GBP/USD dropped sharply last week, losing 1.1%. There are five events in the upcoming week. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

There were no major British events last week. CBI Realized Sales showed a weak gain of 1 point, after two straight readings of zero. This marked the first gain in 10 months.

In the U.S., durable goods orders reports were mixed. The headline figure declined by 0.2%. This beat expectations but was much lower than the gain of 2.4% a month earlier. However, core durable goods orders jumped 0.9%, its strongest gain in seven months. Preliminary (second estimate) GDP came in at 2.1%, confirming the initial estimate.

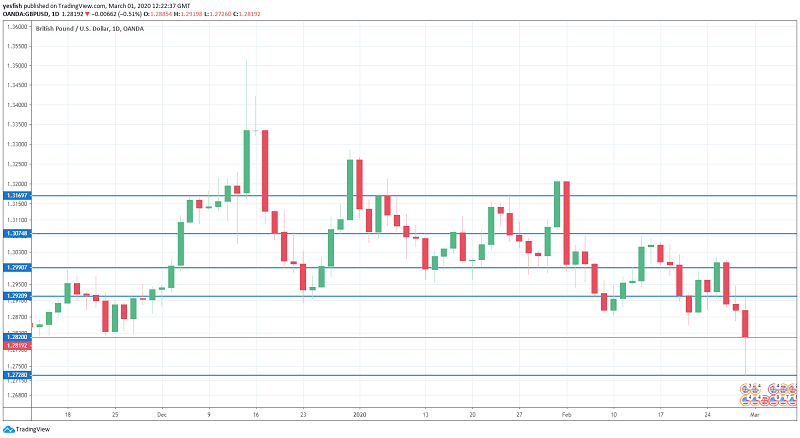

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Manufacturing PMI: Monday, 9:30. The initial estimate for this index came in at 51.9, beating the estimate of 49.7 points. The second estimate is expected to confirm this figure.

- Construction PMI: Tuesday, 9:30. The PMI remains mired in contraction territory and came in at 44.4 in December. The index is expected to improve to 48.4 in January.

- Services PMI: Wednesday, 9:30. The initial estimate for services PMI came in at 53.3, with the second estimate slightly revised lower to 53.2 points.

- BRC Retail Sales Monitor: Thursday, 0:01. This indicator looks at retail sales in BRC stores. In January, the indicator fell flat at 0.0%, short of the estimate of 0.6%. Will we see gains in February?

- Halifax HPI: Friday, 8:30. This housing price index slowed to 0.4% in January, down from 1.7% in the previous release. The downtrend is expected to continue in February, with a forecast of 0.3%.

GBP/USD Technical analysis

Technical lines from top to bottom:

We begin with resistance at 1.3170.

1.3075 (mentioned last week) is next.

1.2990 has switched to resistance after sharp losses by GBP/USD last week.

1.2910 was breached in support for the first time since December.

1.2820 is fluid, as the pair ended the week just below this line.

1.2728 is providing support.

1.2616 is next.

1.2535 is the final support line for now.

I am bearish on GBP/USD

The U.S. dollar continues to post broad gains, boosted by a strong economy and high risk apprehension over the coronavirus. As well, the EU and UK are bickering over their future trade relationship, which is not good news for the pound.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!