- GBP/USD showed a modest rebound from the 1.3200 area but did not continue.

- In the face of Brexit uncertainty, the Fed’s restrictive expectations have supported the dollar.

- Putting off further losses would require a sustained break below 1.3200.

The GBP/USD price appears to have entered the consolidation phase, and its volatility was observed in a tight range above 1.3250 during the mid-European session.

–Are you interested to learn more about MT5 brokers? Check our detailed guide-

On the first day of the new week, the pair managed to hold above 1.3200 and rally some buying, although attempts to rebound failed due to renewed strength in the US dollar. Investors were still well supported by the prospect of a faster Fed tightening after last Friday’s mixed US NFP report.

According to investors, the Fed will be forced to enact an aggressive monetary policy response to contain persistently high inflation. Hence, money markets are pointing to a high probability of a Fed hike by May 2022, which has boosted the dollar. However, due to this and Brexit uncertainty, the GBP/USD pair has seen limited upside.

Preliminary observations from South Africa suggest Omicron patients had relatively mild symptoms, stabilizing global risk sentiment. It can deter dollar bulls from rebounding and limit the fall of the GBP/USD pair as a result of the generally positive tone in equity markets.

We recommend waiting for a sustained break below 1.3200 before initiating another short-term depreciation of the GBP / USD pair. A single PMI report is available for the UK economy, but no significant market data is available for the US. Therefore, aggressively bearish traders should exercise caution.

However, Bank of England Deputy Governor Ben Broadbent’s expected speech could impact the British pound and add momentum to the GBP/USD pair. When looking for a short-term trading opportunity around an underlying currency, we take this into account, as well as the broader market risk sentiment.

–Are you interested to learn more about Australian forex brokers? Check our detailed guide-

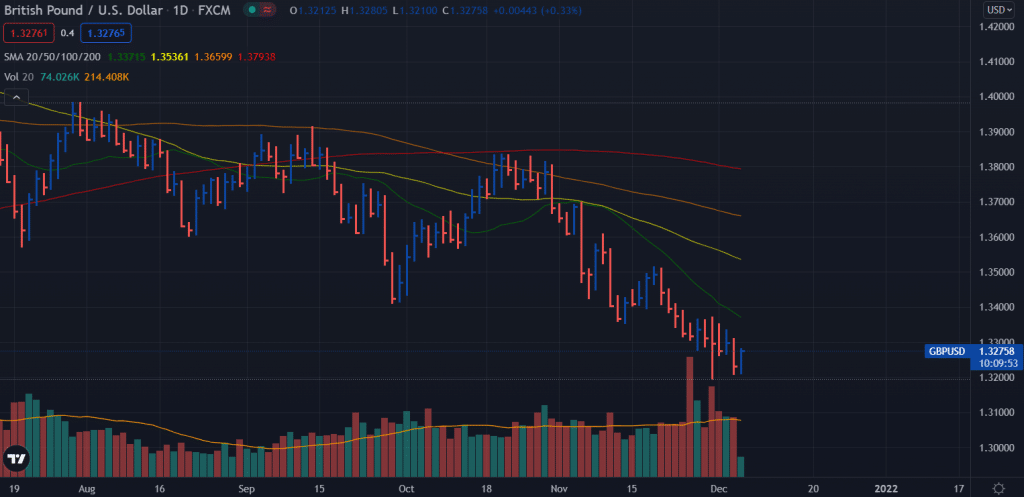

GBP/USD price technical analysis: 20-SMA to cap rally

The GBP/USD price remains firm above the mid-1.3200 area, and the buyers are trying to test the 1.3300 handle. However, the price is currently capped by the 20-period SMA near 1.3280. The volume is showing a mild sign of bullishness. Hence, we may see a minor bullish wave aiming for 1.3330. On the flip side, 1.3200 remains key support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.