The NZD/USD price bounced back and continues to stay in the buyer’s territory. DXY’s drop forced the Greenback to decline versus its rivals. The pair is into a neutral zone. We have to wait for a valid breakout before going long or short.

–Are you interested to learn about forex bonuses? Check our detailed guide-

The price is trapped between strong support and resistance levels. Kiwi is rising right now versus the Dollar only because the Dollar Index failed to stay higher. The pressure is high ahead of the FOMC meeting that will take place on Wednesday.

The New Zealand Trade Balance was reported lower at 261M in June, below 297M expectations and 489M in May. The US is to release the New Home Sales economic indicator later today, expected at 800K.

NZD/USD price technical analysis:

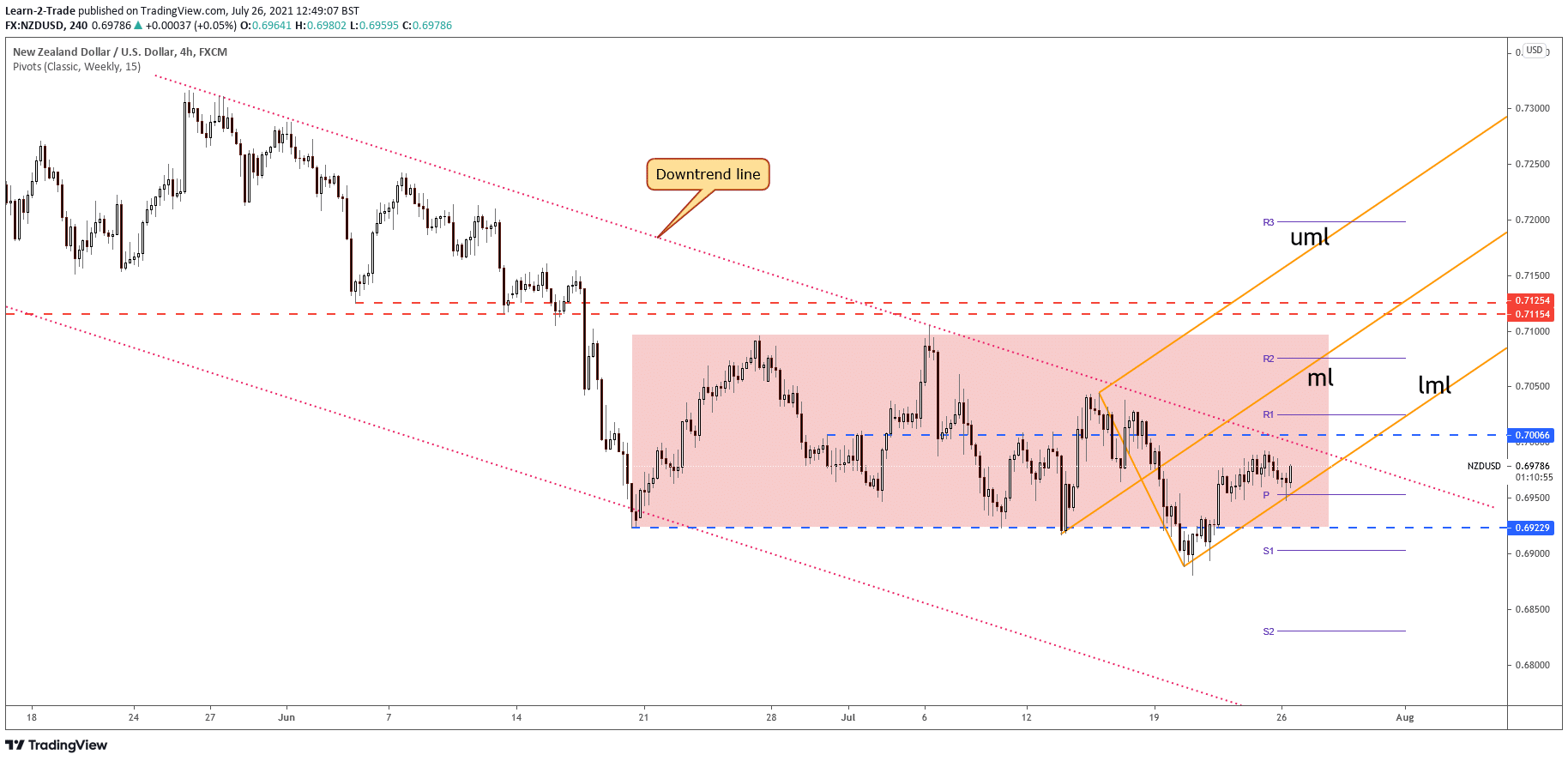

NZD/USD registered a false breakdown with a pin bar below the weekly pivot point (0.6953) and through the lower median line (LML). Now it looks to trade higher. However, the immediate upside target is seen at the downtrend line.

As you can see on the H4 chart, NZD/USD failed to approach and reach the downtrend line in the last attempts. It remains to see what will really happen as a potential drop below the immediate support levels could really announce a broader drop ahead.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Technically, a valid breakout above the down trendline indicates an upside movement, a potential reversal. Still, it’s premature to talk about this scenario as long as the pair stands far below the resistance.

NZD/USD stands between the down trendline and the ascending pitchfork’s lower median line. Therefore, registering a valid breakout in any direction could bring us a great trading opportunity. On the other hand, making a new lower low, to drop and close under 0.6947 signals more declines.

The ascending pitchfork’s lower median line (LML) is seen as strong dynamic support in the short term. NZD/USD could jump higher as long as it stays above it.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.