- For the second straight day, the GBP/USD pair is experiencing stronger weakness on the back of a broad US dollar base.

- The safe-haven dollar continued to be under pressure due to better risk appetite and lower US bond yields.

- Due to fundamental factors, bullish bets should be approached with some caution.

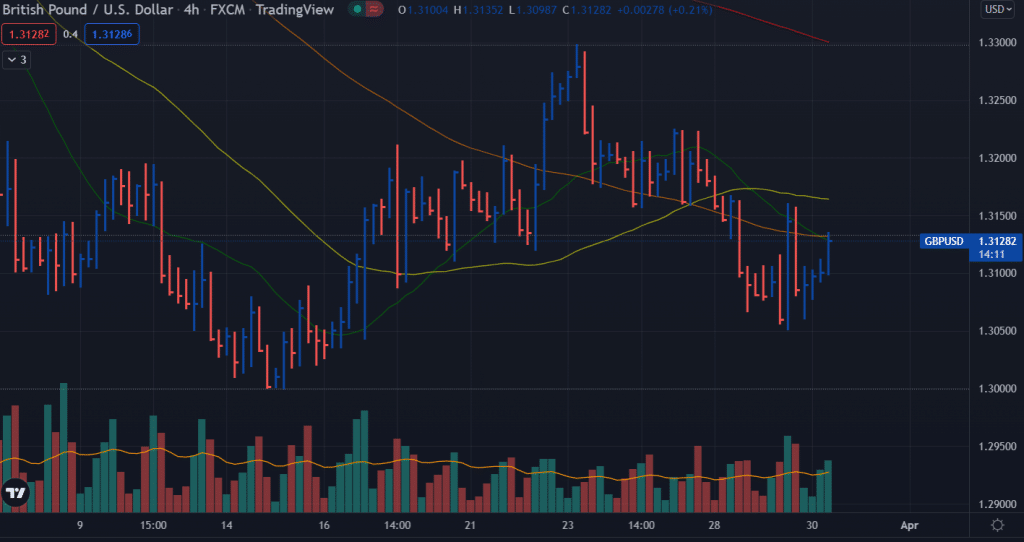

The GBP/USD price posted modest intraday gains during the European session, finishing only a few pips off the daily high of 1.3120-1.3125.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

Greenback slips

Continuing Tuesday’s mixed price action, the GBP/USD pair rose for the second straight day on Wednesday, supported by a weaker US dollar. Continuing optimism over a breakthrough in Russia-Ukraine peace talks supported the risk sentiment prevailing in the market. Moreover, with the continued decline in US Treasury yields, the dollar has risen above its weekly low, and spot rates have been supported.

Central banks and bonds yields

US bond yields should benefit from the expectation that the Fed will raise rates by 50 basis points at its next two meetings. In contrast, the Bank of England seems to have softened its stance on the need to raise interest rates further. Consequently, the GBP/USD should be limited on the upside, and caution should be exercised before positioning for meaningful recovery from the two-week low near the previous day’s mid-1.30s.

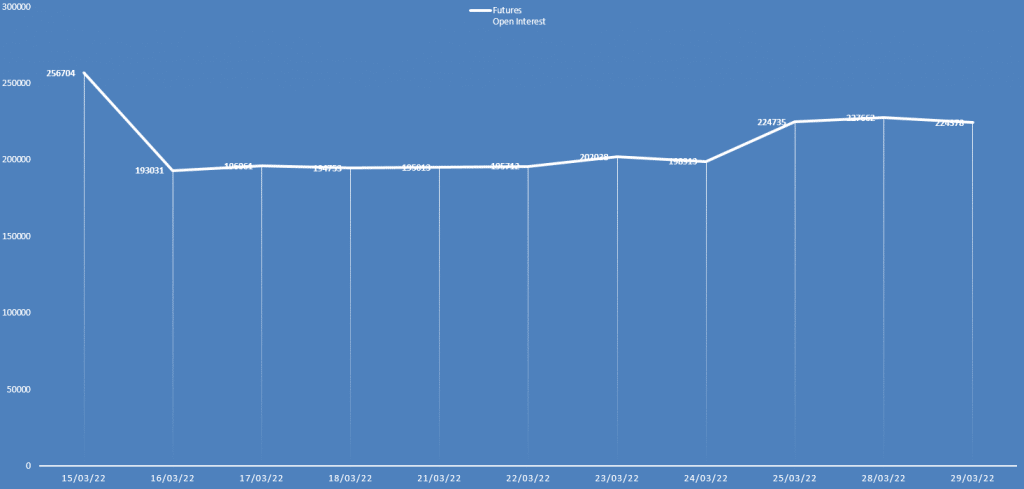

GBP/USD daily open interest and price

The GBP/USD price closed with a nominal gain on Tuesday. Similarly, the open interest showed no significant change. So, the pair lacks directional bias at the moment.

What’s next to watch for GBP/USD price?

A lack of major UK economic data will leave the GBP/USD pair vulnerable to the US dollar price momentum. However, ADP’s private sector employment report and the final Q4 GDP report are included in the US economic report. Both of these factors will boost demand for the US dollar. Furthermore, traders will be paying close attention to the latest developments in the Russia-Ukraine saga for near-term opportunities.

–Are you interested in learning more about social trading platforms? Check our detailed guide-

GBP/USD price technical analysis: Bulls eying above 1.3200

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money