GBP/USD continues to show strong movement, as the pair declined 0.7% last week. There are four events in the upcoming week. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

In the UK, employment numbers were mixed. Wage growth fell to 2.9% in December, down from 3.2% a month earlier. Jobless claims dipped to 5.5 thousand, down from 14.9 thousand a month earlier. The unemployment remained at 3.8% for a fourth straight month. Consumer inflation jumped to 1.8% in January, up sharply from 1.3% in the previous release. This was the strongest gain since July. There was also good news from retail sales, which climbed 0.9% in January, after three consecutive declines. The week wrapped up with the initial estimate manufacturing and services PMIs for February, which pointed to expansion in the manufacturing and services sectors.

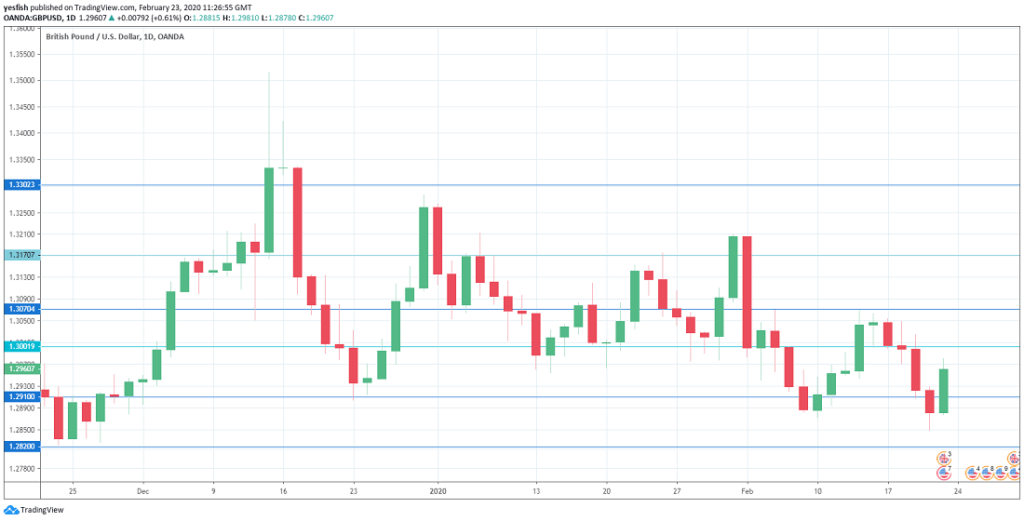

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- CBI Realized Sales: Tuesday, 11:00. The Confederation of British Industry’s gauge of sales came in at zero points in January, unchanged from a month earlier. This was an indication of no change in sales volume. The indicator is expected to move into positive territory in February, with an estimate of 4 points.

- BRC Shop Price Index: Wednesday, 0:01. The British Retail Consortium’s inflation gauge has reeled off eight consecutive declines, pointing to low inflation levels. In January, there was an annual drop of 0.3% in prices in BRC stores. The data for February is due now.

- GfK Consumer Confidence: Friday, 0:01. This survey of around 2,000 consumers improved to -9 points in January, up from -11 points a month earlier. This indicates pessimism among shoppers. A score of -8 points is projected for February.

GBP/USD Technical analysis

Technical lines from top to bottom:

1.3300 has held since December. 1.3170 is next.

1.3070 has some breathing room in resistance following GBP/USD losses last week.

1.3000 (mentioned last week) has switched to a resistance role. It is a weak line.

1.2910 which has held in support since early December, finds itself under pressure. This is followed by support at 1.2820.

1.2728 is providing support.

1.2616 is the final support level for now.

I remain neutral on GBP/USD

The pound gained ground last week and crossed above the 1.30 line, but with the British economy not in the best of shape, the currency may have trouble holding its own against the greenback.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!