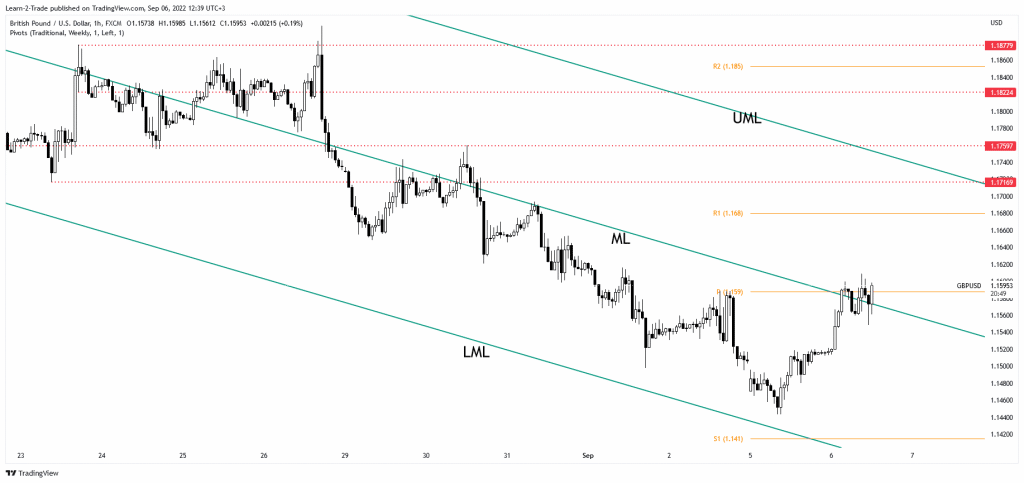

- The GBP/USD pair maintains a bullish bias in the short term as long as it stays above the ML.

- A new higher high could activate further growth towards the R1.

- The US data could be decisive later today.

The GBP/USD price rallied in the short term as the Dollar Index registered a temporary downside correction. The pair is trading at 1.1597 at the time of writing and is fighting hard to stay beyond the 1.1600 mark.

–Are you interested in learning more about forex signals? Check our detailed guide-

Fundamentally, the UK Final Services PMI came in at 50.9 points below 52.5 expected yesterday, signaling a slowdown in expansion. Today, the UK BRC Retail Sales Monitor rose by 0.5% versus 1.6% in the previous reporting period, while Construction PMI came in at 49.2 points versus 48.0 points expected.

Later, the US data may provide fresh stimulus to the GBP/USD. The ISM Services PMI may drop from 56.7 points to 55.4 points, while the Final Services PMI could drop to 44.3 points from 44.1.

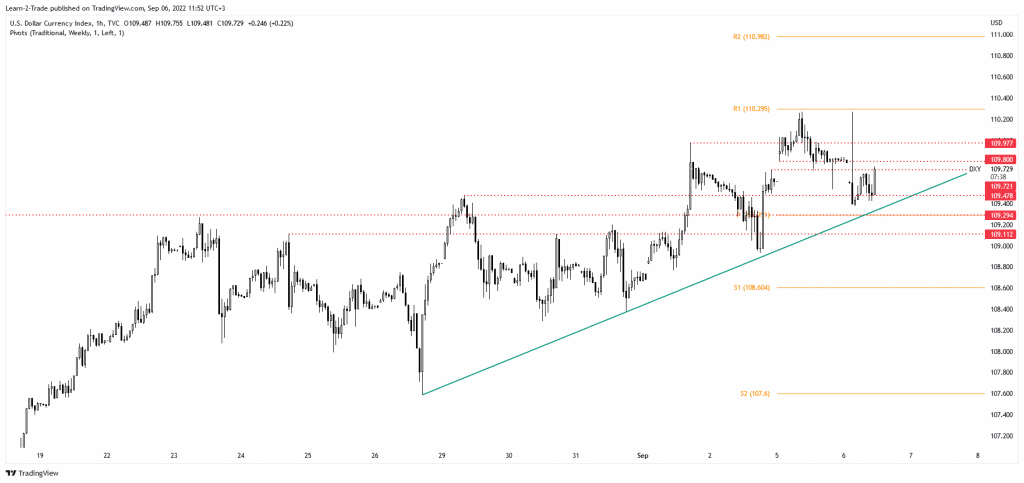

Dollar Index price technical analysis: Uptrend remains intact

From the technical point of view, the DXY signaled strong downside pressure after failing to make a new higher high and closing the up gap. Still, the Dollar Index rebounded after failing to stabilize below 109.47. The bias remains bullish as long as it stays above this key level and the ascending trendline. A new bullish momentum could force the USD to appreciate versus its rivals.

GBP/USD price technical analysis: Gains capped by key resistance

The GBP/USD pair challenges the weekly pivot point of 1.1590 again after failing to close below 1.1550 or to stabilize below the median line (ML). The 1.1600 psychological level represents an upside obstacle as well.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

A valid breakout through the pivot point may signal further growth. Failing to reach the descending pitchfork’s lower median line (LML) signaled exhausted sellers and a potential rebound. Stabilizing above the median line (ML) and making a new higher high could activate a potential further growth towards the R1 (1.1680) and up to the upper median line (UML).

On the other hand, staying below 1.16 and making a new low, coming back and stabilizing below the median line (ML), could activate a new sell-off.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.