- GBP/USD maintains the bullish momentum ahead of the London session.

- Declining US Treasury yields keep the Greenback subsided.

- BOE’s rate hike plan in H1-2022 further strengthens the pound.

- Brexit woes may hamper the path of gains.

With the market still climbing, the GBP/USD price is profiting from the previous Friday session. As a result, we expect the pair to close the week on a higher note.

-Are you looking for automated trading? Check our detailed guide-

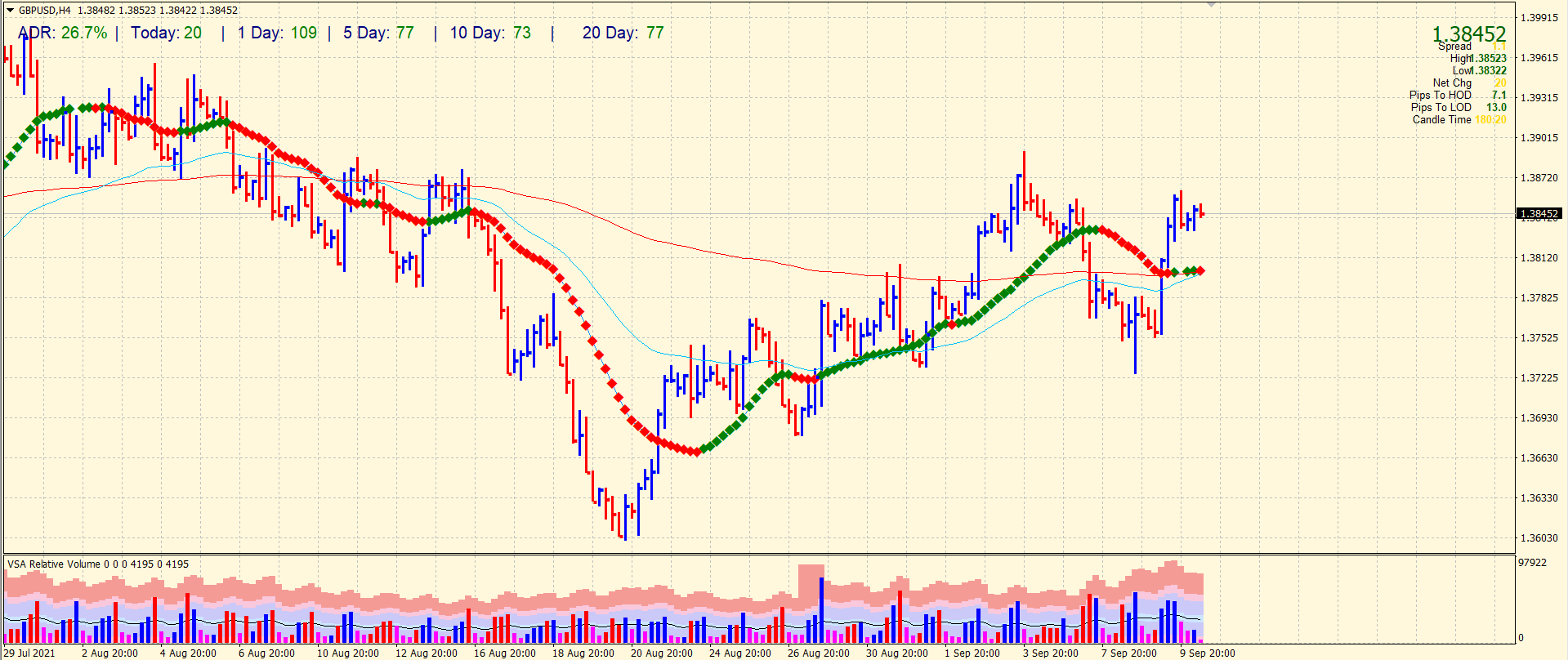

At the time of writing, GBP/USD is trading at 1.3847, up 0.08% on the day.

After the yields on 10-year Treasury notes plummeted, the US Dollar Index (DXY), which tracks the dollar’s value against its six major rivals, is reversing its direction.

The economic recovery remains tinged with pessimism due to the rise in Coronavirus cases. On Thursday, Joe Biden announced an anti-vaccine movement. It was his goal to combat vaccine resistance in America. Biden and Xi’s conversation was encouraging.

The number of initial claims for unemployment in the US has fallen to a new low. A disappointing NFP estimate the week before resulted in fewer applications than anticipated.

However, after optimism over the expectation that the Bank of England (BOE) would raise interest rates in the first half of 2022, the pound recovered earlier than expected.

The most influential party in Northern Ireland (NI) also stated that post-Brexit tensions were to blame for limited profits.

UK trade balance, industrial production, and US producer price index data are considered important for investors.

-If you are interested in forex day trading then have a read of our guide to getting started-

GBP/USD price technical analysis: Key SMAs supporting the upside

The GBP/USD price managed to break above the key SMAs, standing near the mid-1.3800. As a result, the pound bulls may look to extend rally towards 1.3900 and above. Although the average daily range so far is only 26%, the pair is likely to find some traction during the London session. The price is now consolidating gains while the volume is drying up. Any breakout will determine the next directional bias.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.