- The GBP/USD pair seems overbought, so a new sell-off is in cards.

- A new lower low could activate more declines.

- Only a new higher high could bring new long opportunities.

The GBP/USD price remains sideways in the short term. The price action signaled that the buyers are exhausted and the sellers may take the lead. Still, it’s premature to talk about a new sell-off.

-Are you interested in learning about forex indicators? Click here for details-

The price could come back to test the resistance levels before going down. Actually, we need strong confirmation from the Dollar Index before taking action. The DXY was in a corrective phase but the index signaled that the sell-off could be over.

As you already know, DXY’s growth should force the greenback to appreciate. The GBP/USD pair was traded at 1.2600 at the time of writing.

Today, the fundamentals could move the price. The UK Final Manufacturing PMI came in line with expectations at 54.6 points, Nationwide HPI rose by 0.9% versus 0.6% estimates, while the BRC Shop Price Index registered a 2.8%.

Later, the ISM Manufacturing PMI may drop from 55.4 to 54.4 points, while the JOLTS Job Openings are expected at 11.29M versus 11.55M in the previous reporting period. In addition, Construction Spending, ISM Manufacturing Prices, and Wards Total Vehicle Sales indicators will be released as well.

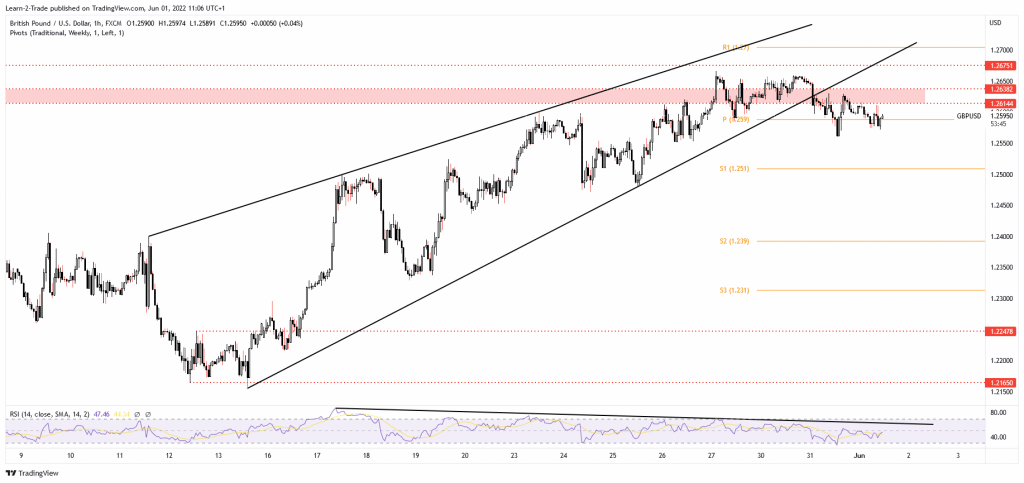

GBP/USD price technical analysis: Bearish divergence

The GBP/USD pair failed to stabilize above the 1.2614 – 1.2638 signaling that the swing higher could be over. As you can see on the 4-hour chart, the price action escaped from a Rising Wedge pattern. It has found temporary support at 1.2560 and now it has tried to test and retest the immediate resistance levels.

-Are you interested in learning about the forex signals telegram group? Click here for details-

The RSI showed a bearish divergence but only a new lower low could activate a potential sell-off. Staying above 1.2560 and making a new higher high could activate an upside continuation. In the short term, it has changed little as the DXY changed little as well.

Personally, I believe that the US data and the BOC could bring sharp movements today. The volatility could be high, that’s why you have to be careful. A false breakdown below the 1.2560 static support could announce a new bullish momentum.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money