GBP/USD recorded modest gains last week, as the pair closed slightly above the 1.22 level. This week’s highlight is Preliminary GDP. Here is an outlook on the major market-movers and an updated technical analysis for GBP/USD.

In the US, unemployment claims surprised by missing expectations for the first time in 10 weeks. Construction data was mixed while manufacturing numbers were stronger than expected. British job numbers were solid, as Average Earnings Index remained steady and Claimant Change beat expectations.

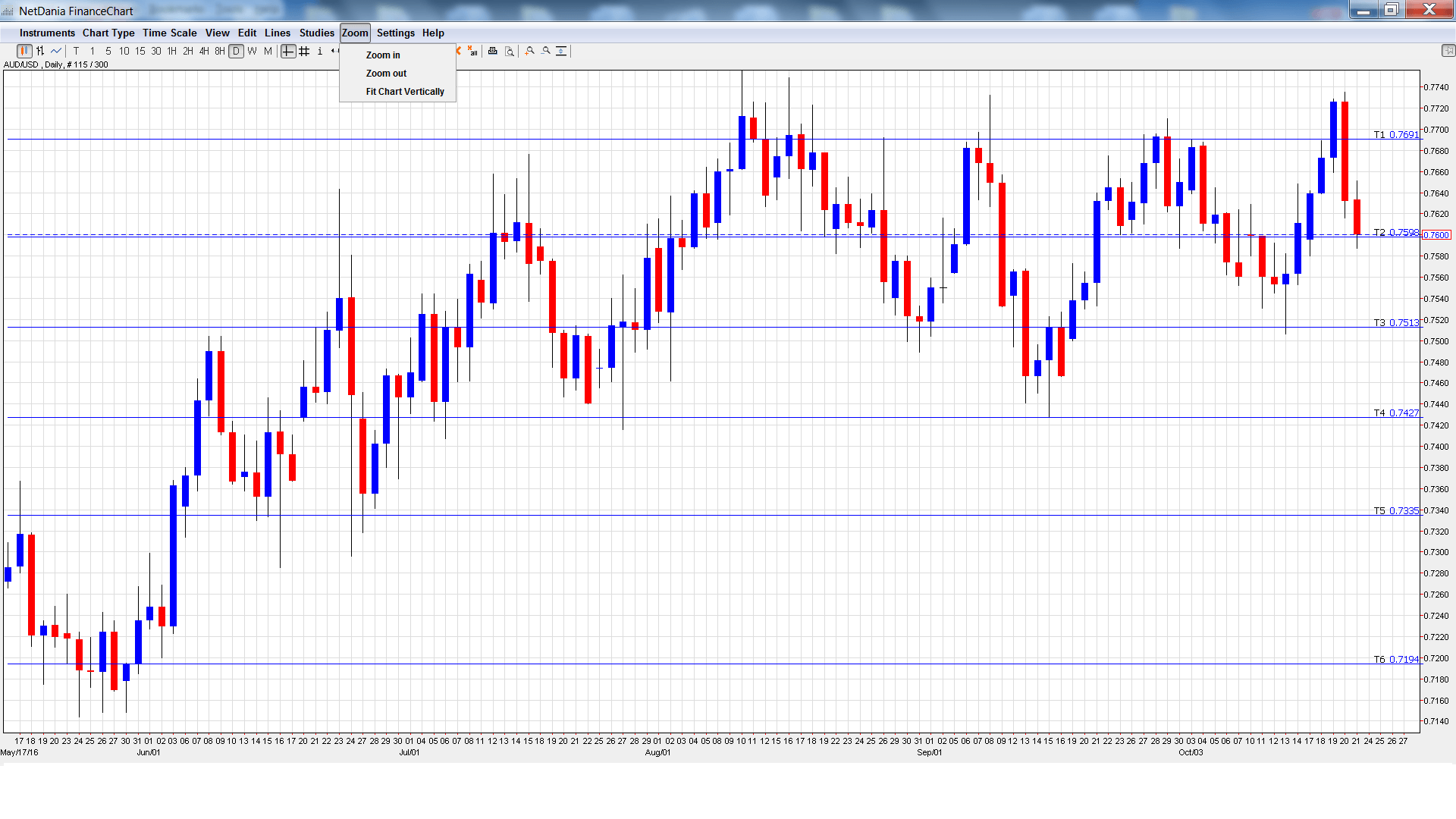

GBP/USD graph with support and resistance lines on it. Click to enlarge:

- BOE Deputy Governor Nemat Shafik Speaks: Monday, 6:30. Shafik will speak at an event in Hong Kong. A speech that is more hawkish than expected is bullish for the British pound.

- CBI Industrial Order Expectations: Monday 10:00. The indicator continues to post readings in negative territory, indicative of a weak manufacturing sector. The past two readings have come in at -5 points, but the October report is expected to improve to -2 points.

- BoE Governor Mark Carney Speaks: Tuesday, 14:35. Carney will testify before the House of Lords Economic Affairs Committee in London. If Carney paints a pessimistic picture of the fallout from Brexit, the pound could lose ground.

- BBA Mortgage Approvals: Wednesday, 8:30. This indicator provides a snapshot of the level of activity in the UK housing sector. In August, the indicator dipped to 37.0 thousand, slightly short of expectations. Little change is expected in September, with an estimate of 37.3 thousand.

- Preliminary GDP: Thursday, 8:30. This is the first of three GDP reports, all of which are released on a quarterly basis. Final GDP in the second quarter came in at 0.7%, edging above the forecast of 0.6%. Preliminary GDP for Q3 stands at 0.3%.

- CBI Realized Sales: Thursday, 10:00. Retailers and wholesalers were very pessimistic in September, with a reading of -8 points, compared to a forecast of +8 points. October is expected to show improvement, with an estimate of -2 points.

- Nationwide HPI: Friday, 28th-2nd. This key indicator measures wage growth. This housing inflation index dipped to 0.3% in September, matching the forecast. The downward trend is expected to continue in October, with an estimate of 0.2%.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.2176 and quickly touched a low of 1.2132, as support held at 1.2130 (discussed last week). The pair then reversed directions and climbed to a high of 1.2332. GBP/USD retracted somewhat and closed the week at 1.2216.

Live chart of GBP/USD:

Technical lines from top to bottom

1.2620 was a cushion back in 1985.

1.2400 is next.

1.2130 held firm in support last week.

1.1943 has been the low point in the month of October.

1.1844 is the final support line for now.

I remain bearish on GBP/USD.

With the British government signaling it is preparing to invoke Article 50 and formally leave the EU, Brexit jitters will likely worsen, despite decent UK numbers. The BoE is expected to lower rates in November, while a Fed rate hike is priced in at 70%. So, monetary divergence continues to favor the US dollar.

Our latest podcast is titled Bold BOJ vs. Fearful Fed

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.