- GBP/USD is printing some intraday gains despite holding off monthly support.

- The post-Brexit test has recently attracted attention, NI, as the Brexit negotiations proceed more regularly.

- Prime Minister Johnson is being pushed to impose sanctions against Russia.

Early Wednesday morning in Asia, the GBP/USD price analysis is neutral at 1.3600, struggling to defend yesterday’s rebound off the monthly support line.

–Are you interested in learning more about STP brokers? Check our detailed guide-

As a result of ongoing Russia-Ukraine tensions, the cable pair fell to its lowest level in a week on Tuesday. However, a lack of major downsides on the Brexit front, combined with hawkish remarks from the Bank of England’s Deputy Governor Dave Ramsden, have fueled the recent rebound. A second reason for the corrective rollback is that Russia failed to respond to the West’s punitive measures and US President Joe Biden’s slightly more conciliatory tone when announcing US sanctions against Moscow.

In a statement to Reuters on Tuesday, Ramsden said the UK economy has so far shown resilience despite COVID and Brexit. However, Reuters reports that Bank of England’s Ramsden said further tightening will likely be needed in the short term to prevent wage and price adjustments from becoming a major factor in current high inflation.

The BBC reported that Liz Truss and Maros Sefcovic, Vice-President of the European Commission, agreed to meet regularly to discuss any issues raised by either side since the last Brexit negotiations. A statement by Messages noted that Ms. Truss replied to a question about whether the UK would activate Article 16, which allows both sides to unilaterally decide whether to end parts of a trade agreement. The Independent hinted at British criticism of the EU’s push for product quality control in a separate update. There has been a split in the Cabinet over plans to subject UK companies’ products to post-Brexit tests before they go on sale.”

In contrast, Britain imposed the first additional sanctions against Russia in response to the recent aggression against Ukraine’s borders, triggering additional sanctions. The United States, Canada, and the European Union have also followed suit, while the White House ruled out a meeting between Biden and Putin. Anthony Blinken, who rejected meeting with Russian Foreign Minister Sergei Lavrov on Thursday, made similar comments.

Nevertheless, statements by US President Biden, such as “We are not going to war with Russia,” have allayed fears that a full-blown war would break out between the West and Moscow. Also, comments by Japanese Prime Minister Fumio Kishida asking Russia to resume diplomatic relations provide a breather for the bears.

Amid this backdrop, S&P 500 futures gained 0.5% intraday, and US Treasury yields remain around 1.94%, primarily due to a holiday in Japan, after gaining about 2.0% daily the previous day.

With hawkish rhetoric from policymakers and market expectations for more rate hikes, the Bank of England’s (MPR) monetary policy report hearing is a key event for GBP/USD traders to watch. As of press time, the CME BOEWatch tool shows a 100% chance of a 0.30% rate hike in March.

–Are you interested in learning more about forex robots? Check our detailed guide-

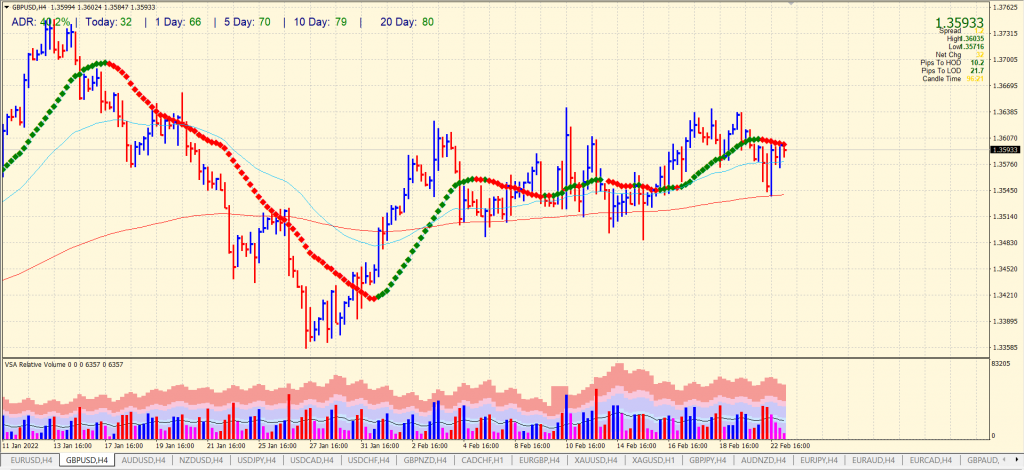

GBP/USD price technical analysis: Bulls shy to breakout

The GBP/USD price remains barred by the 20-period SMA on the 4-hour chart. The pair found firm support by the 200-period SMA and posted a shakeout bar closing above the 50-period SMA. However, the volume data shows no respite for the bulls as the upside comes with a declining volume. The average daily range is 40% at the moment, indicating high volatility.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money