GBP/USD had another action-filled week amid Brexit headlines, weak data, and the Fed decision. What’s next? The Conservative Party Conference and PMI data stand out. Here are the key events and an updated technical analysis for GBP/USD.

Ahead of the Tory conference, former Foreign Minister Boris Johnson lashed out at the government and called it to scrap its plans. The EU ramped up its preparations, putting pressure on the Pound. UK GDP missed expectations with a downgrade of annual growth from 1.3% to 1.2% and the current account deficit ballooned over 20 billion pounds. The Fed raised rates signaled more, but the greenback initially dropped on the removal of the words “accommodative policy”. The greenback recovered on Powell’s upbeat message.

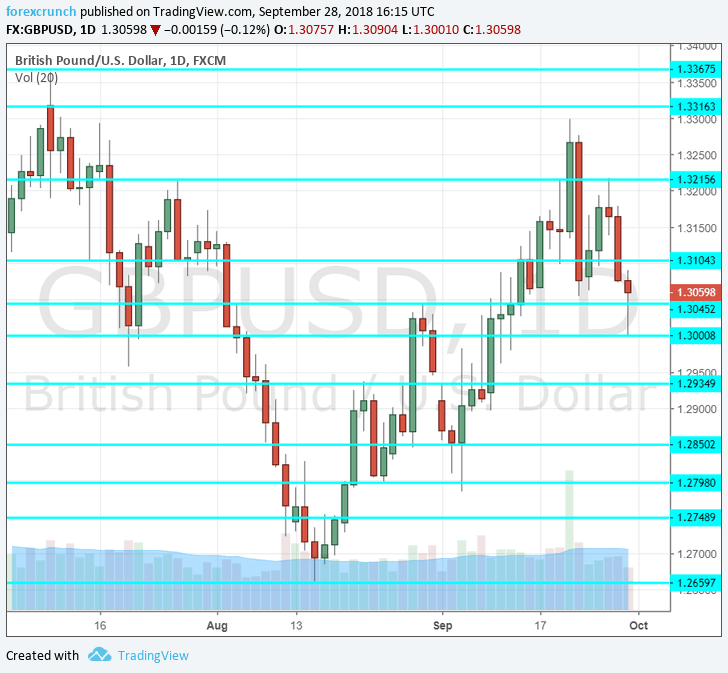

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Conservative Party conference: Sunday to Wednesday. Prime Minister Theresa May faces a challenge from the hard-Brexiteers with her former Foreign Minister Boris Johnson playing a critical role. Pro-Remain MPs are also in play. While May is expected to survive, her Chequers plan may not last that long. The rhetoric around the event will likely be harsh and fears of a collapse of the government could weigh on the pound. The UK may opt for a softer Brexit after the event, but not immediately. Headlines from Birmingham will likely rock Sterling all week.

- Manufacturing PMI: Monday, 8:30. The first of Markit’s forward-looking indices relate to the manufacturing sector. The indicator stood at a not-so-impressive 52.8 points in August. A minor drop to 52.6 is on the cards. A fall below 50 would indicate contraction.

- Net Lending to Individuals: Monday, 8:30. A higher borrowing rate implies enhanced economic activity. After a level of 4 billion pounds in July, an increase to 4.8 billion is projected for August.

- Nationwide HPI: Tuesday, 6:00. This housing sector measure comes out quite early. After a drop of 0.5%, a rise of 0.2% is on the forecast.

- Construction PMI: Tuesday, 8:30. The second PMI is for the more volatile construction sector. A minor drop from 52.9 to 52.8 points is on the cards. The figure dropped below 50 points early in the year and this can happen again.

- BRC Shop Price Index: Tuesday, 23:01. The British Retail Consortium’s measure rose by only 0.1% y/y in August, showing that inflation is not that high. A similar figure could be seen now.

- Services PMI: Wednesday, 8:30. The third and final purchasing managers’ indicator from Markit is for the largest sector: the services one. Back in August, the number slightly surprised with 54.3 points, reflecting OK growth. It will be interesting to see if concerns about Brexit adversely impact the result. A score of 54 points is on the cards.

- Halifax HPI: Friday, 7:30. Contrary to Nationwide, this HPI showed an increase back in August, but only of 0.1%. A rise of 0.2% is expected now.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar made an attempt to recover but hit the 1.3215 level mentioned last week. It then fell sharply and stopped only at 1.3000.

Technical lines from top to bottom:

1.3375 was a high point in July. It is followed by 1.3315 that capped the pair earlier that month.

1.3215 was the high point for the pair in mid-July and a lower high on the chart. The round number of 1.3100 supported the pair earlier in September.

The round number of 1.3000 is important after providing support to the pair in late September.

Below 1.3000 we find 1.2935, a high point in late August. 1.2865 separated ranges in late August. Further down, 1.2790 served as support late August and also beforehand.

1.2750 held the pair down when the pair was on the back foot. The current 2018 trough at 1.2660 is the next level.

1.2590 was a swing low in September 2017. Even lower, 1.25 is a round number and also worked as support in early 2017.

I remain bearish on GBP/USD

The Conservative Party Conference will be full of plots and hard-Brexit rhetoric. On this background, it is hard to see the pound recovering. In addition, fears of a cliff-edge Brexit will likely weigh also on the PMI data. The intention of the Fed to continue raising rates supports the greenback.

Our latest podcast is titled Too hot or too cold? The world is watching the Fed

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!