GBP/USD enjoyed its strongest week since late March, with gains of 1.5 percent. There are seven events on the schedule. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

It was a quiet week in the UK on the fundamental front. CBI Realized Sales pointed to a sharp decline in retail sales, with a May reading of -50 points. This was slightly better than the April release of -55 points.

Over in the U.S., consumer confidence improved in May, as the CB consumer index came in at 86.6, up from 85.7 a month earlier. First-quarter GDP was revised downwards to -5.0%, compared to -4.8% in the initial estimate. Durable goods plunged in April, with the headline figure falling by 17.2% and the core reading falling by 7.2 percent. Unemployment claims continue to fall, with 2.12 million new claims last week. This was slightly higher than the forecast of 2.10 million and raises the total during Covid-19 to a staggering 41 million.

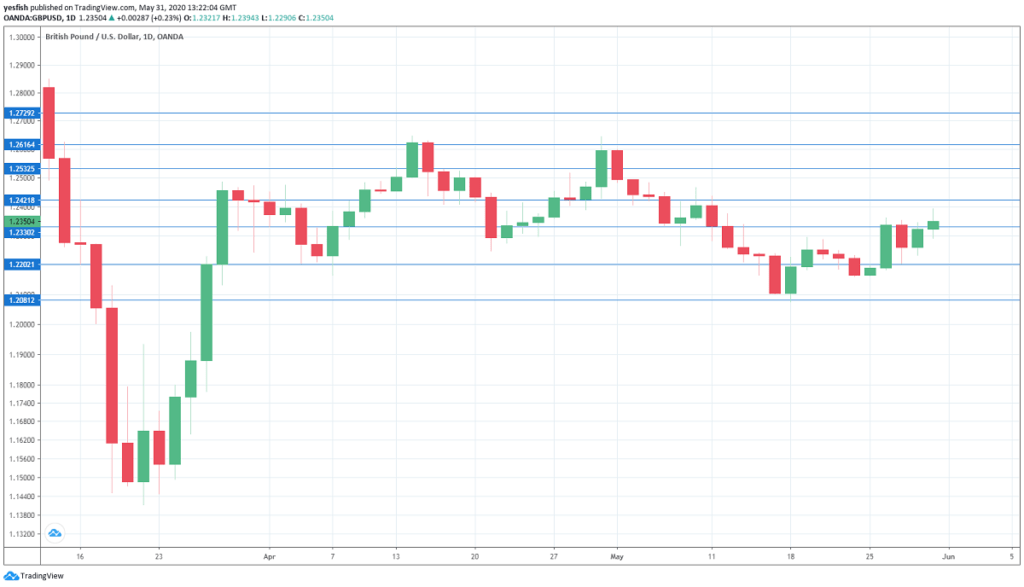

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Manufacturing PMI: Monday, 8:30. The initial read for May came in at 40.6, pointing to contraction. The final reading is expected at 47.0 points.

- Net Lending to Individuals: Tuesday, 8:30. Credit levels sunk in March, falling to GBP 1.0 billion. This was well below expectations and marked the lowest level since 2013, as consumers have sharply cut back on borrowing and spending. The April reading is expected to rebound to GBP 1.7 billion.

- BRC Shop Price Index: Tuesday, 23:01. Inflation continues to fall in the UK, and the British Retail Consortium gauge fell by 1.7% in April, compared to a decline of 0.8% in March. Will we see an improvement in May?

- Services PMI: Wednesday, 8:30. The services sector has been hit hard by the Covid-19 pandemic, and the initial reading in May stood at 27.8 points. The final reading is projected at 27.9 points.

- Construction PMI: Thursday, 8:30. The construction industry has been decimated by the economic meltdown, and the April reading was a staggering 8.2, pointing to a severe contraction in the sector. The index is expected to rebound in May, with a forecast of 30.0 points.

- GfK Consumer Confidence: Thursday, 23:01. Consumer confidence has been steady, continuing to show sharp pessimism. The April read came in at -34 and an identical drop is projected in May.

- Halifax HPI: Friday, 7:30. This inflation gauge fell by 0.6% in April, its first decline since October. Another drop is expected in May, with an estimate of -0.7 percent.

Technical lines from top to bottom:

We start with resistance at 1.2728.

1.2616 has held in resistance since late April. 1.2532 is next.

1.2420 (mentioned last week) came under pressure last week.

1.2330 is an immediate support level.

The round number of 1.22 has some breathing room after strong gains by GBP/USD last week.

1.2080 is the final support level for now.

I remain neutral on GBP/USD

The British economy continues to struggle, as the country has been hit hard by the Covid-19 pandemic. The Brexit deadline is just a month away, which could put more pressure on the pound. At the same time, the U.S. dollar has lost some of its luster, allowing GBP/USD to make up ground.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!