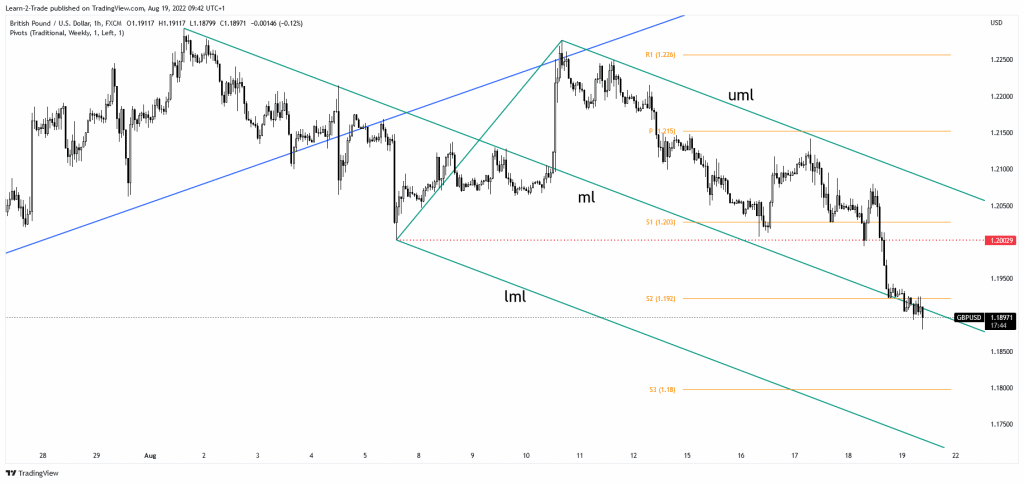

- The GBP/USD pair is strongly bearish after validating its breakdown below the median line (ml).

- The weekly S3 is seen as a potential downside target.

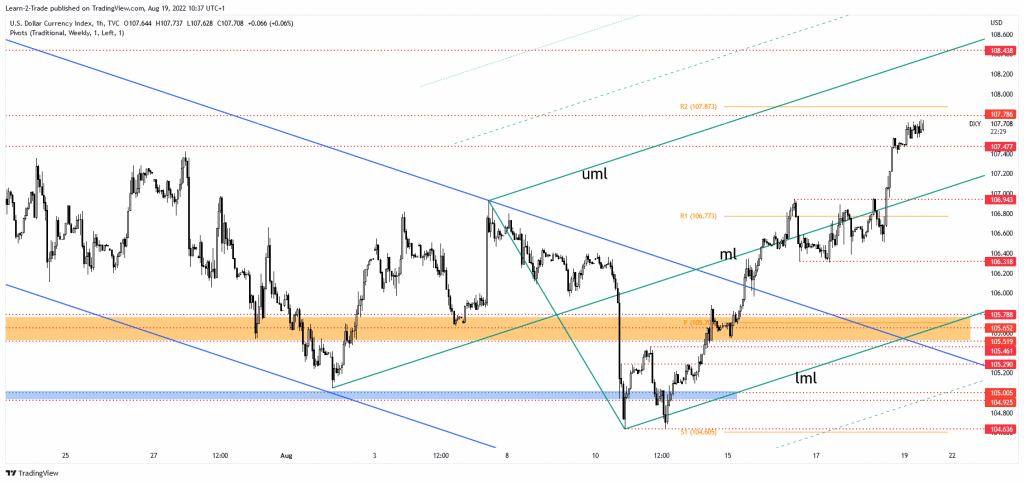

- DXY’s rally forced the USD to appreciate versus its rivals.

The GBP/USD price crashed as the US dollar strongly soared to new levels. The price was located at 1.1871 at the time of writing. It seems under intense selling pressure.

-Are you looking for automated trading? Check our detailed guide-

Technically, the price took out strong support levels, signaling a potential for a deeper drop. Fundamentally, the USD received a helping hand from the US economic data. The Unemployment Claims, Philly Fed Manufacturing Index, and the CB Leading Indicator came in better than expected.

Today, the UK Retail Sales indicator rose by 0.3% even though the analysts expected a 0.2% drop. In addition, Public Sector Net Borrowing was reported at 4.2B versus 25.3B expected, while the Gfk Consumer Confidence came in at -44 points below -42 points estimated. Later, the Canadian retail sales data could have a significant impact on the USD as well.

Dollar Index price technical analysis: Strong rally

As you can see on the hourly chart, the Dollar Index moved sideways between 106.94 and 106.31, trying to accumulate more bullish energy before resuming its growth. The price failed to reach and retest 106.31, signaling strong upside pressure.

Its aggressive breakout through the 106.94 activated further growth. The current leg higher forced the USD to appreciate versus the other currencies.

GBP/USD price technical analysis: Strong bearish trend

After retesting the uptrend line, the GBP/USD pair developed a strong leg down. Personally, I’ve drawn a descending pitchfork, hoping that I’ll catch a potential sell-off. As you can see on the hourly chart, the price retested the upper median line (UML), confirming the pitchfork.

-Are you looking for forex robots? Check our detailed guide-

From the technical point of view, the 1.2002 represented strong support. Breaking below this level has opened the door for a more significant drop. Now, it has validated its breakdown below the S2 (1.1920) and through the median line (ml). The bias remains bearish as long as it stays under the median line (ml), so the GBP/USD pair could approach and reach new lows. The weekly S3 (1.1800) is seen as a potential downside target.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.