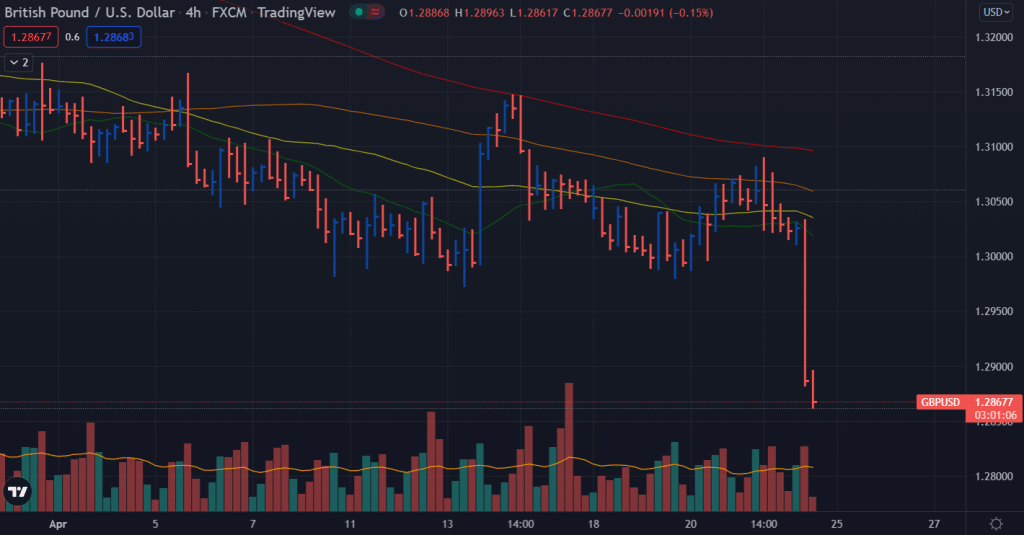

- GBP/USD fell aggressively on Friday, reaching its lowest level since November 2020.

- Disappointing retail sales data in the UK weighed heavily on sterling, adding to the already solid US dollar buying.

- Further bearish momentum was accelerated by technical selling below the round number of 1.3000.

In the first half of the London session, the GBP/USD price fell to its lowest level since November 2020 during heavy selling pressure on the last day of the week.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

Dismal UK retail sales

The British pound weakened across the board due to disappointing retail sales data released by the UK, which failed to break away from mixed PMI readings. As a result, the GBP/USD pair has further been affected by bearish pressure due to the sharp increase in demand for the US Dollar.

Following the disappointing release of UK retail sales data on Friday, the GBP/USD pair hit a fresh offer for the second straight day. The UK Office for National Statistics reported total retail sales declined 1.4% in March instead of the 0.3% expected. Furthermore, sales excluding automotive fuel fell by 1.1% for the month, which was also below expectations.

Hawkish Fed to weigh on the pound

Meanwhile, the US dollar continued to be supported as expectations of the US Federal Reserve’s more aggressive monetary tightening rose. A combination of this and risk-aversion momentum supported the dollar, which pushed yields on interest-rate-sensitive US Treasuries above 3% for the first time since 2018.

What’s next to watch for GBP/USD price?

It also seems that some trading stops could be triggered below psychological 1.3000, adding further downside pressure around the GBP/USD pair. In the meantime, the recent move lower appears to confirm a fresh break setting the stage for further depreciation in the near term. For fresh impetus, market participants are eagerly awaiting the UK and US PMI data release. Later in the session, traders will also be paying attention to BoE Governor Andrew Bailey’s appearance.

GBP/USD price technical analysis: Bears eying 1.2800

The GBP/USD price finally breaks below the 1.3000 mark and cracks another support at 1.2900. The widespread down bar with a huge volume was followed by another down bar. The bears are not stopping here. We may see a test of 1.2800 level ahead of 1.2750.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

On the upside, the pair may find some correction after a strong downtrend. Hence, the pair may jump back above the 1.2900 area. However, any subsequent buying lifting the pair above 1.3000 will again neutralize the pair’s outlook.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money