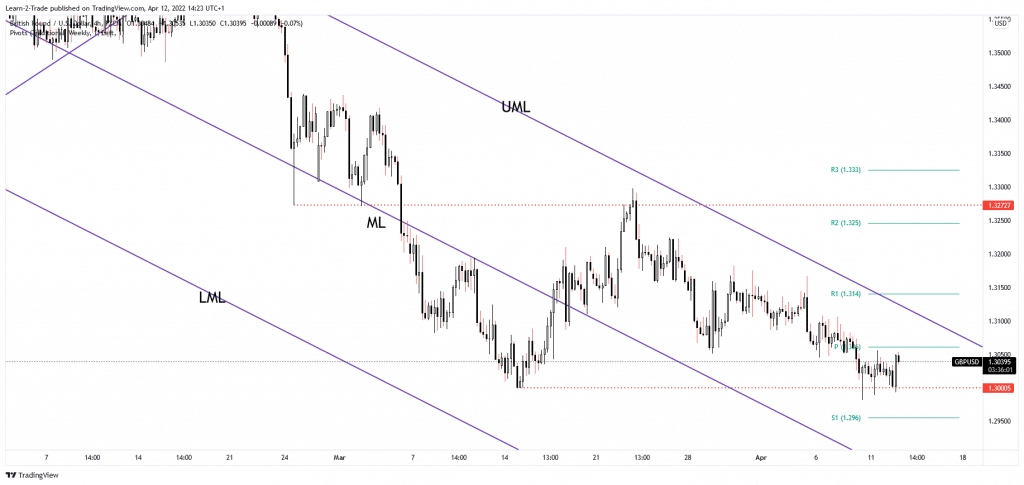

- The GBP/USD pair seems determined to come back to retest the upper median line (UML).

- The price rallied as the Dollar Index retreated after the US inflation data.

- In the short term, the pair is trapped within a minor range. However, a valid breakout could bring new opportunities.

The GBP/USD price rallied after the US released its inflation data last hour. The price retested the 1.3000 psychological level, a major downside obstacle. It has registered only a new false breakdown through this key level, signaling that the sellers are exhausted.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

Technically, the bias remains bearish, and the pressure remains high despite temporary rebounds. The USD lost ground versus its rivals as the Dollar Index plunged. Still, DXY could find only a temporary drop.

Fundamentally, the UK data came in mixed today. The Unemployment Rate dropped from 3.9% to 3.8%, matching expectations. The Average Earnings Index came in line with expectations, registering a 5.4% growth, while the Claimant Count Change was reported at -46.9K versus -41.1K expected.

The greenback depreciated after the Consumer Price Index was released. The economic indicator rose by 1.2%, matching expectations, while the Core CPI registered a 0.3% growth in March versus 0.5% estimates compared to 0.5% growth in February. Tomorrow, the UK inflation data and the US PPI could bring high volatility to the GBP/USD pair.

GBP/USD price technical analysis: Bulls attempting a recovery

As you can see on the 4-hour chart, the GBP/USD pair was rejected at the 1.3000 psychological level. After its massive drop, a temporary rebound is natural. Also, the price failed to come back to test and retest the descending pitchfork’s median line (ML), signaling exhausted sellers. Still, the bias remains bearish as long as it stays under the upper median line (UML). In the short term, it’s trapped between 1.3060 and 1.3000 levels.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

Escaping from this minor range could bring us new opportunities. Staying above the 1.3 and making a valid breakout above the descending pitchfork’s upper median line (UML) could announce that the GBP/USD pair may develop a new leg higher. Still, don’t forget that the price could register only a temporary rebound. Also, a valid breakdown below 1.3000 could activate more declines.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money