- On a weak session in Asia, the GBP/USD bounces off a five-week low.

- Foreign Secretary Liz Truss expects significant progress in Brexit talks by February, queues at Dover, DUP express pessimism

- More negative details have come to light of British Prime Minister Johnson’s future leadership, delaying the release of a report on his future leadership.

- Despite outperforming US GDP for the fourth quarter, the Fed’s preferred inflation indicator expects fresh momentum.

As markets suspend support for the US dollar ahead of the Fed inflation report, the GBP/USD price analysis surpasses the 1.3400 line to a fresh intraday high ahead of the London open on Friday. Bullish Brexit headlines and moderate optimism about UK politics also support the corrective pullback from multi-day lows.

–Are you interested to learn more about ETF brokers? Check our detailed guide-

However, according to Reuters, Britain’s truss hoped to speed up Brexit negotiations by February to gain support from pro-British unions in Northern Ireland, contrary to current agreements. A British Brexit negotiator said during a visit to Belfast the day before.

In addition, the delay in Sue Gray’s report appears to be supporting buyers of GBP/USD in hopes that British Prime Minister Boris Johnson will easily survive the political challenges. Meanwhile, his conservative friends continue to take on new challenges to prepare for a change in leadership, most recently the National Insurance Boost Program reversal.

Against this backdrop, the long lines of trucks at Dover and the Democratic Unionist Party (DUP) pushing Liz Truss towards the Northern Ireland (NI) protocol seem to be testing the optimists.

Additionally, the US dollar has slipped from its peak last seen in July 2020 as traders await December’s key US PCE price index data, which is considered the Fed’s preferred measure of inflation. The market is expecting 4.8% y/y versus 4.7% earlier.

The US Advance Q4 GDP rose 6.9% y/y, compared with market consensus of 5.5% and 2.3% previously. Likewise, US jobless claims for the week ended Jan. 21 came in at 206k, compared to expectations of 260k and 290k. However, it should be noted that US durable goods orders fell 0.9% in December, falling 0.5% below market expectations.

Furthermore, after a sharp rise over the past few days, the mixed market momentum, reflected in stable yields and modest demand for stock futures, is also a test for US dollar bulls.

If UK politics and Brexit make positive headlines, traders may extend the recent jump. Although the expected strength in US inflation data could challenge the pair’s buyers.

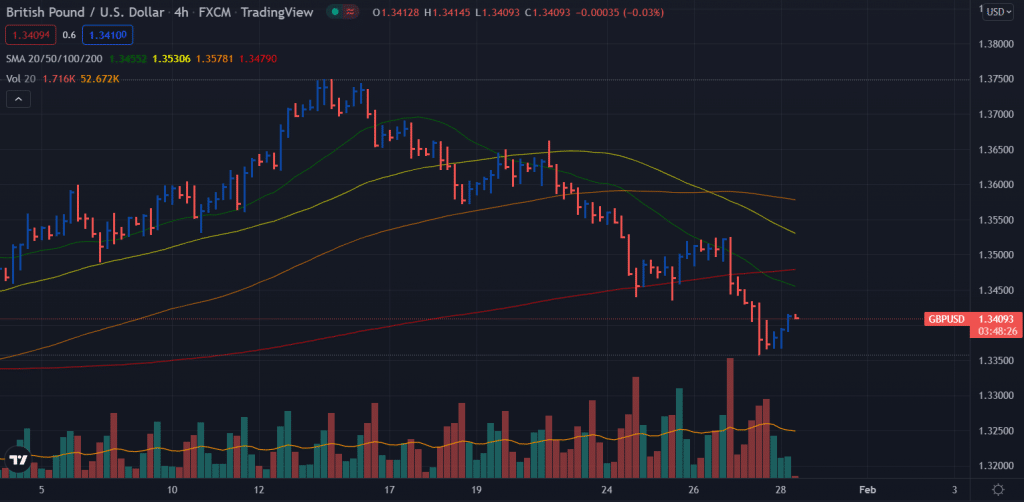

GBP/USD price technical analysis: Gains capped by 1.3450

The GBP/USD price analysis reveals a slightly positive picture as the price gains back above the 61.8% Fibonacci level and heads towards the 20-period SMA on the 4-hour chart. However, the pullback lacks follow-through momentum, and the gains may be capped around the 1.3450 area. Furthermore, the volume data is not quite supportive of the gains. Bearish volume is quite imminent at the moment. However, price action around the London session will be the key to watch.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

The average daily range is 51% so far, showing higher volatility for the day. However, the price is expected to play rangebound between 1.3360 to 1.3450.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.