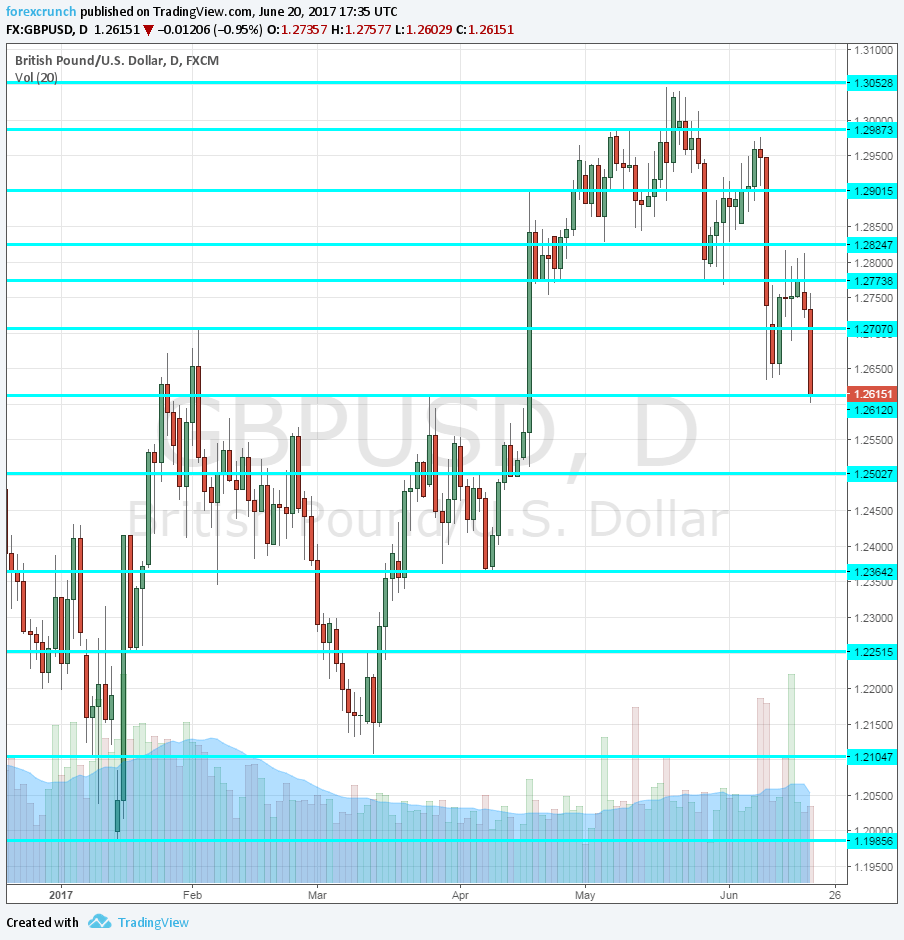

GBP/USD is trading around 1.2620, after having dipped to a low of 1.2603. 1.2615 was the swing high seen in April. After that, the pair returned down to its range. On April 18th, Theresa May announced the snap elections and the pair shot higher, eventually reaching 1.3050.

May’s election failure resulted in a dip under 1.27, but the pair managed to stabilize since then. It is now diving deeper.

What is behind the fall? Here are three reasons:

- Carney crash: The Governor of the BOE made it clear that rate hikes are not on the agenda. His stance was a contradiction to the close vote on the MPC just this Thursday. Three of his colleagues voted for a hike, against Carney and four other members that voted for no change.

- No coalition: A deal between May’s Conservatives and the Northern Irish DUP was supposed to be a “done deal”. Well, the deal is postponed even though Brexit talks are underway. The latest news was that the DUP does not want to be taken for granted. More political uncertainty could delay Brexit negotiations.

- USD strength: The Fed’s hawkish hike and Yellen’s dismissal of inflation were compounded by a hawkish speech from Dudley. The No. 3 at the Fed was very optimistic and helped propel the greenback higher not only against the pound but also against other currencies.

GBP/USD

The next level of support is only 1.25, a round number. Real technical support is only at 1.2350. Will the pair extend its losses?

Resistance is at 1.27 and 1.2775, the lines within the range.