temporarily dipped to contraction territory a few months ago. After nearly dipping there again with a score of only 50.2 points, a small rise to 50.5 is on the cards now.

- Mark Carney talks Friday, 10:00. The Governor of the Bank of England will speak at the Scottish Economics Conference in Edinburgh and the topic is cryptocurrencies. Nevertheless, he may comment on monetary policy as well.

GBP/USD Technical Analysis

Pound/dollar struggled to break above the 1.40 level mentioned last week.

Technical lines from top to bottom:

1.4345 is the January 2018 swing high that is worth watching. 1.4280 was a top line in early February and it comes next.

1.4150 capped the pair in mid-February. It is followed by the round level of 1.40, which is eyed by many.

1.3850 was the low point in mid-February. 1.3765 was the low point in early February.

1.3620 capped the pair on its way up and then turned into support. 1.3550 was the November peak.

I remain bearish on GBP/USD

The British government is pressured by the hard-Brexiteers and markets will not like it. In addition, the economy is slowing down and we will learn more about it now.

Our latest podcast is titled Volatility is back with a vengeance and the perky pound

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!