The pound reversed directions last week, as GBP/USD jumped 350 points. The pair closed the week at 1.4222. This week’s highlight is Manufacturing Production. Here is an outlook on the major events moving the pound and an updated technical analysis for GBP/USD.

The pound bounced back last week, shrugging off PMI reports that missed expectations. In the US, the ISM services sector report weighed on the greenback and an excellent Non-Farm Payrolls report wasn’t enough to stem the impressive pound rally. Wage growth in the US fell by 0.1%, well below predictions.

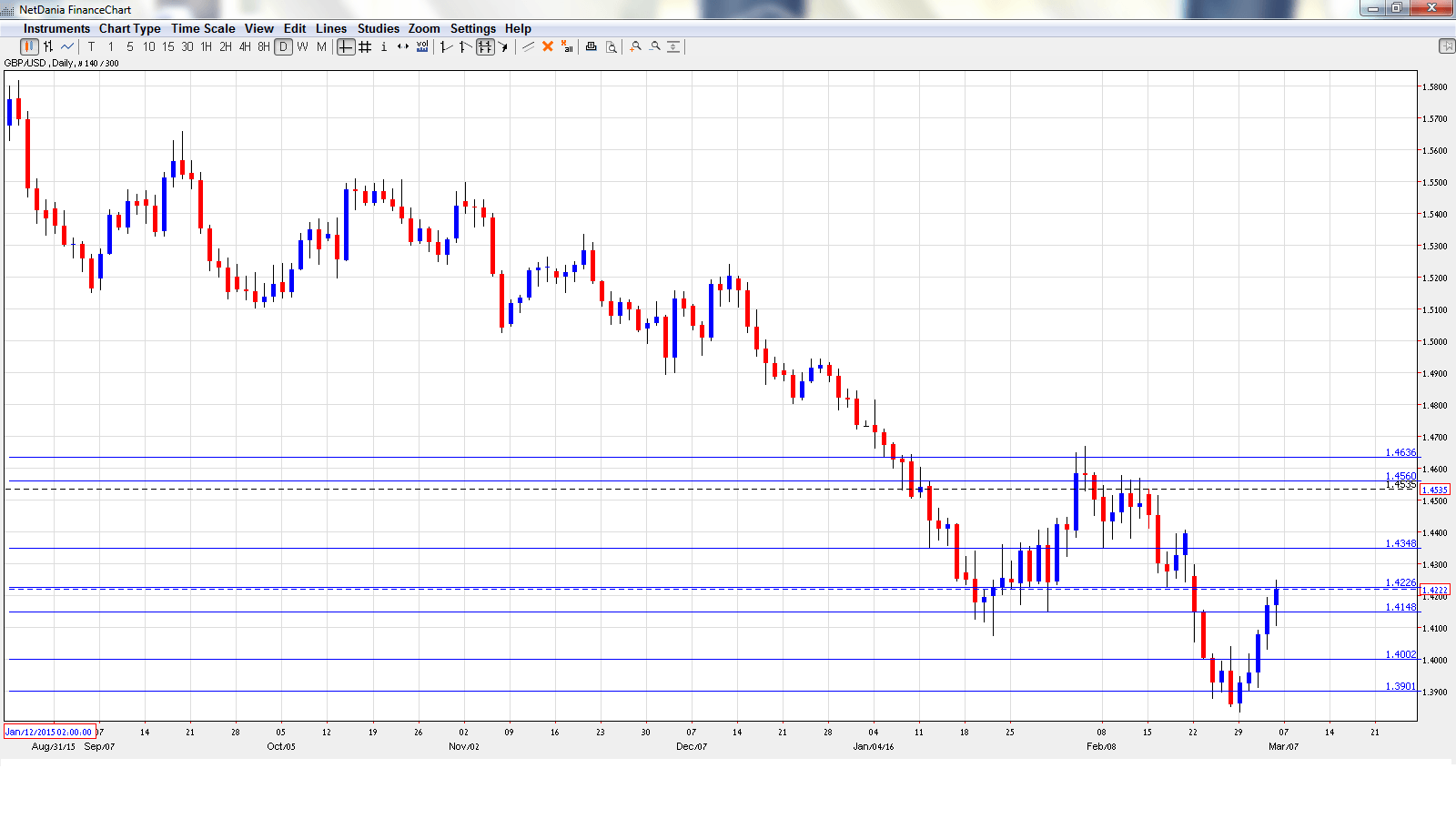

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- BOE Chief Economist Andy Haldane Speaks: Monday, 9:10. Haldane will speak at an event in London. The markets will be looking for hints regarding possible monetary moves by the BOC.

- BRC Retail Sales Monitor: Tuesday, 00:01. This indicator measures retail sales volumes in BRC stores. In January, the indicator climbed 2.6%, marking a 4-month high.

- BOE Deputy Governor Mark Carney Speaks: Tuesday, 9:15. Carney will testify before a parliamentary committee about the UK’s EU membership. Traders should be prepared for volatility during the Carney’s remarks.

- External BOE MPC Member Martin Weale Speaks: Tuesday, 17:00. Weale will speak at an event in Nottingham. A speech that is more hawkish than expected is bullish for the British pound.

- Manufacturing Production: Wednesday, 9:30. An unexpected reading from this key indicator can have an immediate impact on the direction of GBP/USD. The indicator has posted three straight declines, but the markets are expecting better news January, with an estimate of 0.2%.

- NIESR GDP Estimate: Wednesday, 15:00. This monthly release helps analysts forecast GDP, which is only released every quarter. The indicator dipped to 0.4% in January, marking a 9-month low. Will we see an improvement in the February report?

- RICS House Price Balance: Thursday, 00:01. This indicator provides a snapshot of the strength of the UK housing sector. The indicator has hovered close to the 50% mark, and no significant change is expected in the February reading.

- Trade Balance: Friday, 9:30. The UK trade deficit narrowed to GBP 9.9 billion, much better than the estimate of GBP 10.4 billion. The markets are expecting a reversal in January, with an estimate standing at GBP 10.3 billion.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.3860 and quickly touched a low of 1.3835. The pair then reversed directions and climbed to a high of 1.4249, breaking above support at 1.4245 (discussed last week). The pair closed the week at 1.4222.

Technical lines from top to bottom

With GBP/USD recording sharp gains last week, we start at higher levels:

1.4635 has been a resistance line since early February.

1.4562 is next.

1.4346 is an immediate resistance line. It has weakened due to last week’s strong gain by the pound.

1.4227 has switched to a resistance role. It is a weak line and could see further action early in the weekend.

1.4148 was a cushion in late January.

The symbolic level of 1.40 is next. It was last breached in March 2009.

1.3901 is next.

1.3809 is the final support level for now.

I am bearish on GBP/USD.

The Fed is unlikely to raise rates in March, but the bias remains towards tightening. This monetary divergence favors the US dollar. Although the US economy has had a soft start to 2016, recent employment numbers have been solid, so the US dollar could head higher.

Our latest podcast is titled Drum roll for Draghi

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.