GBP/USD has reached new lows at 1.2633 as the free-fall continues. What’s next? The team at Deutsche Bank sees further falls on top of the Hard Brexit talk and as Brexit has a date. Update: GBP/USD flash crashes under 1.20, jumps back to only 1.24

Here is their view, courtesy of eFXnews:

While the market was anticipating a relatively benign outcome from the UK’s forthcoming renegotiation, political developments from the Conservative Party Conference this week will have come as more of a shock.

Hard Brexit has become a meaningful risk, with Prime Minister May tying herself to a deadline of end-March 2017 to trigger Article 50 and prioritizing immigration and sovereignty from the ECJ – both incompatible with continued Single Market membership.

Our takeaway from the conference was that May believes the threat of rebellion from hard-line eurosceptic Conservative MPs is significantly greater than from the more centrist wing of the party or a divided opposition – the corollary being a much tougher negotiating stance. The risk is that this does not play well with EU partners, particularly given French and German elections next year.

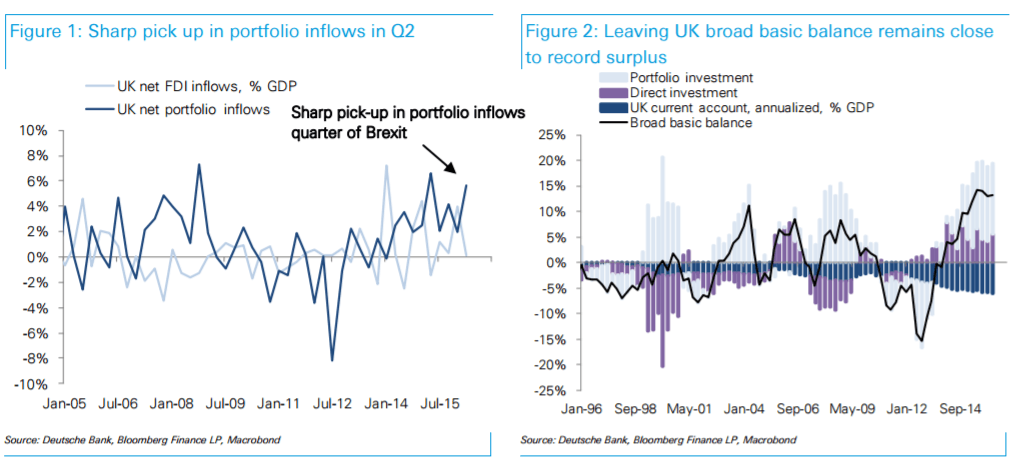

With political risks growing and much of the flow impact yet to be felt, we remain bearish sterling.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.