GBP/USD was under pressure once again as the EU rejected the UK’s proposal on customs. The main event of the upcoming week is the rate decision by the BOE. Will the pound recover? Here are the key events and an updated technical analysis for GBP/USD.

Chief EU Negotiator Michel Barnier rejected the British proposal for a common rulebook. Time is running and Brexit negotiations are far from being concluded. In the US, GDP came out at 4.1%, the best in four years, but below the overhyped expectations, weighing on the dollar. The easier approach on trade also sent the greenback a bit lower. Nevertheless, Brexit pressure sent GBP/USD down on the week.

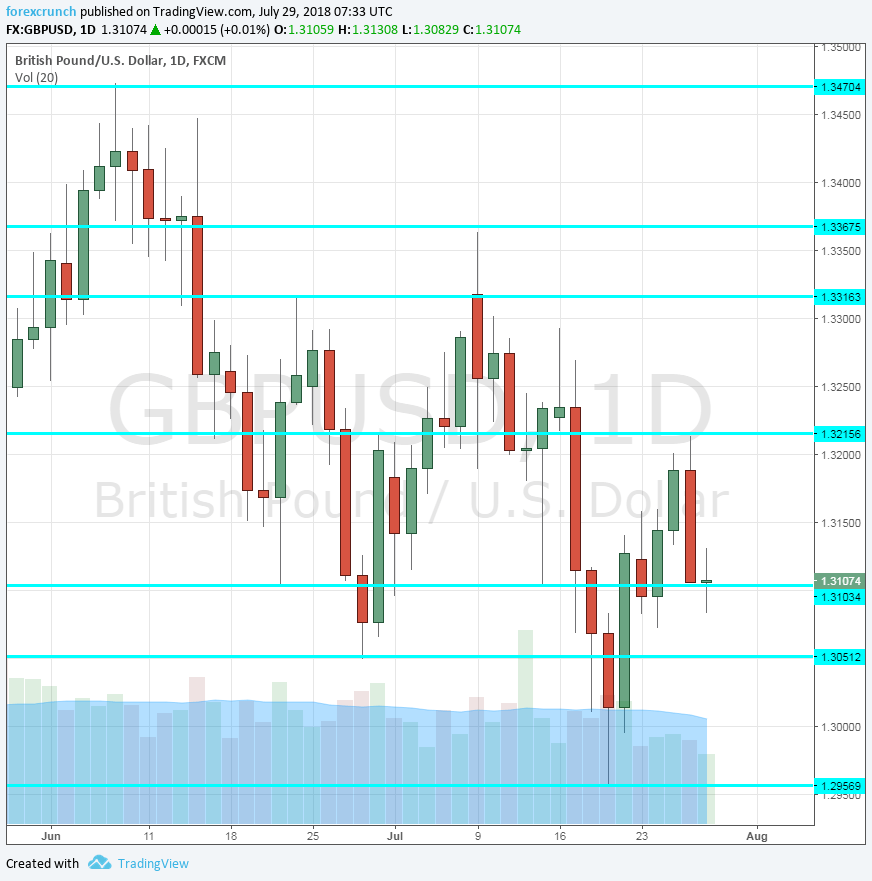

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Net Lending to Individuals: Monday, 8:30. An increased level of borrowing results in more overall economic activity. Net lending stood at 5.3 billion pounds in June and the same level is projected now.

- M4 Money Supply: Monday, 8:30. The amount of money in circulation increased by 0.4% in May, the second consecutive month of rises. A faster clip is projected now: 0.6%.

- Mortgage Approvals: Monday, 8:30. The official number comes out after the High Street Lending figure but still have an impact. The total number of mortgages is forecast to rise from 65K in May to 66K in June.

- GfK Consumer Confidence: Monday, 23:01. This broad survey of 2,000 consumers disappointed with a drop to -9 points in June, reflecting growing pessimism among shoppers. A repeat of the same score is on the cards for July.

- BRC Shop Price Index: Tuesday, 23:01. The British Retail Consortium’s gauge of inflation showed a drop of 0.5% y/y in June, a slower pace than beforehand. We could see another drop now.

- Nationwide HPI: Wednesday, 6:00. The relatively early indicator of house prices surprised in June with a jump of 0.5% in prices. A more modest increase of 0.1% is projected now.

- Manufacturing PMI: Wednesday, 8:30. The first of Markit’s purchasing managers’ indices is for the small, yet important manufacturing sector. The forward-looking figure stood at 54.4 points in June and a small slide to 54.2 is expected for July. The 50-point threshold separates expansion from contraction.

- Construction PMI: Thursday, 8:30. The construction sector has seen its ups and downs in recent months, including a temporary dip into contraction territory. A small slide from 53.1 to 52.9 points is expected now.

- UK rate decision: Thursday, 11:00, press conference at 11:30. The Bank of England hinted it would raise rates in its August meeting. A hike to 0.75% would send the interest rate to the highest level since the financial crisis. However, as inflation remained stuck at 2.4%, retail sales disappointed in June, and with Brexit uncertainty, the BOE may yet surprise by not moving. Apart from the interest rate, the BOE will also publish the meeting minutes of the event, which will show how many members supported the decision. No less important is the Quarterly Inflation Report released on this occasion, making it “Super Thursday”. Updated forecasts for inflation and growth will be eyed. BOE Governor Mark Carney will present the report and will certainly be asked about Brexit uncertainty.

- Services PMI: Friday, 8:30. The third and last of Markit’s purchasing managers’ indices for the UK is the most important one. The services sector had an OK PMI score of 55.1 in June, above the 50-point threshold that separates expansion from contraction. A drop to 54.7 is on the cards.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar made an attempt to move higher but did not manage to conquer the 1.3205 level mentioned last week. It eventually closed at lower ground.

Technical lines from top to bottom:

1.3615 capped the pair in late 2017. 1.3470 was a swing high in early June.

The round number of 1.34 could provide further support. 1.3365 was a swing high in mid-July. Further down, 1.3315 was a swing high in late June.

1.3215 was the high point for the pair in mid-July and a lower high on the chart.

1.3100 was a swing low in mid-June and 1.3050 is the latest 2018 low. The round number of 1.3000 awaits below. Even lower, 1.2955 is the low point seen in mid-July.

I remain bearish on GBP/USD

The rate hike is fully priced in and no further hikes are likely anytime soon. On the other hand, Brexit uncertainty is not. In addition, the Fed’s hawkishness is set to continue.

Our latest podcast is titled Festive Fed, Dovish Draghi, and a global trade war

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!