- A worthy opening for GBP/USD amid the de-escalation of the Russian-Ukrainian conflict.

- Bears may be on the ropes due to geopolitical tensions causing a risk-off tone.

- The UK Market Services PMI could increase volatility in an already uncertain market.

In spite of negative developments in Russia-Ukraine tensions over the weekend, the GBP/USD price attracted significant demand near 1.3580. There have been increased expectations of a possible Russian invasion of Ukraine due to a surge of troops by Moscow and separatists near Ukraine’s eastern region. However, the French President calls for a Biden-Putin summit that de-escalates the tension.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Market sentiment has been devastated by NATO’s constant warnings that Russia could attack Ukraine. Furthermore, Russia and Belarus have extended their exercises despite their agreement to halt these exercises on Sunday.

On the one hand, Moscow demands guarantees that the North Atlantic Alliance will not accept Ukraine. But, on the other hand, it would threaten Putin Square from the Ukrainian President Volodymyr Zelenskyy, who has requested security guarantees against the Kremlin from Western leaders.

A lack of clarity in the geopolitical picture prevents investors from finding an asset to add due to the wide range of ticks but in a limited range. The issue of risk aversion on the part of investors continues to develop in this regard.

Meanwhile, rising bets on the Federal Reserve’s aggressive monetary policy will put a damper on the Cable’s growth.

Despite headlines regarding tensions between Russia and Ukraine, the UK Purchasing Managers’ Index (PMI), released by the Chartered Institute of Purchasing & Supply and Markit Economics, is expected to keep investors on their toes. According to market expectations, the Markit Services PMI is expected to increase from 54.1 to 55.2.

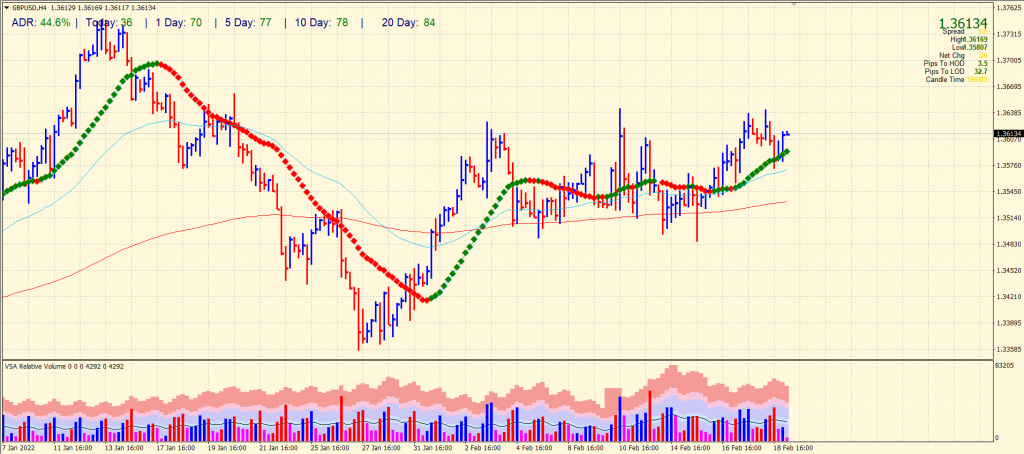

GBP/USD price technical analysis: Bulls charged

The GBP/USD price has been able to gain back above the 1.3600 mark. The next important resistance is a double top at 1.3641. If broken, the pair will aim at the 1.3700 handle which is another key level. However, the recent gains have not been supported by the volume data. The fall on Friday was led by a rising volume, while today’s gains look like a minor up wave.

–Are you interested in learning more about forex robots? Check our detailed guide-

On the other hand, the key SMAs on the 4-hour chart are sloping up, lying one above another. It shows strong bullish behavior. Perhaps, we see some correction before a meaningful bullish breakout occurs in a London session.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money