After the OK NFP some doubt that the Fed will really raise rates in September and the dollar eventually took a hit.

Nevertheless, the team at Goldman Sachs sees further gains for the greenback, and explains:

Here is their view, courtesy of eFXnews:

Goldman Sachs has been and remains a structural USD bulls. Adding to this very ‘high-conviction’ call, GS advises clients in a note after the US payrolls on Friday to start buying the Dollar tactically.

The following are the key points constituting GS’ argument along with its latest forecasts for EUR/USD.

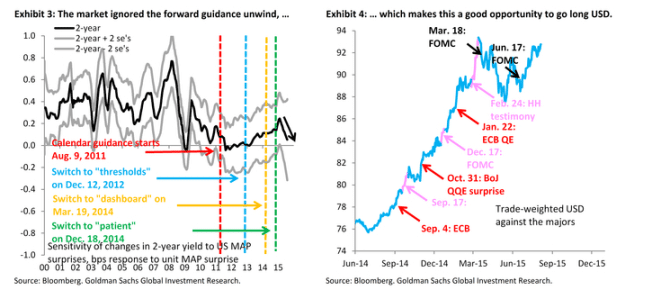

1- “Tactically, we think now is a good time to position for Dollar strength. That is because some of the progress the Fed made last year towards data dependence has been undone since the March FOMC, when Chair Yellen memorably said that dropping “patient” does not translate to impatience,” GS advises.

2- “Since then, our estimate for the sensitivity of two-year yields to US data surprises has fallen back to near “calendar guidance” level, meaning that – even though it de jure abandoned forward guidance in March – de facto the market sees the Fed as having gone into reverse. This matters for the Dollar because the dilution of forward guidance last year was an important Dollar positive in the weeks following the September and December meetings (Exhibit 4, pink arrows),” GS clarifies.

3- “Regardless of when ‘lift-off’ happens, we think this means that more of a risk premium needs to go into front-end US rates, which is Dollar positive. Indeed, a higher risk premium may be the main take-away from this week’s dueling Fed speakers,” GS argues.

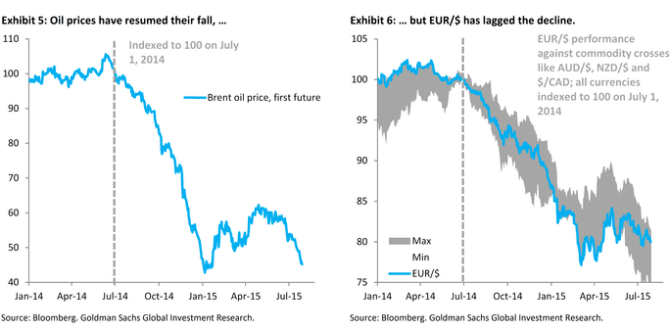

4- “Dollar upside is also actionable because falling oil prices are most obviously a threat to those places – the Euro area and Japan – that are battling deflation…We think the market is – falsely – dismissing the threat that falling oil prices pose for the deflation fight in the Euro area,” GS adds.

5- “Much as last summer, it will be key to see if falling oil prices spill over into inflation expectations, where the fall so far has been relatively muted. In Japan, it would take a herculean rebound in sequential core inflation to reach the BoJ forecast of 0.7% for FY2015, even if a new inflation measure from the BoJ (that excludes energy and fresh foods but includes processed foods) shows a better inflation trend. In both Japan and the Euro area, the odds of additional stimulus may be rising, a further reason to be long Dollars,” GS advises.

GS maintains its EUR/USD targets at 1.02 in 3-month and at 1.00 in 6-month.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.