The New Zealand dollar enjoyed a very strong rally, rising to levels last seen in June 2015, mostly thanks to the weakness of the US dollar. Milk prices stand out this week? Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

Building consents leaped by 10.8%, providing some fuel for the kiwi’s rise. However, the bigger move above 0.69 came from the US: a very dovish speech by Yellen sent the dollar plunging across the board, and the “risk” NZD certainly benefited.

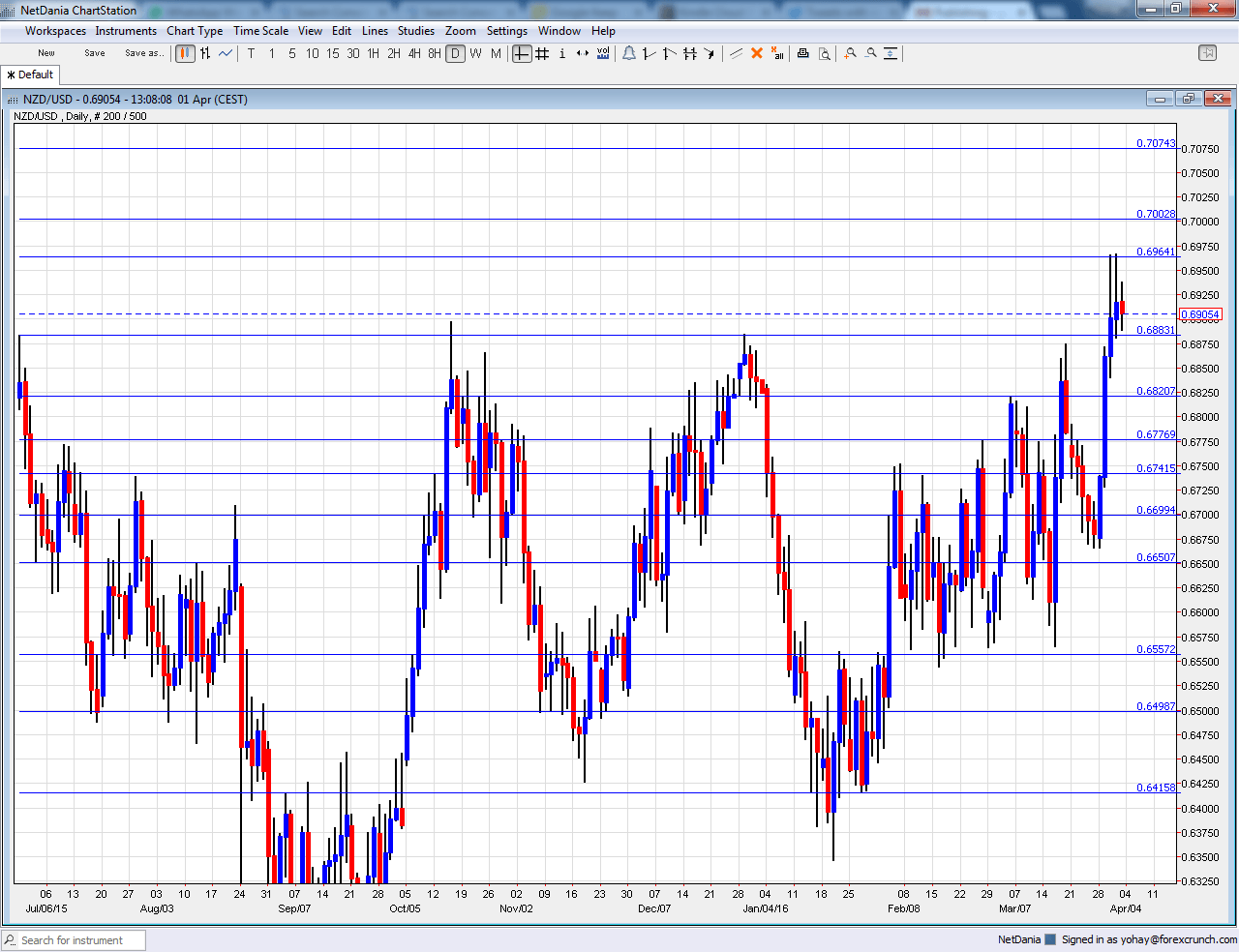

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- ANZ Commodity Prices: Tuesday, 1:00. This measure of commodity prices plays seond fiddle to milk prices, but is still watched. After three months of falls, commodity prices have risen by 0.4% in February.

- GDT Price Index: Tuesday, during the European afternoon. The Global Dairy Trade is a significant market mover as New Zealand’s man export is milk. Prices did manage to edge in early March, breaking the sequence of 4 falls. However, they resumed their falls in the next release. Will they recover now?

NZD/USD Technical Analysis

Kiwi/dollar had a gradual fall from the highs, struggling with the 0.67 level mentioned last week..

Technical lines, from top to bottom:

We start from higher ground this time. 0.7160 worked as support when the kiwi was trading on much higher ground in 2014. Also 0.7075 served as support back in mid 2014.

The round level of 0.70 is already in sight. The low of 0.6940 allowed for a temporary bounce.

The round 0.69 level has switched positions to resistance. 0.6860 was a low point as the pair dropped in June 2015. 0.6820 is worth noting after it capped the pair in March 2016.

It is followed by 0.6780 that capped the pair in recent months. The round level of 0.67 that works nicely as support. Another line worth noting is 0.6640, which capped the pair in November.

The post crisis low of 0.6560 is still of importance. Below, the round 0.65 level is of high importance now, serving as support.

I am neutral on NZD/USD

While the US dollar is free-falling, these kind of levels may be too high for the RBNZ, which may begin jawboning the NZD down. In a dovish Fed because of global concerns could result in a “risk off” mood that could weaken the “risk” kiwi.

In our latest podcast we crunch some commodities