- The NZD/USD pair could develop a larger upside movement if it makes a valid breakout through the confluence area.

- The price has shown some oversold signs, so the current rebound is natural.

- Only DXY’s rebound could force the pair to drop again in the short term.

The NZD/USD price rallied in the short term as the USD was weakened by the DXY’s sell-off. The price is somehow expected to resume its gains in the short term as the New Zealand data have come in better than expected in the early morning.

The Retail Sales surged by 3.3% in Q2 versus 2.4% expected compared to 2.8% growth in the first quarter. In addition, the Core Retail Sales raised by 3.4% versus 2.1% estimate.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

The USD could try to appreciate a little as the United States New Home Sales have increased from a revised 701K to 708K, exceeding the 698K forecast. Tomorrow, the New Zealand Trade Balance and the US Core Durable Goods Orders could impact the NZD/USD pair. In the short term, the bias is bearish again. I believe that only the US Prelim GDP and the FED Chair Powell speech at the Jackson Hole Economic Policy Symposium could have a major impact during the week. These events could change the sentiment again.

NZD/USD price technical analysis: Key levels to watch

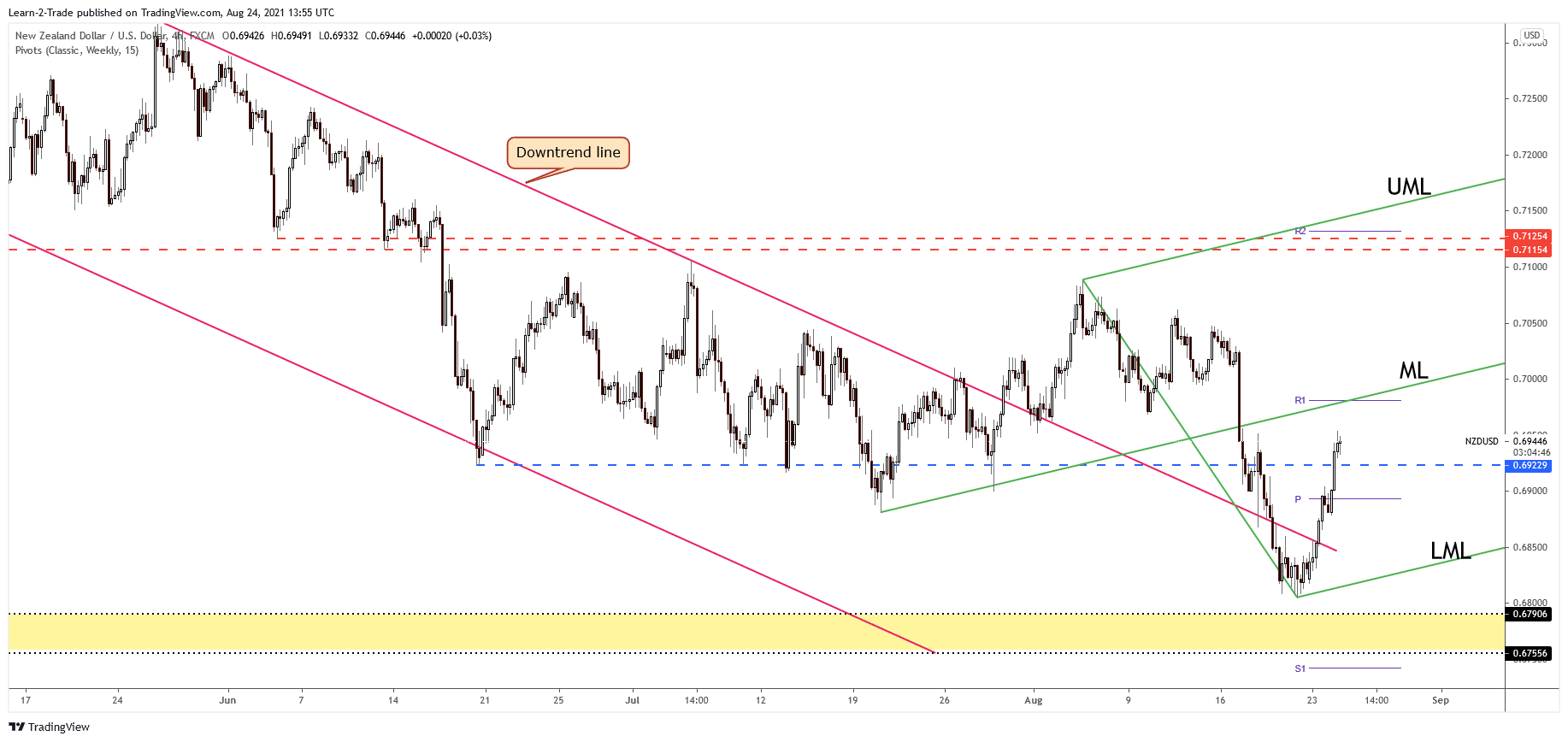

The NZD/USD pair ignored the weekly pivot point of 0.6893 level and the 0.6922, and now it moves towards the ascending pitchfork’s median line (ML). Actually, it could be attracted by the confluence area formed at the intersection between the weekly R1 (0.6981) and the median line (ML).

–Are you interested to learn more about forex signals? Check our detailed guide-

Its failure to stay under the downtrend line signaled that the NZD/USD pair could turn to the upside. Also, the price couldn’t reach the 0.68 psychological level or the 0.6755 – 0.6790 area. It remains to see how it will react when it hits the immediate resistance levels and the 0.7000. A valid breakout above these obstacles could indicate further growth towards a 0.71 psychological level. Registering a temporary decline could help us to catch a new swing higher from around 0.69.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.